Cyprus-based international gaming and entertainment company GDEV this week released its financial results for the second quarter of 2024, posting $108 million in bookings.

This highlights the continued growth of its popular gaming franchises, including Hero Wars, Island Hoppers, and Pixel Gun 3D.

The company, listed on NASDAQ, reported strong performance across its subsidiaries Nexters and Cubic Games, which together have surpassed 550 million installs and generated $2.5 billion in bookings overall.

In Q2 2024, GDEV achieved strong financial results, generating $108 million in bookings. The company’s investment of $47 million in user acquisition supported this growth, resulting in an adjusted EBITDA of $16 million.

This quarter’s highlights include franchise expansions, such as the addition of Lara Croft in Hero Wars and the launch of Pixel Gun 3D on Steam, broadening the reach and appeal of GDEV’s portfolio.

Following Q2 results, GDEV launched an At-The-Market (ATM) programme to enhance market engagement, reintroducing shares initially acquired in a Self Tender Offer in early 2024.

This initiative is designed to improve liquidity and maximize shareholder value.

Beyond financial growth, GDEV emphasises sustainability as part of its core mission. The company’s 2023 Sustainability Report highlights its environmental stewardship, corporate social responsibility, and governance practices.

This report also introduces GDEV’s “Games for Good” philosophy, which reinforces the company’s commitment to creating a positive impact through gaming.

Reflecting on this mission, Founder and CEO Andrey Fadeev said, “It is personally gratifying to me that our games not only entertain but also contribute to meaningful positive outcomes.”

“From engaging players in eco-friendly practices to raising awareness on crucial social issues, we are transforming gaming into a powerful force for good,” Fadeev concluded.

Natasha Braginsky Mounier, Chairperson of the Board of Directors, added that “This report reflects our deep belief in the long-term value of sustainable business practices. We demonstrate this through ongoing innovative and educational initiatives, engaging our workforce and the local communities.”

In addition, GDEV celebrated the 11th anniversary of Pixel Gun 3D, developed by its portfolio studio, Cubic Games.

Having surpassed 220 million installs and generated $210 million in revenue, Pixel Gun 3D ranks among the top 10 in its genre by both revenue and downloads, according to AppMagic.

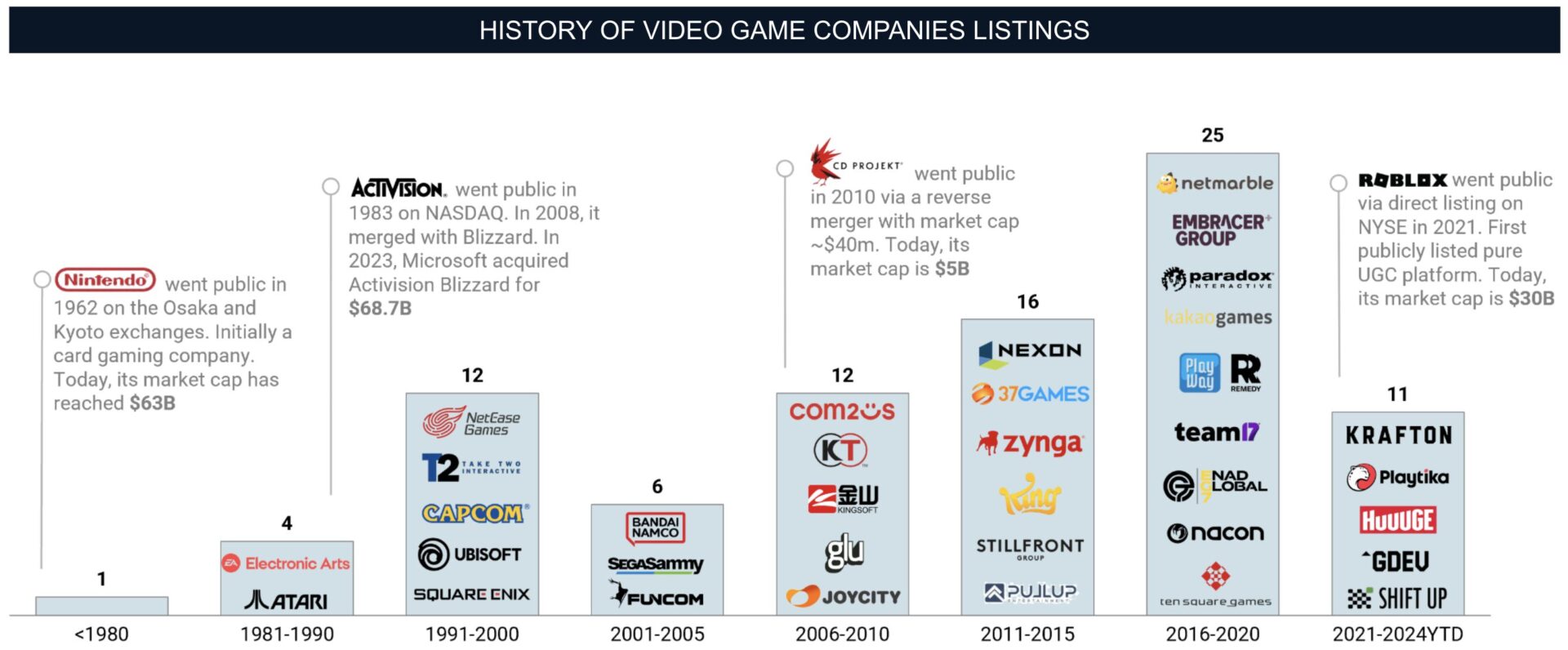

The gaming industry itself has experienced a dramatic transformation, evolving from a niche market to a global powerhouse valued at $365 billion. At its peak in 2020, the industry’s market cap reached $535 billion.

Since 2000, the number of publicly traded gaming companies has increased nearly fivefold, underscoring the industry’s resilience.

GDEV, in partnership with InvestGame, recently conducted an analysis that explores the evolution of the gaming sector’s public market presence.

The report examines how the IPO landscape has shifted, the speed at which gaming startups are progressing from inception to going public, and the regions that are leading or lagging in IPO activity.

In addition, it also compares the performance of various segments within the industry, such as mobile, PC, console, and multi-platform operators.

The analysis focuses on 87 public gaming companies, exclusively covering developers and publishers with market caps over $100 million, including leaders like Take-Two Interactive and Nintendo, as well as rising stars like Krafton and Roblox.

Insights from BGM’s 2024 Game Discovery Survey reveal that gamers today rely on multiple channels to discover new games, with YouTube leading as the most popular discovery tool.

However, TikTok and word of mouth also play significant roles, especially among younger audiences, who prefer these platforms for authentic, community-driven recommendations over traditional ads.

Despite YouTube’s popularity, only 52 per cent of gamers report full trust in it, emphasising a broader demand for credible, genuine insights.

IPO trends within the gaming industry reflect these shifts. Between 2016 and 2020, the sector experienced a peak in IPOs, with 25 companies going public due to the rise of mobile gaming and heightened interest during COVID-19 lockdowns.

However, economic factors like rising interest rates have recently slowed IPO activity, with only one new IPO (Shift Up in July 2024) since 2022.

Regionally, Asia dominates the public gaming landscape, hosting 46 per cent of all publicly listed gaming companies.

Since 2000, the number of Asian public gaming firms has grown from seven to 36 by 2024, underscoring the region’s large player base. North America and Europe have also expanded steadily, contributing 18 per cent and 35 per cent, respectively, to the global gaming market.

Platform distribution in the gaming industry has also shifted. Initially dominated by PC and console, the market now sees mobile gaming accounting for nearly 47 per cent, driven by smartphone accessibility and successful free-to-play models.

Meanwhile, diversified companies that operate across multiple platforms have gained traction, bolstered by acquisitions like EA’s purchase of Glu Mobile and Take-Two Interactive’s acquisition of Zynga. This trend illustrates a broader shift toward multi-platform strategies to reach diverse audiences.

The industry’s market capitalisation trends further highlight its growth. Peaking at $535 billion in 2020, the market cap adjusted to $353 billion due to recent economic pressures.

Asia remains the leader in market cap growth, with North America and Europe also contributing significantly, which stresses the sector’s global appeal.

Typically, gaming companies go public within 5 to 12 years after founding, though some, like Take-Two Interactive, have achieved IPO status in under four years.

In an interview with Forbes, Andrey Fadeev discussed productivity, sharing that “habits are the foundation of one’s life. They can give your life a direction by boosting your productivity and mood or take the sense of purpose away from you by promoting procrastination and anxiety.”

Further supporting these insights, Unity’s 2024 Mobile Growth and Monetization Report reveals a shift toward hybrid monetisation models as developers explore diverse strategies to cater to different user preferences.

This aligns with the BGM Discovery Survey findings, which show that influencers and peers are key to game discovery, particularly on platforms like YouTube, TikTok, and Instagram.

Click here to change your cookie preferences