Cyprus’ tax-free income threshold is set to rise to €20,500 per year, following the announcement of a set of sweeping tax reform plans by President Nikos Christodoulides on Tuesday.

The plans will see the minimum earnings threshold to pay income tax rise by €1,000 from its current level, at which it has sat since Cyprus introduced the Euro in 2008.

Additionally, Cyprus’ 35 per cent top income tax rate will now only apply to those earning more than €80,000 per year, rising from its current level of €60,001.

Christodoulides promised his reforms will strengthen Cyprus’ middle class, which he described as the “foundation of every prosperous and democratic society”.

The most notable of his planned reforms is an increase in individuals’ tax-free incomes, while he also promised a “series of significant tax deductions which take into account the needs of households and the composition of the family”.

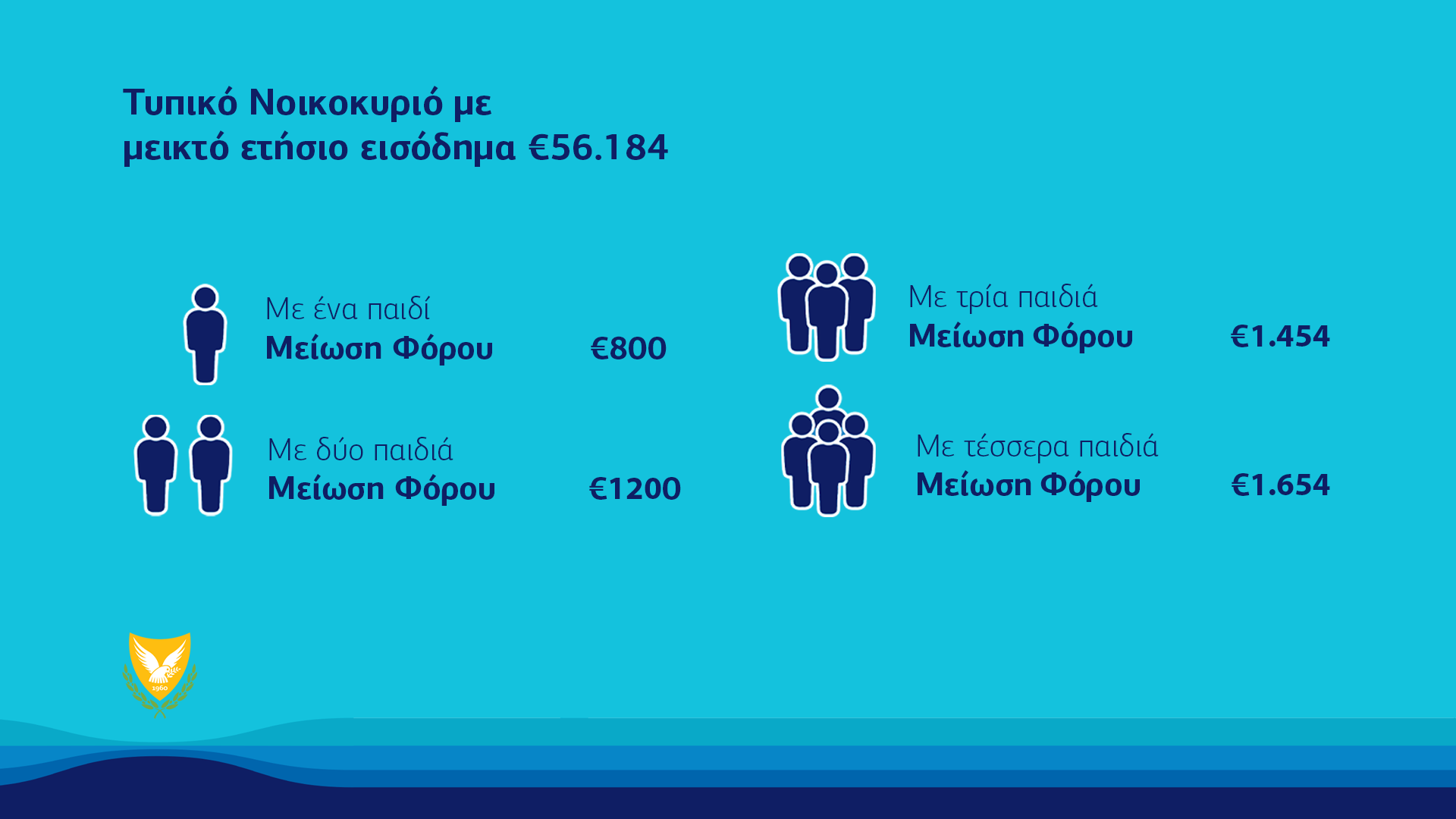

In addition to the €1,000 additional tax-free amount, parents will receive an extra €1,000 for every dependent they have, while Christodoulides’ plan also foresees €1,500 of tax-free income for every parent who is either buying their first house or renting, and €1,000 for a “green investment” on the part of every parent.

Single parents will receive double the ringfenced tax-free amount.

Christodoulides also promised that young people will be “essentially supported” with tax relief incentives for parents, which he said will “further encourage the employment of women and respond to structural, long-term distortions”.

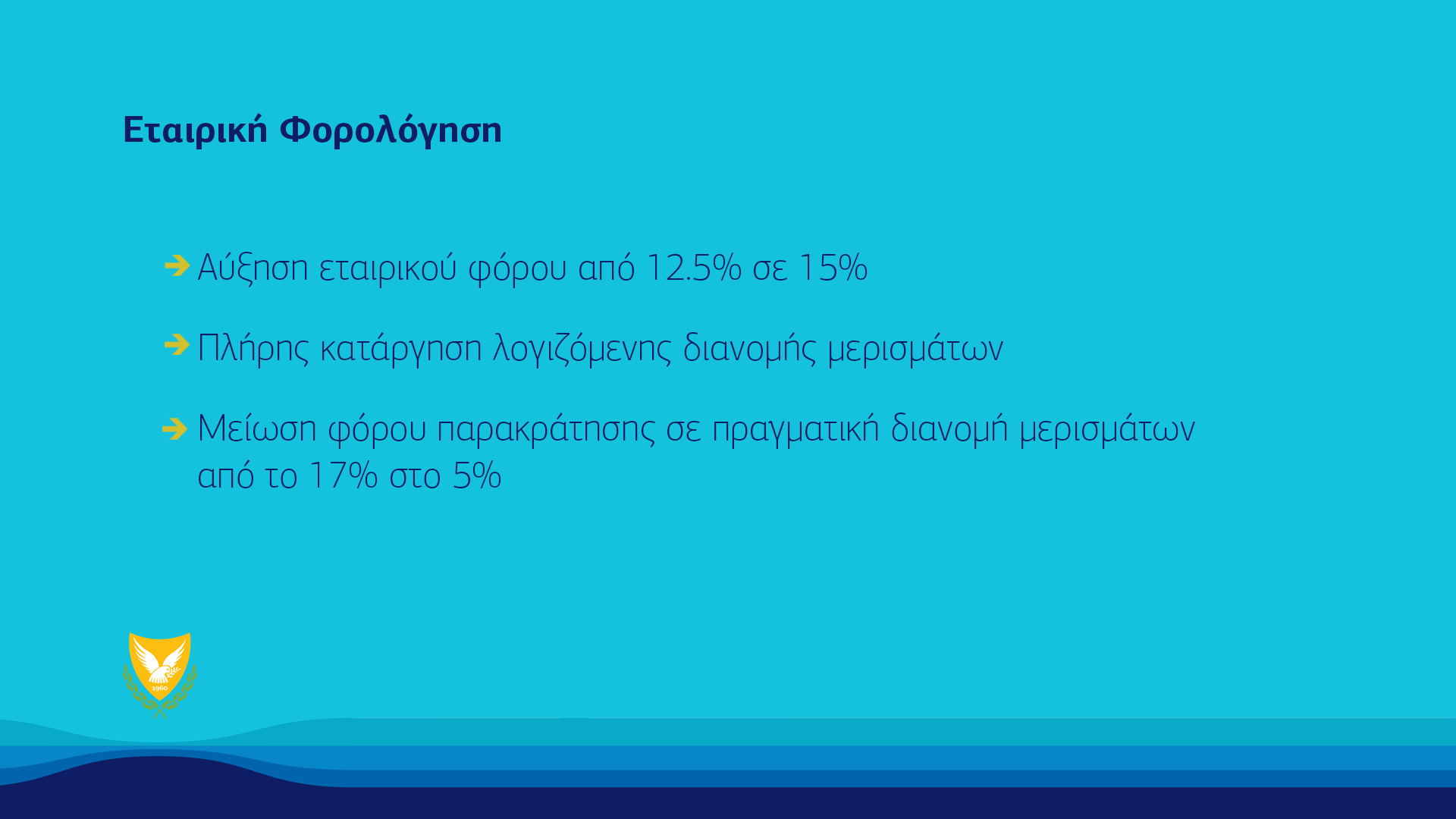

On the matter of businesses, he said the government plans to completely abolish deemed dividend distribution payments and “significantly reduce” the withholding tax on the distribution of actual dividends from 17 per cent to five per cent.

At the same time, he said corporation tax will increase from 12.5 per cent to 15 per cent, bringing Cyprus into line with European Union requirements.

Elena Andreou, director of the University of Cyprus’ economics research centre (CypErc), said the planned reforms will reduce the tax payable by a typical middle-class household to between 63 per cent and 82 per cent.

She also used the example of the Republic of Cyprus’ average salary of €28,356, saying that a single-person household earning that much will pay €422 in tax under the new plans.

If that person is a parent of two children, she said, that tax bill would fall to €22, and that that figure would fall to zero if that person is a single parent.

These plans will soon be brought before cabinet for approval, before being submitted to parliament, where an extended debate can be expected.

Business news website InBusinessNews reported that the government aims for the reform to be fully implemented in 2026.

The business tax changes, he said, “demonstrate our clear will to strengthen the country’s productive fabric and enhance our international image and credibility, which, for our government, is a top priority”.

“The goal remains to invest in innovation, quality, and credibility, so that Cyprus becomes a pole of attraction for quality investments and of course a pillar of security and stability in the wider eastern Mediterranean region,” he said.

He also said his reforms are “of particular political, economic, and social importance in a Cyprus which is changing”, and that they will “ensure a fairer distribution of income, which limits social inequalities, and which strengthens economic and social cohesion in our country.

“A Cyprus which is changing with a tax system which is more efficient, fairer, more adapted to modern needs.”

He also extolled the virtues of the current state of Cyprus’ economy, saying it has one of the highest growth rates in the Eurozone, a “strong” fiscal surplus, and a steady reduction in public debt.

“The responsible fiscal policy that is being followed is bringing results and allowing the state to make targeted social interventions. And all this in the midst of two wars and with the strong economies of Europe being placed under supervision,” he said.

He added that “taking into account all the challenges, and there are many, internal and external, we are moving forward with determination, with a clear plan, in our country’s tax transformation, strengthening our economy’s competitiveness and its further development”.

He went on to say that the reforms “reflect in practice our political ideology as a government, that of social liberalism, but also the imprint of our human-centric approach”.

“Moreover, tax policy is not a neutral technical process, it is first and foremost a political act, a political decision which reflects the compass of social justice and development. The aim, therefore, is to strengthen the real economy and the competitiveness of Cypriot businesses which create well-paid jobs and, above all, strengthen people’s disposable income in a time of many challenges.”

Click here to change your cookie preferences