Cyprus faces high tourism intensity and overtourism risks, says analyst

Cyprus’ tourism sector achieved record-breaking arrivals and revenues in 2025, underscoring strong real income growth and improved market diversification, according to a analysis by Eurobank’s Konstantinos Vrachimis.

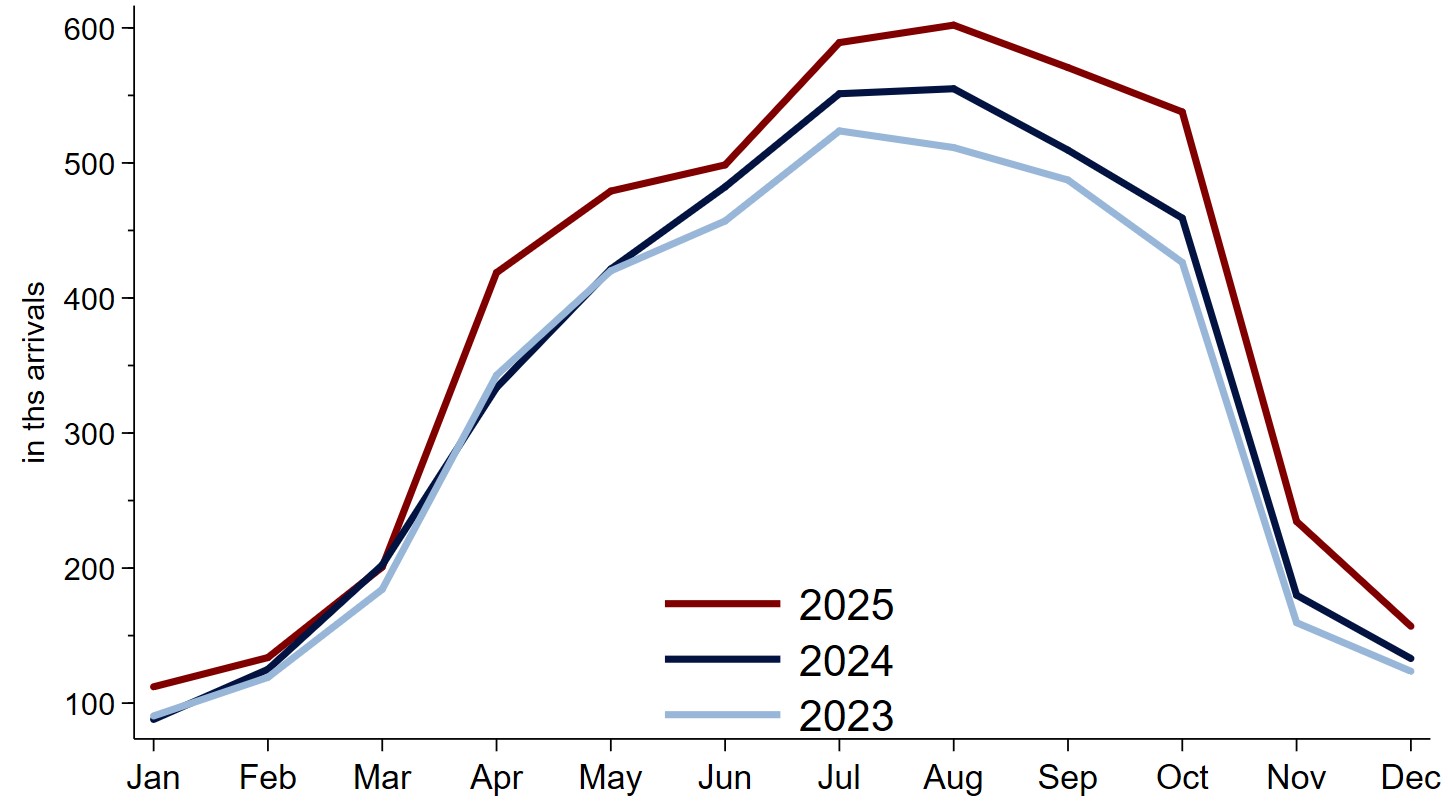

Total tourist arrivals reached 4.5 million in 2025, up from 4 million in 2024, marking an increase of 12.2 per cent year on year, with strong momentum sustained through the final months of the year.

The performance on the revenue side was even stronger, with cumulative tourism receipts for January to November rising to €3.6 billion, reflecting a 15.3 per cent year-on-year increase that outpaced inflation.

This, he explained, implies a clear real uplift in tourism-driven income and broader service-sector turnover.

Expenditure per person increased by 4.6 per cent, while expenditure per day rose by 9.2 per cent in the January to November 2025 period.

The data indicate that revenue gains were not driven solely by higher visitor volumes, as increased per-visitor spending played a meaningful role in strengthening tourism-led income growth.

Monthly arrivals followed the familiar seasonal pattern, building from spring and peaking in summer, but remained above recent years throughout much of the high season, supporting employment, fiscal receipts and corporate earnings across hospitality, transport and retail.

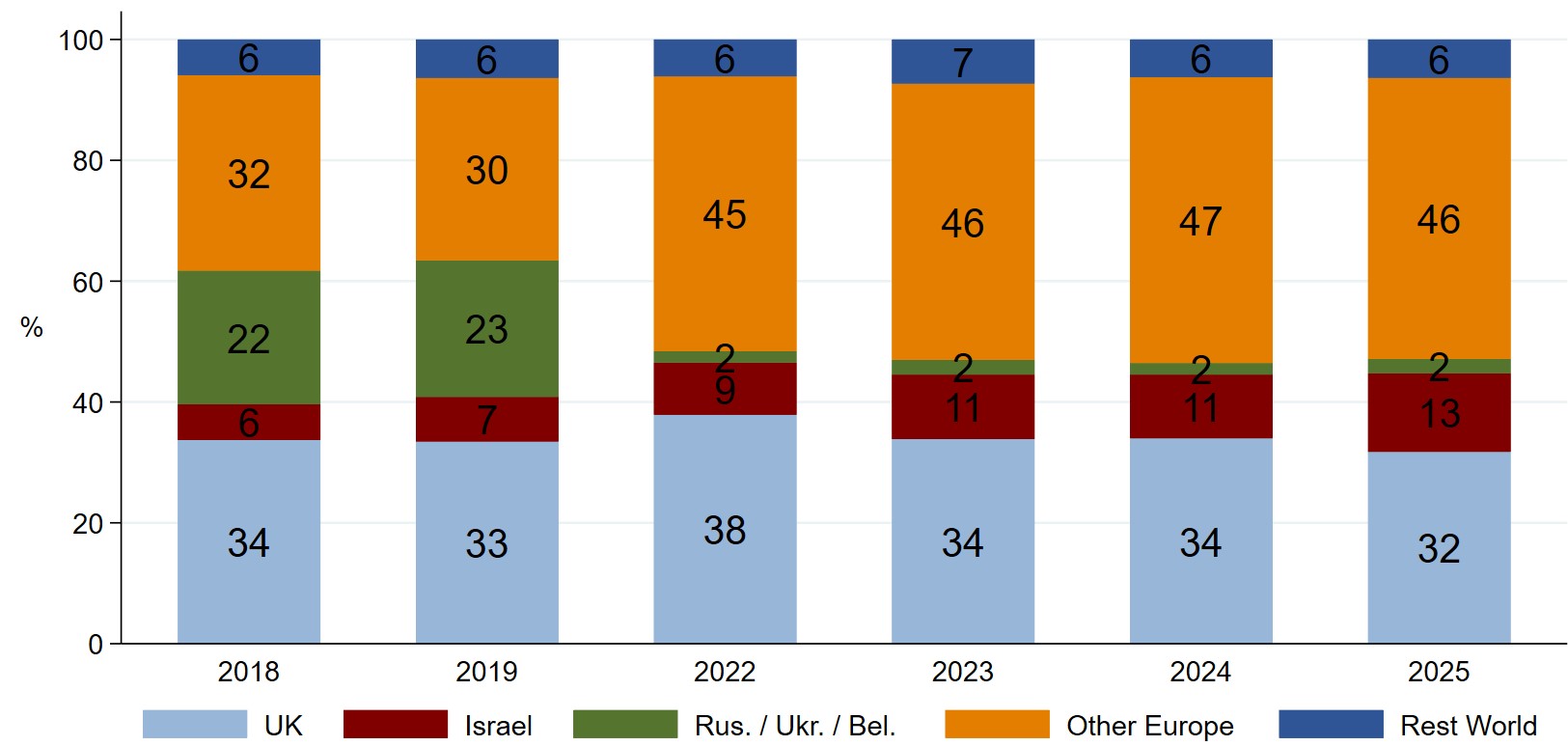

Vrachimis pointed out that the composition of demand points to increased diversification of source markets, while developments on the supply side signal a structural upgrade in accessibility.

The United Kingdom remains the largest source market for Cyprus, although its share eased, while Israel’s contribution increased materially and Germany recorded a marginal rise.

Several European countries, including Italy, the Czech Republic, the Netherlands, Austria and Poland, posted double-digit increases in arrivals in 2025 compared with 2024.

He described this rebalancing as constructive, arguing that it reduces concentration at the margin without undermining headline growth.

Air connectivity improved further during the year, with flight volumes to Cyprus expanding significantly compared with 2019 across all quarters.

This expansion reflects increased airline capacity, stronger route coverage and improved frequency, factors that support shoulder-season demand and reduce reliance on a narrow set of peak-month flows.

Despite the strong near-term momentum, Vrachimis cautioned that risks are concentrated more in structural characteristics than in immediate performance trends.

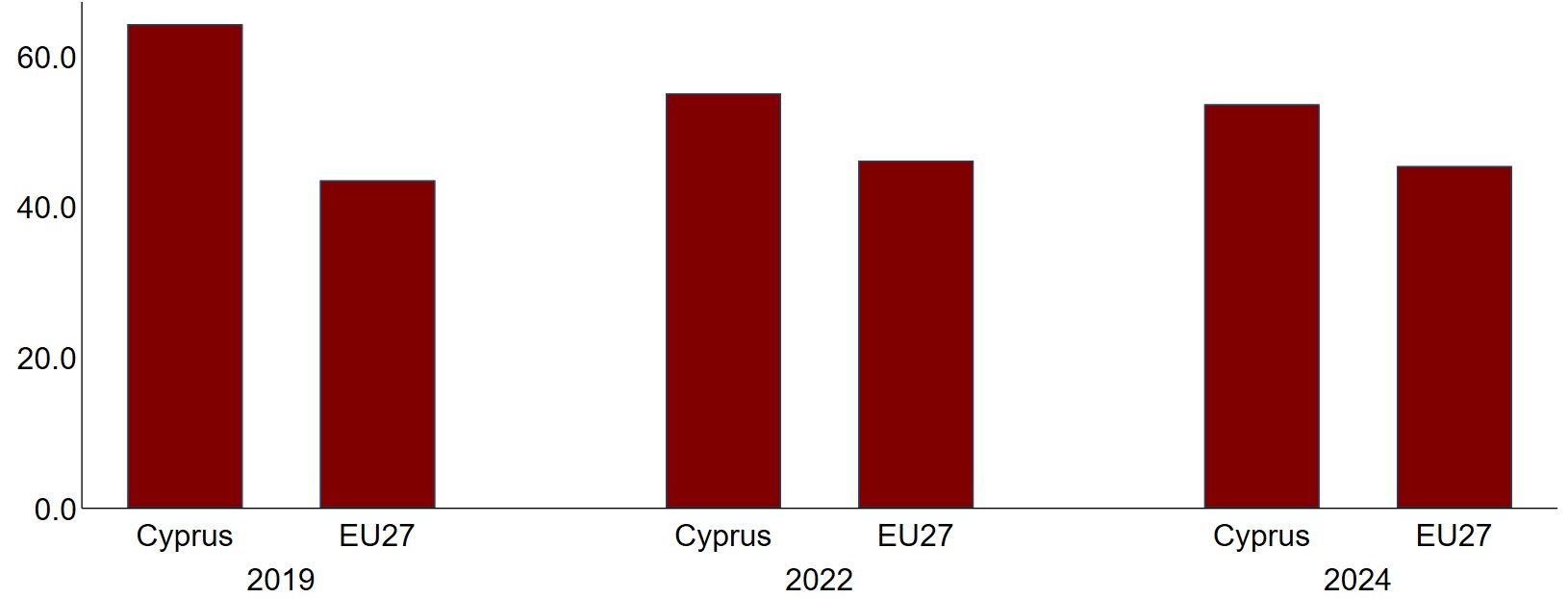

The European Commission has introduced the EU Tourism Dashboard as a new monitoring tool to track tourism intensity, seasonality and source-market concentration.

The framework provides a common European Union basis for identifying conditions of unbalanced tourism and related vulnerabilities at country level.

Cyprus continues to exhibit high tourism intensity, measured by the number of nights spent in tourist accommodation relative to the resident population, an indicator associated with potential overtourism.

The country also remains heavily dependent on a limited number of origin markets, leaving tourism earnings exposed to geopolitical shocks or demand fluctuations in key countries.

Seasonality remains pronounced, placing pressure on infrastructure, housing and labour markets during peak months.

This seasonal strain extends to natural resources such as water and contributes to higher levels of pollution.

“Targeted investment, product upgrading and continued market diversification remain key to resilience,” Vrachimis concluded.

Click here to change your cookie preferences