European stocks are set for a bullish start if they follow the Asia-Pacific lead, buoyed by a drop in bond yields on deepening confidence that the major central banks’ tightening cycle has peaked.

Japan’s Nikkei share average (.N225) jumped 1.8 per cent, as investors piled back in following the benchmark’s drop to a three-week low in the previous session. Two of the top three points movers were heavyweight chip industry players Tokyo Electron (8035.T) and Advantest (6857.T).

Hong Kong’s Hang Seng (.HSI) shook off an early wobble, buoyed by a 1.2 per cent leap in its tech subindex (.HSTECH). An index of mainland blue chips (.CSI300) managed a small gain, after dipping to a nearly five-year trough early in the session amid lingering worries over a Moody’s downgrade warning for China’s credit rating.

Australia’s stock benchmark (.AXJO) powered 1.6 per cent higher, still riding the feel-good factor of the Reserve Bank of Australia’s rate hike pause.

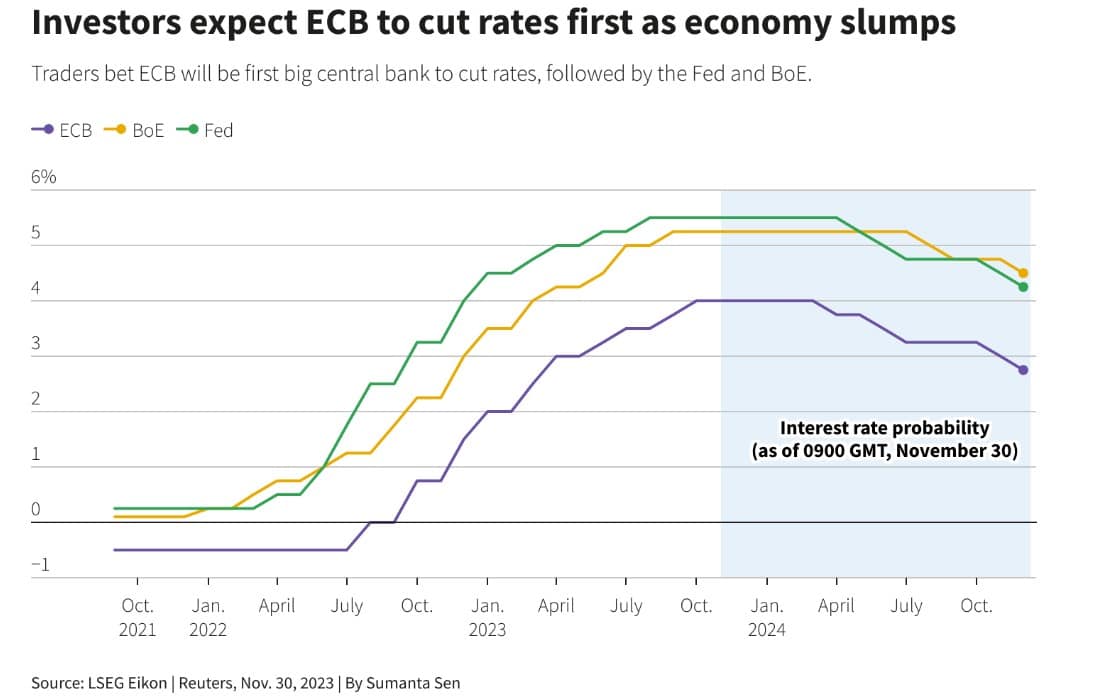

Coupled with recent Federal Reserve dovishness and Tuesday’s interview with ECB policy maker Isabel Schnabel, where she told Reuters that further tightening is “rather unlikely”, there’s a growing sense that the major central banks are done hiking. The Bank of Canada is seen likely to add to that narrative with a “hold” decision later in the day.

Benchmark government bond yields have fallen sharply, hitting multi-month lows in Japan, as they tracked the slump in US Treasury yields overnight.

But while the US economy is certainly slowing, signs still point to a likely soft landing. The labour market is the key focus for the week, with the ADP employment report later in the day, setting up for Friday’s monthly payrolls report.

Macro data from Europe’s biggest economies is also due soon, with Germany reporting industrial orders and the UK releasing purchasing manager surveys, while the euro area publishes retail sales figures.

Key developments that could influence markets on Wednesday:

Germany industrial orders (Oct)

UK all-sector PMI (Nov)

Bank of England financial stability report

Euro area retail sales (Oct)

US ADP employment (Nov)

Bank of Canada rate decision

Click here to change your cookie preferences