Investors around the world have poured money into Exchange-Traded Funds (ETFs) this year.

More than $800 billion have been invested thus far this year, up from $600 billion in assets under management in all of 2020.

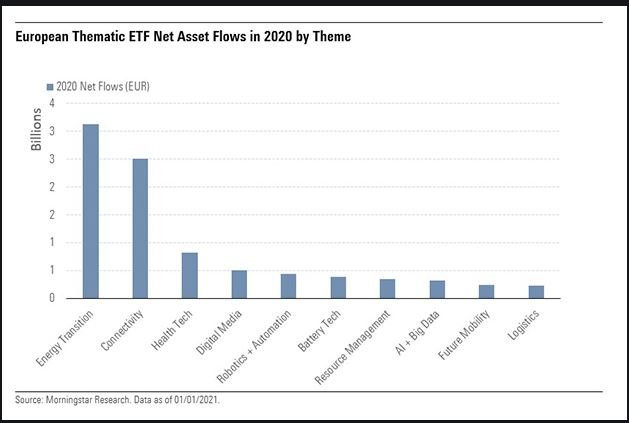

Thematic ETFs, which track an individual commodity or type of company, have been among the most popular, according to ETFGI, a research company that specialises in ETFs. Investors are apparently betting on long-term trends that they themselves perceive as ongoing. Some of the most popular funds track megatrends that are well-recognised; the trick is to select a fund that has an original take on asset choices. Funds that track Amazon and Uber – and there are many – are less likely to appreciate than those that make more adventurous choices.

Research suggests this surge in demand is not just a temporary blip. According to Brown Brothers Harriman’s (BBH) 2021 Global ETF Survey, 80 per cent of financial advisers, fund managers and institutional investors globally plan to increase allocations to thematic ETFs, reports ETF Stream.

Antonette Kleiser, senior vice president and product manager for ETFs in Europe and Asia at BBH, said she is witnessing investors “choosing very specific themes, very niche targeted exposures to sub-industries, and using thematics as a way to tap into changes in industries”.

A key advantage of thematic ETFs over sector products is that the former are linked to long-term structural themes rather than short-term economic cycles, according to Gregory Berthier, head of product at Lyxor ETF.

There are some good examples from technology. Consider the Global X Lithium & Battery Tech ETF for an indirect play on the rise in demand for electric vehicles. This fund is up 200 per cent over the last three months, driving higher by the immense investor interest in batteries that enable electric cars to drive farther.

For those who prefer an index-based approach to the same underlying assets, the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry, offers a good choice.

Another hot fund thematic is clean water. The global water supply is dwindling, and that is set to become one of the biggest issues facing societies across the globe.

According to the United Nations, water shortages are now impacting more than 3 billion people around the world driven by rising demand and poor water management while the amount of fresh water available has fallen by 20 per cent over the past two decades.

The L&G Clean Water UCITS ETF offers exposure to companies actively engaged in the clean water industry in areas such as water production and processing.

“LGIM has partnered with industry expert Global Water Intelligence and index provider Solactive to create an index that captures the entire value chain of the megatrend,” according to ETF Stream.

Still another megatrend-based ETF is the WisdomTree Cloud Computing UCITS ETF.

Believe it or not, this has been the most popular ETF in Europe since 2019, according to ETF Stream.

It currently has $663 million in assets under management since its launch in September 2019.

This all thanks to the rising demand for cloud services which is well documented. The market is expected to deliver revenues of $350 billion in 2022, according to ETF Stream, up from $180 billion in 2018.

When creating the index, WisdomTree worked with tech market experts Nasdaq and Bessemer Venture Partners which were able to source the appropriate companies for inclusion.

Unlike rival cloud ETFs, Wisdom Tree ignores giants such as Amazon and Microsoft. Although those companies currently dominate the cloud market, returns can be driven by other parts of their businesses.

Instead, Wisdom Tree selects companies such as Cloudflare and Sprout Social whose revenues are predominantly driven by cloud services.

Staying with megatrends, another popular ETF tracks ecommerce – companies whose business is based on ecommerce platforms. The Global X Fund ecommerce ETF is one of these.

Global X Ecommerce seeks to invest in companies positioned to benefit from the increased adoption of ecommerce as a distribution model, including companies whose principal business is in operating ecommerce platforms, providing ecommerce software and services, and/or selling goods and services online.

Global X Ecommerce claims to offer investors high levels of return on investment, because it enables investors to access high growth potential through companies that are positioned to benefit from the increased adoption of ecommerce as a distribution model.

Like all the funds we’ve discussed, Global X Ecommerce has an original approach. It transcends classic sector, industry, and geographic classifications by tracking an emerging consumer theme. This may explain why the fund is up 13 per cent in this year-to-date.

Picking ETFs of this type is no easy task. And it’s complicated by the fact that past performance may have absolutely nothing to do with future returns.

Even if the fund chooses assets carefully, it is the evolution of the particular niche the fund is in that makes all the difference to gains and losses. Probably the best approach is to find a trend you like in a special niche, and then find the fund that is closest to it.

Click here to change your cookie preferences