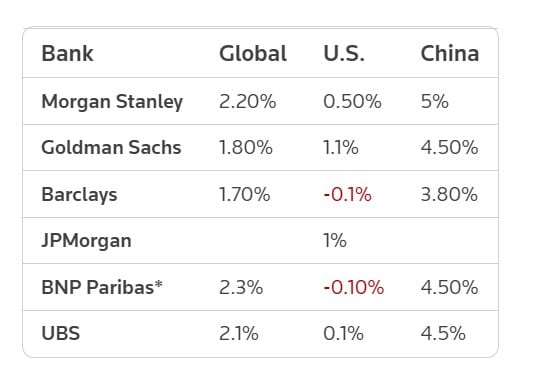

The world’s largest investment banks expect global economic growth to slow further in 2023 following a year roiled by a war and soaring inflation that triggered one of the fastest monetary policy tightening cycles in recent times.

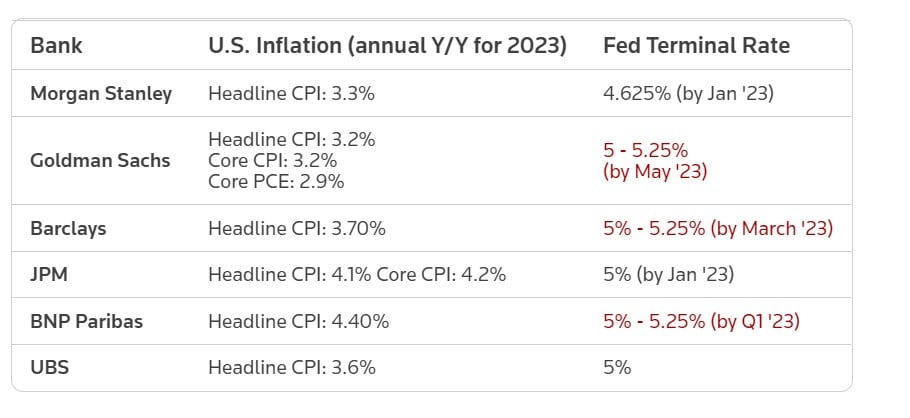

The US Federal Reserve has increased interest rates by 375 basis points this year since rolling out its first hike in March. This has sparked worries about a recession, even as the central bank is expected to temper its pace of hikes.

Real GDP (annual Y/Y) forecasts for 2023:

US inflation forecast for 2023 and Fed terminal rate forecast:

Morgan Stanley sees the Fed delivering its first rate cut by December 2023, taking the benchmark rate to 4.375 per cent by the end of that year. Barclays sees the rate between 4.25 per cent and 4.5 per cent by the end of next year, following a rate cut.

UBS expects US inflation to be “close enough” to the Fed’s 2 per cent target by the end of 2023 for the central bank to consider rate cuts.

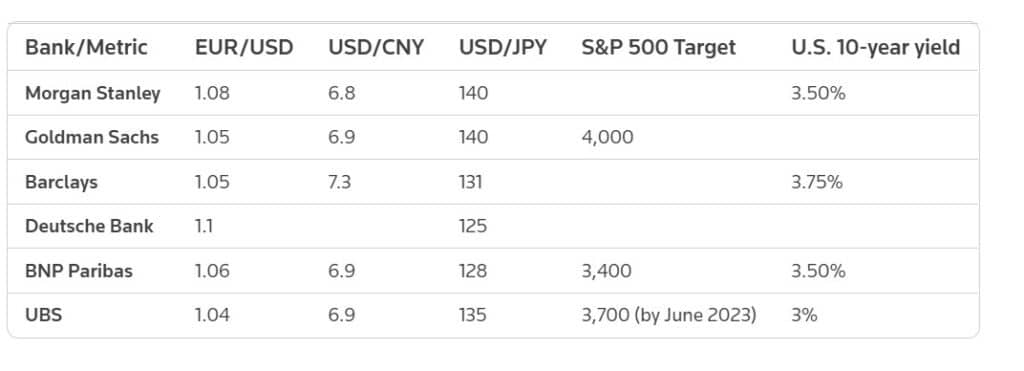

Forecasts for currency pairs, yields on US 10-year Treasuries, S&P 500 target by the end of 2023:

UBS sees the euro falling below parity to the dollar by March 2023 before clawing back by September.

As of 1346 GMT on Nov. 21, 2022:

EUR/USD : 1.02

USD/CNY : 7.16

USD/JPY : 141.72

S&P 500 level (as of Friday’s close): 3,965.34

Click here to change your cookie preferences