The government is investigating reports that a central Hamas figure has a stake in a “lucrative” Cyprus-based company which mines Egyptian gold, spokesman Konstantinos Letymbiotis said on Friday.

His statements come at the heels of another Cyprus Confidential investigation by the International Consortium of Investigative Journalists (ICIJ) and the Israeli news outlet Shomrim.

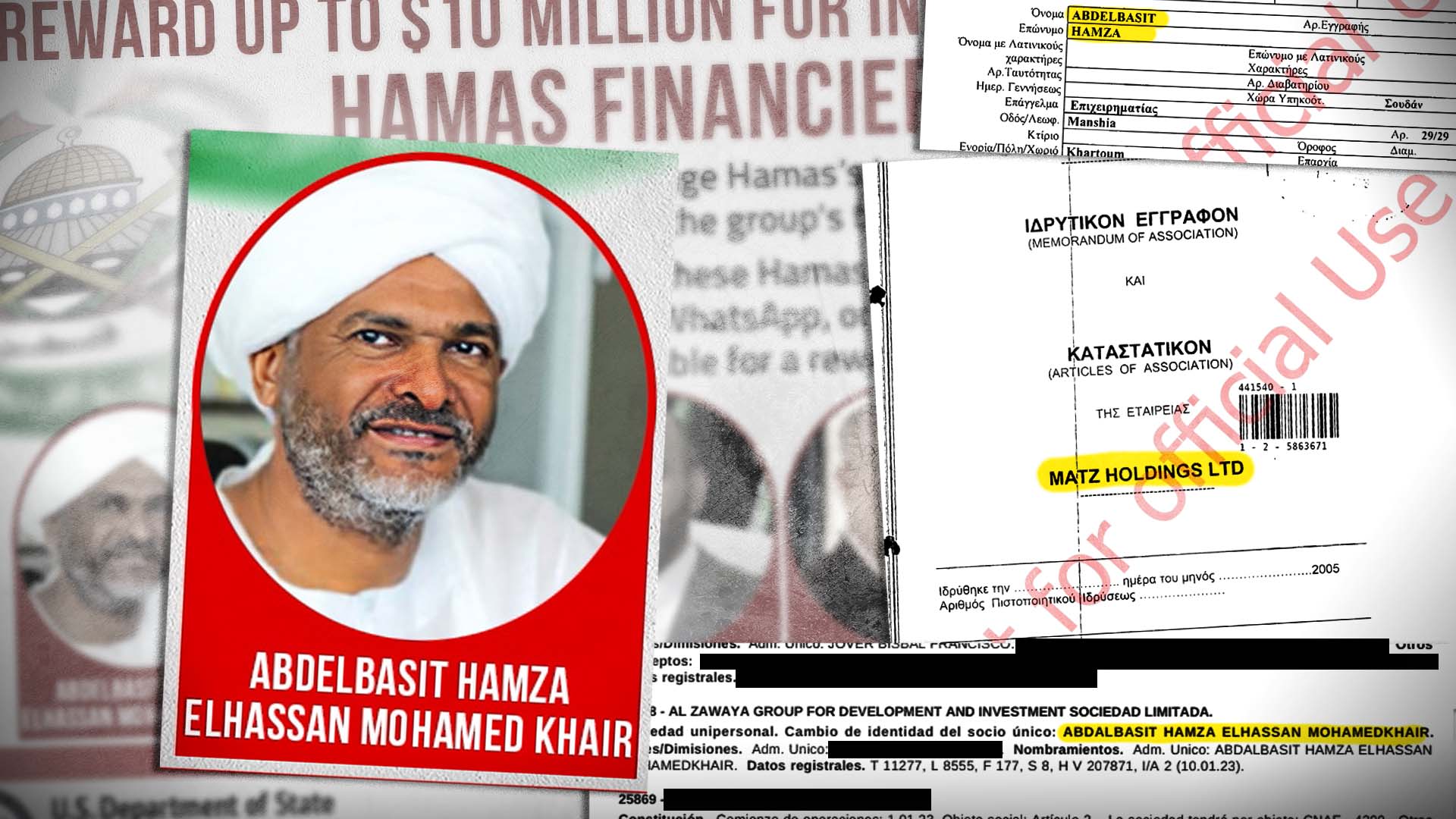

Citing a trove of leaked files, the report named Sudanese businessman Abdelbasit Hamza as the alleged Hamas financier. He has been sanctioned by the US and UK – but not the EU.

Hamza is accused of being “a central figure in Hamas’ investment portfolio” with a stake in Matz Holdings, a Cyprus firm incorporated in February 2005.

The company holds “lucrative concessions” to exploit two gold mines in Egypt. In 2018, the company’s assets totalled roughly $35 million, ICIJ reported.

According to ICIJ, the alleged financier is an ally of former Sudanese President Omar al-Bashir.

Though he was formerly the director of Matz Holdings, Hamza resigned from the post a month after he was convicted on corruption charges in April 2021 in Sudan. He was sentenced to ten years in prison but was reportedly released from jail following Sudan’s October 2021 military coup.

Letymbiotis, speaking to a pool of reporters on Friday did not delve into details but said: “We are in the process of trying to verify this information. It is something we are aware of and are also investigating it.”

The ICIJ report detailed that after al-Bashir’s fall from power in 2019, Hamza sold “a large portion” of his shares in Matz Holdings, retaining a 10 per cent stake.

That stake is owned through the Zawaya Group for Development and Investment, a Sudan-based company, ICIJ highlighted, that was also sanctioned by the US Treasury Department in October, citing the firm’s links to Hamas’ investment portfolio through Hamza.

According to the report, the concession agreement between Matz Holdings and the Egyptian government outlines that both receive “a roughly equal share of the profits from gold extracted from the mines.”

Hamza has a Swiss partner in Matz Holdings, named as Jakob Felix Bliggenstorfer. Together, the two “threatened legal action against a separate Cyprus firm that the pair claimed owed them nearly $20 million for the purchase of a large portion of their stake in Matz Holdings.”

Hamza was sanctioned by the US in the aftermath of the October 7 Hamas terror attack on Israel for managing Hamas’ investments. ICIJ detailed Hamza was involved in the transfer of almost $20 million to the organization, including funds sent directly to a senior Hamas financial officer.

The US Treasury Department accused Hamza of “longstanding ties to terrorism financing,” including past links with companies connected to al-Qaida and Osama bin Laden.

Hamza was sanctioned by the UK in November.

ICIJ quoted Bliggenstorfer denying that Hamza had any ties to Hamas, describing the sanctions as “a case of mistaken identity”.

It added that Hamza sold the majority of his Matz Holdings shares to another Cyprus firm, Matz Dungash. By April 2019, the latter company had acquired over 90 per cent of Matz Holdings’ shares, ICIJ said.

Matz Dungash’s director is named as Egyptian businessman Hesham ElHazek who is reportedly tied to Egypt’s former President Hosni Mubarak.

ElHazek was sanctioned by Canadian authorities for corruption, while his assets in Egypt were frozen.

According to ICIJ “ElHazek appears to have found himself back in the good graces of Egypt’s military-dominated government and remains on the board of Matz Holdings.”

The investigation detailed that “Hamza told ICIJ and Shomrim in an email that ElHazek owns Matz Dungash and its Cayman Islands-based parent company. He wrote that neither he nor Bliggenstorfer ever received payment from Matz Dungash for their shares in Matz Holdings and that ElHazek has not communicated anything to them about the company’s activities since taking control.”

Click here to change your cookie preferences