The government on Tuesday was forced to deny media reports it has taken any final decisions hidden from the public eye regarding funding for the controversial electricity interconnector project.

“No definitive agreement has taken place in relation to the final content of the regulatory framework governing the Cyprus-Crete electricity connection,” director of the president’s press office Viktoras Papadopoulos said.

Talks between the stakeholders are ongoing, he added, advising “patience”.

Papadopoulos reiterated that the government’s priority remains driving down the price of electricity. To this end, the government is working on three ‘pillars’ – the advent of natural gas, ending the island’s energy isolation, and making the most of renewables.

His comments quickly followed MPs expressing strong doubts over the state’s reported decision to utilise the country’s emissions penalty fund to finance the Great Sea Interconnector (GSI).

The decision, expected to be formalised on Wednesday by the cabinet and the energy regulator’s top officials, was reportedly taken on Monday after a marathon session by stakeholders.

The media reports prompted the chairman of the House energy committee to dispatch an urgent missive to President Nikos Christodoulides asking him to either confirm or deny.

In the letter, Kyriacos Hadjiyiannis said lawmakers once again convey their concerns over the mode of financing for the interconnector project, and seek clarity from the president as to the government’s intentions.

“This project has certain gaps, and these gaps entail potential dangers,” Hadjiyiannis commented.

Speaking to the Cyprus Mail, Greens MP Charalambos Theopemptou said the reported move – tapping the emissions penalty fund – had met furious opposition from electricity authority (EAC) experts who have long held that investing in the island’s own infrastructures was the only sane priority.

This would entail, firstly, fixing the massively polluting Dhekelia power station, building-up energy storage, and unpegging the price of renewable energy (RES) from conventional fuel production.

The reported agreement has been portrayed as a means to avoid foisting the GSI funding gap – to the tune of €125 million – onto consumers directly via an electricity bill tariff.

Hadjiyiannis, who has been sounding the alarm for weeks, alleged that this was actually an unscrupulous sleight of hand.

“Instead of the cost being paid through a monthly fee it will be paid by the central state, ‘theoretically’ until 2030,” the MP told CyBC. He argued that the project – as it stands – left the state open to ongoing cost hikes, with the consumer ultimately footing the bill sometime in the future, giving free rein to Admie, the provider, to rake in profits.

He further decried the notion that Cyprus would be supplied lower-costing electricity from Greece, “the fourth most expensive energy producer in Europe” and said the island did not need Greece’s RES energy since it had sufficient resources in that regard which currently go to waste, and would only be receiving Greek energy produced from fossil fuels.

It was questionable whether the state would manage to convince the European Commission to accept Cyprus’ latest bid to propel the project forward, Theopemptou also said.

“The ETS fund [a deposit officially known as the Emissions Trading System fund which forms part of the EU carbon units trading mechanism] is very strictly regulated as to its uses,” the MP told Cyprus Mail.

“Convincing the EU that the proposed usage [towards the GSI] applies will not be easy,” he said, as the state is legally bound to use 100 per cent of the funds towards stipulated goals.

These essentially cover reducing greenhouse gas emissions cost-effectively, through programmes such as upgrading the energy efficiency of buildings, increasing rooftop PV panels, and reducing emissions from transports – overall locally focused, immediate solutions for reducing energy demand, producing the remaining energy efficiently, and gaining energy security.

“We are pushing the interconnector when all sorts of other options have never been explored, which are likely more cost-efficient, [such as] energy from biogas, investing in smaller production facilities island-wide, and others,” Theopemptou said.

The MP seconded Hadjiyiannis, saying that stakeholders were essentially once more putting the cart before the horse.

“We have never had a unified energy policy – which the EU requires us to have. We have never scientifically evaluated and assessed all possible options with the aim of selecting the best way forward. We jump from one ‘good’ business idea to the next,” he claimed.

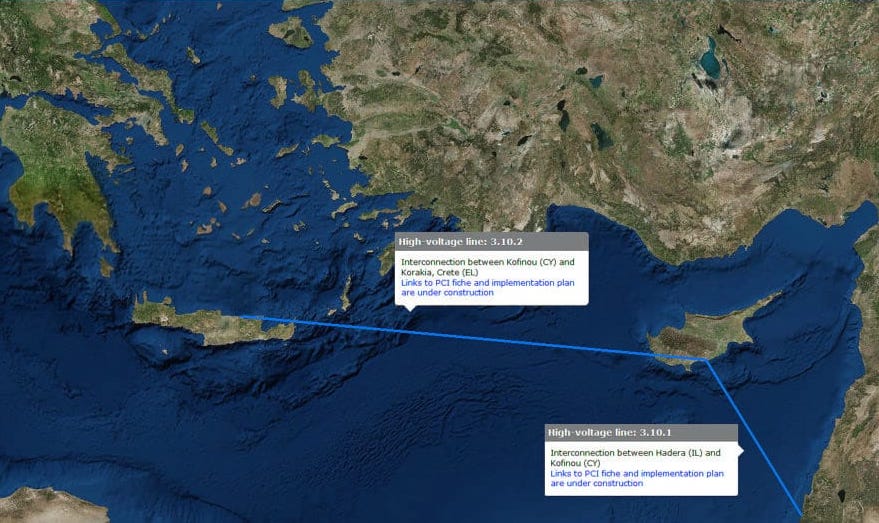

The solution of tapping into the state’s ETS funds (part of the Recovery and Resilience Facility) was reportedly reached by the governments of Cyprus and Greece, the EU directorate-general for energy, the regulatory authorities of the two countries, and Greece’s independent power transmission operator, Admie, after a marathon meeting which capped years of stops and starts for the mooted Crete to Cyprus to Israel sea-cable.

According to the agreed wording, the ETS fund would be used to pay out €25 million per year, from 2025 to 2030, to cover the cost of the project.

Admie had initially been uncooperative, refusing to accept this solution worked out by the energy ministries of Cyprus and Greece and Energy Regulatory Authority (Cera) last Friday, according to Phileleftheros.

Faced with the spectre of the project’s collapse, whereupon it would be liable for tens of millions of euros to cable producer, Nexans, which it had already commissioned to start, Admie eventually relented, the daily said.

Government negotiators reportedly took a hard-nosed stand that no more than a total of €125 million would be paid out, despite threats from Admie to leave the negotiation table.

Additional costs incurred, should they be deemed reasonable construction expenses put out by Admie, can still be recouped via consumers’ electricity bills, but only once the project goes into operation.

As far as geopolitical risk goes, the regulatory framework approved by Cera since 2023 will not change. Should an external risk, for which Admie cannot be held responsible, interrupt the project, it may be permissible for Cera to approve the recovery of said costs from consumers, the contract stipulates.

Efforts by Admie to make the wording regarding this eventuality more definitive failed.

Meanwhile, Admie managed to increase its locked-in profit rates by securing a five-year extension. A rate of 8.3 per cent annually for a period of 12 years had already been provided for in the original regulatory decision, which at the time concerned the EuroAsia Interconnector.

After pressure from Admie as well as an assessment of the matter by an audit consulting firm recruited by Cera, it was agreed to extend the period of validity to 17 years, instead of 12.

Click here to change your cookie preferences