But market participants say it illustrates a confidence among investors that the top end of office real estate will withstand the coronavirus shock – even as questions hang over the viability of shabbier and less well-located spaces.

“Direct investments in prestigious income properties represent an opportunity in terms of diversification and return, as demonstrated by the growing interest of our ultra-high-net-worth clients,” said Angelo Vigano, head of Mediobanca Private Banking.

A good example is the Palazzo delle Poste in the heart of Milan, one of the more elegant office spaces in Europe, hosting the likes of JPMorgan and Italy’s first ever Starbucks outlet.

Having lain empty for part of 2020 as the COVID-19 pandemic sent office workers home, the early 20th-century building was sold this month to a group of private investors coordinated by Italy’s Mediobanca for €246.7 million ($293.3 million), €27 million above the original asking price.

The 2.8 per cent capitalisation rate – the return the property is expected to generate – was a record for office real estate in Milan.

Following a year in which remote working and social distancing have become well entrenched, leaving city-centre offices, retail and hospitality venues deserted, the richness of the deal may seem counterintuitive.

Many investors are betting real estate returns will outstrip equities and bonds as the world emerges from its pandemic funk.

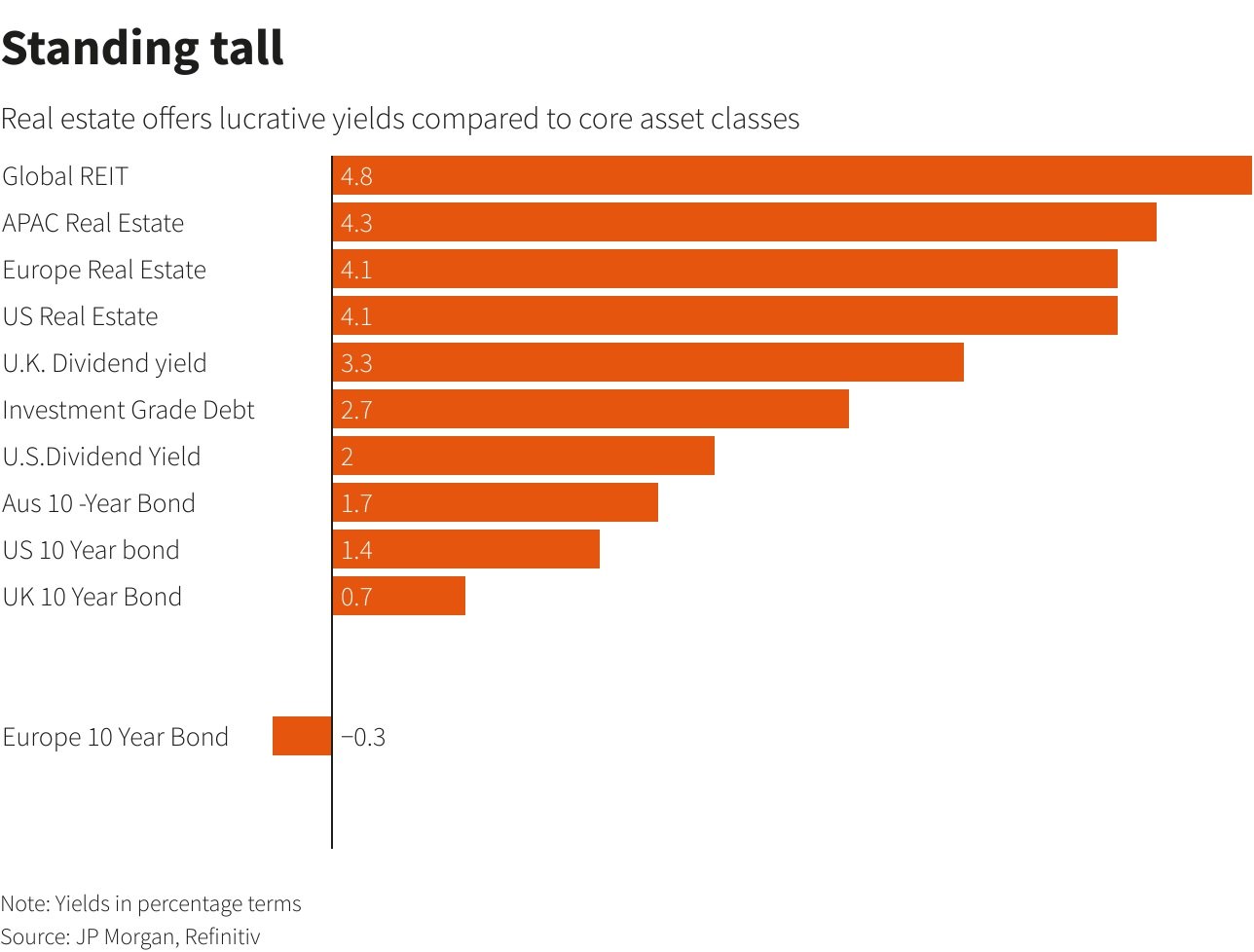

At a time when almost $14 trillion of global bonds pay sub-zero yields, global real estate offers annual yields based on current prices of 3-4 per cent, according to JPMorgan and Refinitiv data.

That compares to 1.6 per cent on U.S. government bonds and minus 0.3 per cent on German debt, or dividend yields of around 1.6 per cent on U.S. equities.

Property is also considered a good hedge against inflation, which is expected to rise in the coming years thanks to two-pronged stimulus campaigns by governments and central banks.

Inflation is “a slow-burning fire hanging over financial assets, but it’s a tailwind for real assets such as real estate”, said Mike Kelly, head of multi-asset at PineBridge Investments, which bought Britain-based real estate fund manager Benson Elliott last October.

“At the moment, these are very disrupted markets – which gives you a good entry spot,” he added.

After a tough start to 2020, global real estate investments in the October to December period rose 65 per cent from the previous quarter to $267 billion, cushioning the year’s overall 28 per cent decline, Jones Lang LaSalle said.

Data from industry specialist Global SWF shows public pension funds’ property investments hit a 2-1/2 year high in December.

The disruption linked to the pandemic means opportunities in ageing offices that can be spruced up, beat-up retail parks that can be redeveloped, and warehouses springing up to cater to the e-commerce explosion.

Blackstone, the seller of Palazzo delle Poste and owner of $368 billion in property assets worldwide, recognises that post-pandemic working and shopping could be radically different.

“Our focus is on creating the highest quality assets, based on what tenants will want tomorrow,” said James Seppala, Blackstone’s head of European real estate.

“Particularly in response to the pandemic, employee safety and wellbeing is at the forefront of tenants’ minds.”

The challenge of finding the right investment is considerable. Many big city-centre employers such as HSBC and Standard Chartered plan to cut their office footprint by up to 40 per cent.

Citi analysts predict the value of office properties across Europe could plunge by 25 per cent-40 per cent over three years, and advises clients to ditch shares in companies providing office space.

South Africa’s Nedgroup Investments has already shed listed exposure to offices in Paris, Sydney and especially New York.

But many investors interviewed by Reuters continue to home in on prime offices. Tenants will likely take a “hybrid approach”, with home-working and offices complementing each other, said Paul Kennedy, JPMorgan Asset Management’s head of strategy and portfolio manager for real estate in Europe.

“These trends should protect ‘core’ buildings at the expense of more marginal assets,” Kennedy added.

Despite Brexit, central London office income beats most European cities; at 4 per cent, it is well above Frankfurt’s 2.8 per cent, says M&G Real Estate’s head of strategy Jose Pellicer.

Consultants Knight Frank predict London offices should draw investment of over £10 billion this year, versus £7.8 billion in 2020.

Click here to change your cookie preferences