The European Commission, the International Monetary Fund National and the credit rating agency Moody’s have reported that the Cyprus Government has managed the Covid-19 crisis relatively well, with considerable fiscal support to locked-down enterprises and workers enabling the avoidance of widespread business failures and high unemployment. And on the economic outlook Moody’s, among other things, contends that Cyprus shows “robust medium-term GDP prospects supported by sizable European funds”.

In their assessment of the prospects for the Cyprus economy and the credit risks of the Government these institutions, particularly Moody’s, give insufficient attention to the large underlying external and internal imbalances that predate the COVID-19 pandemic shock and, indeed, that have been exacerbated by it. Furthermore, the Government finances have been driven into substantial deficit through related emergency support measures and falling revenues. These imbalances have been financed by the accumulation of debt, which at some point must be repaid or written off.

While the task of alleviating the overwhelming indebtedness of the private sector that is inhibiting economic growth constitutes a main macroeconomic problem for Cyprus, the focus of this piece is on how to deal with the accumulating external imbalances that pose downside risks for the Cyprus economy.

How are the large deficits in the balance of payments and the Government’s considerable debt obligations going to be financed over the medium-term? In fact, there are parallels between the accumulating imbalances, especially of the balance of payments and in the Government’s financing requirements, in the years before the 2012/13 crisis and those in the years 2018 to 2020 prior to the current situation, which should herald warnings about the need to effectively address these imbalances.

Parallels and Differences

In the three years 2010 to 2012 preceding the financial crisis current account deficits in the balance of payments averaged 8.7 per cent of GDP with the deficit climbing to 11.7 per cent of GDP in 2012. Similarly, such deficits averaged 7.4 per cent of GDP in the three years 2018 to 2020 with the deficit surging to 11.8 per cent of GDP, 11.4 per cent adjusted for Special Purpose Vehicles (SPVs), in 2020 as tourism receipts declined sharply.

Furthermore, in the two years 2011 and 2012 the fiscal deficit amounted to 5.7 per cent of GDP and in 2020 it was estimated similarly at 5.8 per cent of GDP. Also, both in the three years 2010 to 2012 and from 2018 to 2020 external borrowing by the Government was used as an important source for funding both the current account and its financing requirements with the Government foreign debt to GDP ratio reaching the relatively high level of 97.6 per cent at end-2020.

A major difference between the two years prior to the crisis of 2012/13 and the current situation relates to the Government’s access to international markets for borrowing. Whereas the Government lost such access in 2010 the Cyprus sovereign can now borrow externally at very low interest rates.

External Financing a Major Problem

Whether there will be a significant problem in adequately financing the current account deficits of the balance of payments and external debt obligations will depend importantly on the magnitude of such deficits and foreign debt maturities. The large deficits in the current account of the balance of payments are likely to continue as the adverse effects of the COVID-19 pandemic depress tourism receipts and as higher commodity prices including for fuels as well as for construction materials boost imports. Already in the first 5 months of 2021 a 32 per cent increase in the foreign trade deficit has been recorded, while tourism revenues declined by 81 per cent compared with the corresponding period of 2019 and rose by 7 per cent compared with the extremely low level of 2020. In addition, an eventual increase in interest rates is likely to have adverse effects on the current account of the heavily externally indebted Cyprus economy. Furthermore, the structure of the economy with its large reliance on import-intensive private consumption and construction activity could mean that any return to a normal pattern of production, as say in 2019, could still result in current account deficits of 5 per cent of GDP or more, even if tourism recovers rapidly to the peak 2019 level.

According to the Cyprus Debt Management Office maturities of external longer and medium-term Government debt amount to €94 million in 2021, €1.1 billion in both 2022 and 2023, and €1.9 billion in 2024.

In recent years in addition to new borrowing and debt rollover by the private sector mostly under the TARGET2 settlement system of European Central Banks, Cyprus has financed its relevant current account deficits mainly by Government foreign borrowing and by inflows from direct foreign investments including large proceeds under the Cyprus Investment Program involving the sale of passports to non-EU citizens.

However, in view of the current high level of public debt of around 115 per cent of estimated 2021 GDP and the Government’s current aim to steadily reduce this ratio to under 100 per cent by end-2023 it could be problematic for the Government to undertake new borrowings to finance its external payment obligations and assist with financing sizable current account deficits. Furthermore, with the supposed phasing out of the controversial Cyprus Investment Program and the related tarnishing of the reputation of Cyprus the inflow of funds from direct foreign investments can be expected to decline further to relatively low levels.

Thus, with the probable diminution of two of the main sources of external financing in recent years and the current modest level of foreign exchange reserves the prospect of incurring shortfalls in meeting external payments obligations cannot be excluded, especially if significant new sources of financing cannot be secured and/or current account receipts in the balance of payments and direct foreign investment inflows are unable to be increased substantially.

Policies and New External Borrowing

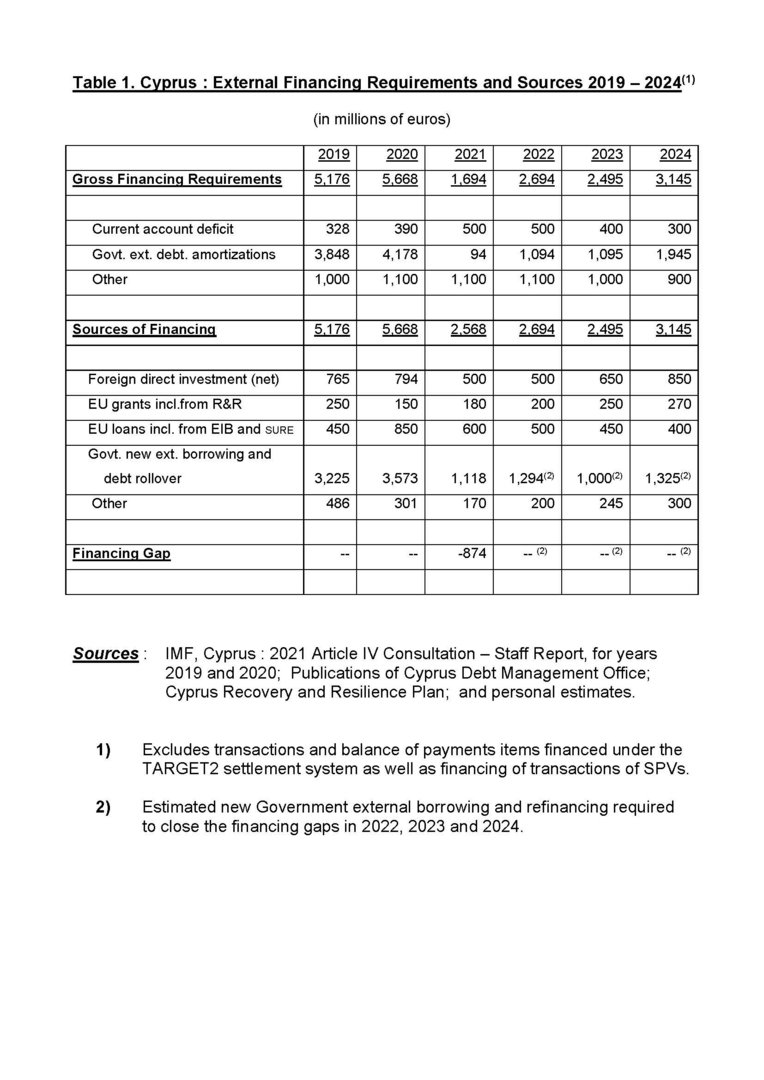

Estimates of the external financing requirements and sources for the period 2019 to 2024 based largely on official data and projections are presented in table1. To meet financing needs not covered under the TARGET2 system including only minor parts of the current account deficits and excluding financing requirements relating to SPVs, it is assumed that grants from the EU including up to €600 million from the Recovery and Resilience (R&R) facility together with loans from the R&R facility and the EIB will make important contributions over the medium-term.

These estimates show that the external financing needs would be more than covered in 2021. However, despite optimistic assumptions being made on the minimum needs for current account financing and that available EU grants and loans will be fully utilized, the projections reveal substantial financing gaps in 2022, 2023 and 2024 totaling some €3.6 billion.

From a policy perspective, it would be imprudent to attempt to plug to a large extent the estimated financing gaps in at least 2022 and 2023 by running down the moderate level of Government reserves and by short-term borrowing as happened prior to the 2012/13 crisis. Indeed, it would be preferable to undertake policies to reduce substantially the current account deficit in the balance of payments and to improve the business environment for attracting productive foreign investments. But this task would require diversifying and enhancing the competitiveness of exports and placing less dependence on import- intensive consumption and construction activity to propel economic growth as well as reforms of the judicial system and strict enforcement of laws and regulations to combat corruption. That is, reforms and a restructuring of the economy would be needed that could take a number of years to achieve. In the interim period it would seem essential for the Government to secure considerable external financing in order to prevent a possible crisis stemming from the inability of Cyprus to meet its external payments obligations.

However, new Government borrowing above that currently planned would run counter to the present official aim to steadily reduce the Government debt to GDP ratio to under 100 per cent by end-2023 and ensure sustainability in the public finances. But as indicated above new Government borrowing is needed to keep the external finances sustainable and creditors would need to acknowledge the dilemma of Cyprus and provide new funding on reasonable terms on the condition that best market-oriented policies and reforms are being implemented to reduce the current account deficit and enhance the business environment for attracting worthwhile foreign investments. Otherwise, without appropriate policy action to address the accumulating external imbalances the serious threat of a future financial crisis could materialize and require harsh restrictive measures to reduce external and internal imbalances, including fiscal austerity and severe restraints on capital outflows and deposit withdrawals.

Thus, it can be concluded that funding from the EU, especially from the R & R facility, would not be enough to enable Cyprus to meet its external payments obligations and support “robust medium-term GDP growth” as stated by Moody’s. Furthermore, policies embodied in the R & R plan need to be amended and more geared to diversifying production toward competitive export-oriented sectors in line with the recent recommendations of the Council of Economy and Competiveness.

Click here to change your cookie preferences