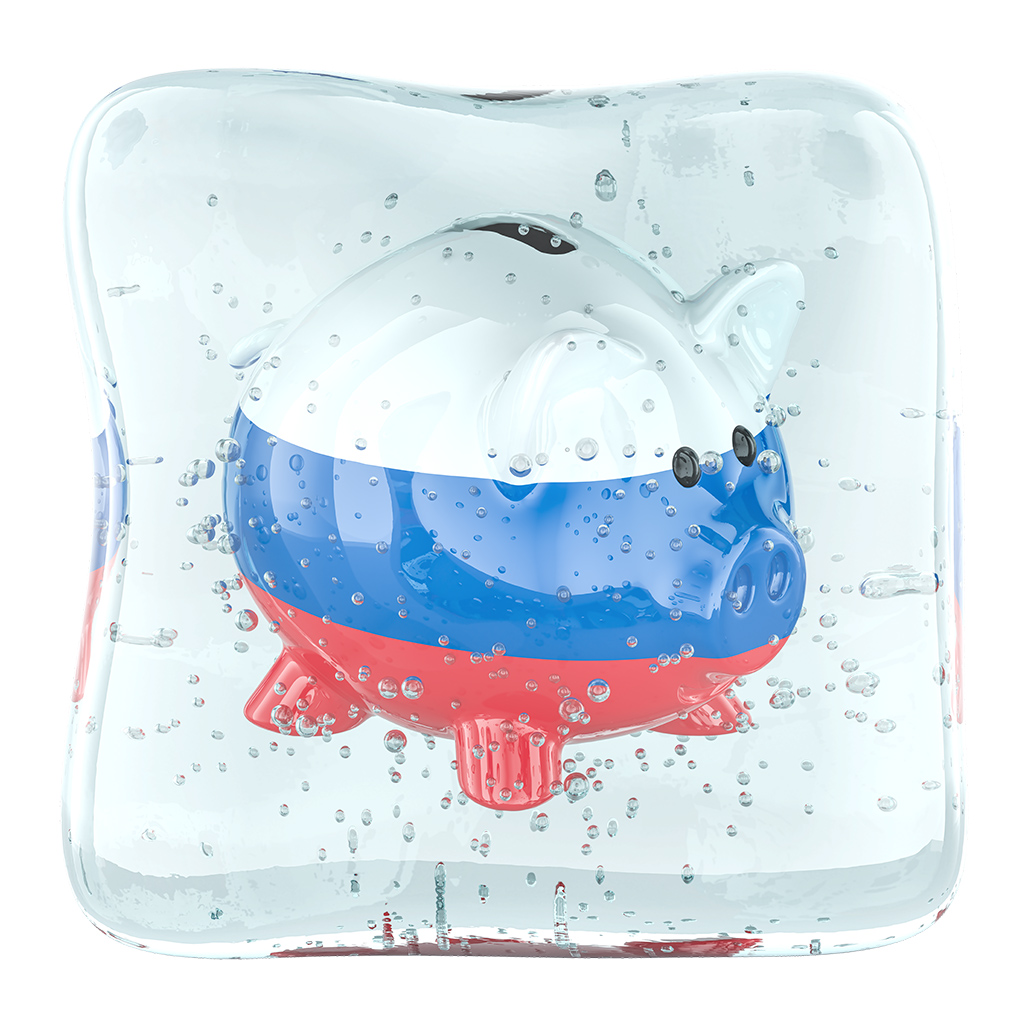

The European Commission proposed on Wednesday an unprecedented use of frozen Russian assets or international borrowing to raise 90 billion euros ($105 billion) for Ukraine to cover its struggling military and basic services against Russia’s war.

The European Union’s executive body has declared it favours a “reparations loan” using Russian state assets immobilised in the EU due to Russia’s invasion of Ukraine. But Belgium, which holds most of the assets, has voiced a range of concerns that it said had not been satisfactorily addressed by the proposals.

“We are proposing to cover two-thirds of Ukraine’s financing needs for the next two years. That’s 90 billion euros. The remainder would be for international partners to cover,” Commission President Ursula von der Leyen told reporters.

“Since pressure is the only language the Kremlin responds to, we can also dial it up,” she said. “We have to increase the costs of war for (Russian President Vladimir) Putin’s aggression and today’s proposal gives us the means to do this.”

She said the proposal to EU member states had taken into account almost all the concerns raised by Belgium, whose Brussels-based financial institution Euroclear is the main holder of the assets.

The proposal would now also cover other financial institutions in the EU that hold Russian assets, von der Leyen said. EU officials said France, Germany, Sweden and Cyprus also held such assets.

Russia has warned the EU and Belgium against using its assets, which it says would be an act of theft. The Commission says the scheme does not amount to confiscation as the money would be in the form of a loan – although Ukraine would only have to redeem it if Russia pays reparations.

The complexities around the scheme increased after a U.S.-backed 28-point plan to end the war in Ukraine proposed that some of the assets be used in a joint American-Russian investment vehicle.

But von der Leyen said she had informed U.S. Treasury Secretary Scott Bessent of her plan to move forward with the reparations loan and it had been “positively received”.

Economy Commissioner Valdis Dombrovskis said the EU was also seeking to persuade other international partners to provide support in the first quarter of next year as the EU money would probably not be available until the second quarter.

The Commission said the EU could proceed with the scheme if 15 out of 27 member countries, representing at least 65% of the bloc’s population, voted in favour.

EU officials said this would also apply to ensure Russia’s sanctioned assets remain immobilised, an essential part of the reparations loans, under EU law allowing financial assistance in instances of “severe difficulties”. Sanctions roll-overs normally require unanimity.

The other option – borrowing on international markets using the EU budget – would also normally require unanimity among EU countries – a potentially difficult hurdle as Hungary’s Russia-friendly government has opposed previous funding for Ukraine.

BELGIUM DEMANDS GUARANTEES FROM EU PARTNERS

European Central Bank President Christine Lagarde told a European Parliament hearing that using a reparations loan would be a stretch from a legal and financial standpoint though it would “hopefully” respect international law and financial stability.

Hours earlier, before the Commission’s legal proposalswere presented, Belgian Foreign Minister Maxime Prevot declared that they fell short of Belgium’s requirements.

“We have the frustrating feeling of not having been heard. Our concerns are being downplayed,” Prevot told reporters at a meeting of NATO foreign ministers in Brussels.

“The texts the Commission will table today do not address our concerns in a satisfactory manner.”

The issue is likely to come to a head at an EU leaders summit on December 18, when the Commission said it hoped to clinch a firm commitment by member states.

Belgium has demanded that other EU countries guarantee they will cover all legal costs arising from any Russian lawsuits against the scheme. It also wants them to guarantee they would help provide money quickly to pay Russia back if a court ever ruled Moscow must be refunded.

Thirdly, it has demanded that other countries holding Russian frozen assets also make those funds available to Ukraine.

Click here to change your cookie preferences