EToro competes with Robinhood, which has become hugely popular with young investors for its easy-to-use interface. Robinhood has emerged as a gateway for amateur traders challenging Wall Street hedge funds.

The deal with FinTech Acquisition Corp V, a special purpose acquisition company, will include a $650 investment from investors including Fidelity Management & Research Co LLC and Wellington Management.

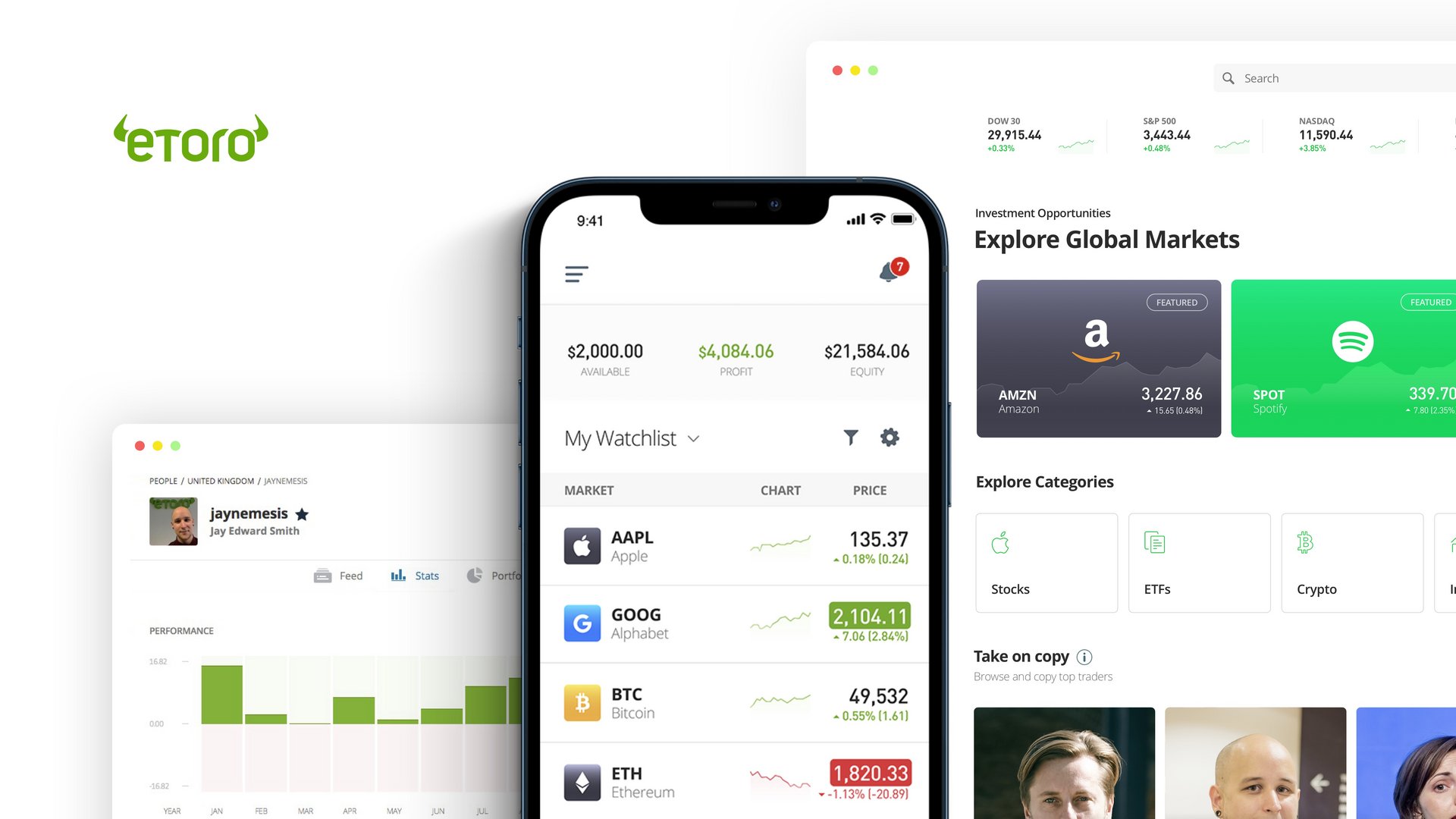

Founded in 2007, eToro has 20 million registered users who can manually invest in cryptocurrencies, stocks, commodities and more, while those who lack time or experience can automatically copy the trades of others on the platform.

Special purpose acquisition companies, or SPACs, are shell companies that use proceeds from an IPO to take private firms public. FinTech Acquisition Corp V’s shares jumped more than 15 per cent before the bell.

Cohen, who founded Jefferson Bank and Bancorp Inc, is one of the prominent businesswomen who have joined the SPAC frenzy.

EToro joins a wave of Israeli tech companies and startups including mobile gaming company Playtika Holding Corp, that are going public in the U.S. to take advantage of the capital markets boom.

In 2020, eToro added over 5 million new registered users and generated gross revenue of $605 million, an 147 per cent jump from a year earlier.

EToro will allow users in the US, who currently trade in cryptocurrencies, the option to buy and sell stocks later this year. Clients outside the US can invest in fractional stocks, or parts of shares. Social networking among investors on the site is an important feature.

Bitcoin accounts for one of every 25 positions opened on eToro, while the most popular stocks are Tesla Inc, Microsoft Corp and Apple Inc, according to the company’s website.

Click here to change your cookie preferences