The European Central Bank (ECB) on Thursday cut interest rates for the first time in five years, a significant move amidst a backdrop of economic uncertainty.

The ECB lowered its record-high deposit rate by 25 basis points to 3.75 per cent, aligning with central banks in Canada, Sweden, and Switzerland, which have also begun to ease some of the steepest rate hikes implemented to combat post-pandemic inflation surges.

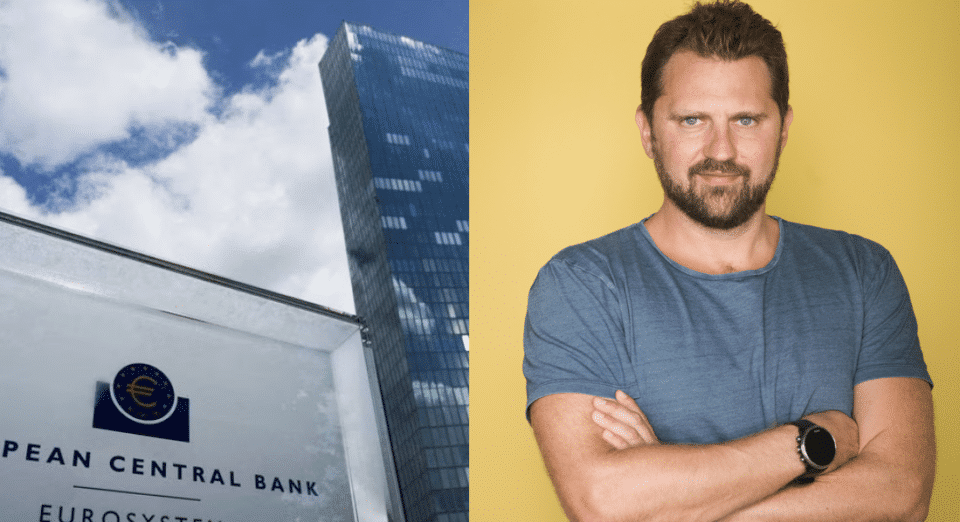

Commenting on this decision, Victor Trokoudes, CEO and founder of fintech Plum, which has offices in Nicosia, Athens and London, said that “the ECB will be hoping that the reduction will help to stimulate further growth in the eurozone area where there have already been promising signs, with growth levels beating expectations and forward-looking business activity coming ahead of forecasts”.

He explained that while the announcement was no surprise, it still represents a major milestone for the ECB.

He also noted that “the cut had been well-trailed, to the effect that the ECB had effectively already committed themselves to this announcement, despite Friday’s inflation figures being higher than expected”.

“Those higher inflation numbers”, he continued, “driven by a rebound in services inflation, make it less likely that the ECB will commit to further cuts right now.”

“Lagarde and her colleagues will be hoping they haven’t moved too early and inflation doesn’t edge even further away from its 2 per cent target,” Trokoudes said.

“That fear will be intensified by the Fed pushing back their rate cuts, meaning import prices are likely to become more expensive as the Euro weakens against the dollar,” he added, noting, however, that it is also “a sign of confidence that the ECB feel they can go ahead with the cut and take a different path given different domestic conditions, despite the UK and USA holding back”.

What is more, the Plum CEO said that “while May’s inflation print may have been driven by one-off factors and have been downplayed as ‘not a significant deviation’ from expectations by the Portuguese central bank governor, it will likely create pause for thought on the ECB’s rate trajectory, which is now harder to predict”.

He explained that this “makes it less likely the ECB will commit to a particular rate path, instead returning to a message of ‘data dependency’, despite market predictions of two further rate cuts this year”.

“What won’t change is the importance of making your money work as hard as possible, especially with the opportunity for people to make real-terms returns from cash for the first time in years,” Trokoudes said.

“In this context, Europeans need to ensure that their savings grow by taking advantage of higher rates now as they may not last,” he added.

“Banks will probably decrease their savings rates at a higher pace than the ECB’s decrease in anticipation for further cuts, especially for fixed-term savings accounts,” he concluded.

Click here to change your cookie preferences