By Dmitry Meshkov and Sergei Ivanov

Alma and Quex set the foundation for real estate to go on-chain — by putting the data (not just the tokens) on-chain.

Tokenizing real estate has been pitched for years as the cure for property’s chronic illiquidity: fractional ownership, 24/7 trading, automated income distribution, and – eventually – real estate-backed assets that can plug into on-chain credit and liquidity venues.

Sergei Ivanov, founder of alma: “There’s a catch: tokens don’t create liquidity – credible, continuously updated data does.”

Real estate “going on-chain” only becomes meaningful when valuation inputs and operational performance can be refreshed continuously and transparently – otherwise token prices drift from reality, automated payouts break, and secondary markets stall. The “real-time data” as the missing ingredient behind credible price discovery, NAV calculation, yield computation, and collateral triggers.

That thesis is exactly what alma (proptech operating platform) and Quex (verifiable computing / oracle infrastructure) have been working to address: building a cryptographically verifiable bridge between off-chain operational data and on-chain consumption.

What alma and Quex actually built

At a practical level, the collaboration focused on moving real estate operational and financial telemetry from alma’s platform – covering an impersonalized portfolio view and key performance/transaction fields—into a format that can be consumed by smart contracts and downstream financial applications.

1) From private operational systems to a public, queryable on-chain feed

The starting point is the reality of real estate data:

- Leasing terms, rent flows, occupancy events, and portfolio-level performance typically live inside private property-management systems.

- Even when the data exists digitally, it is rarely published in a way that markets can verify and price continuously.

In alma’s case, the operational and financial dataset is accessed via a closed API (key-gated, not publicly callable). The technical challenge, then, is: how do you transform private, key-protected operational data into a public on-chain data layer without leaking credentials or weakening security?

2) A minimal on-chain contract interface for “units” (and the market primitives around them)

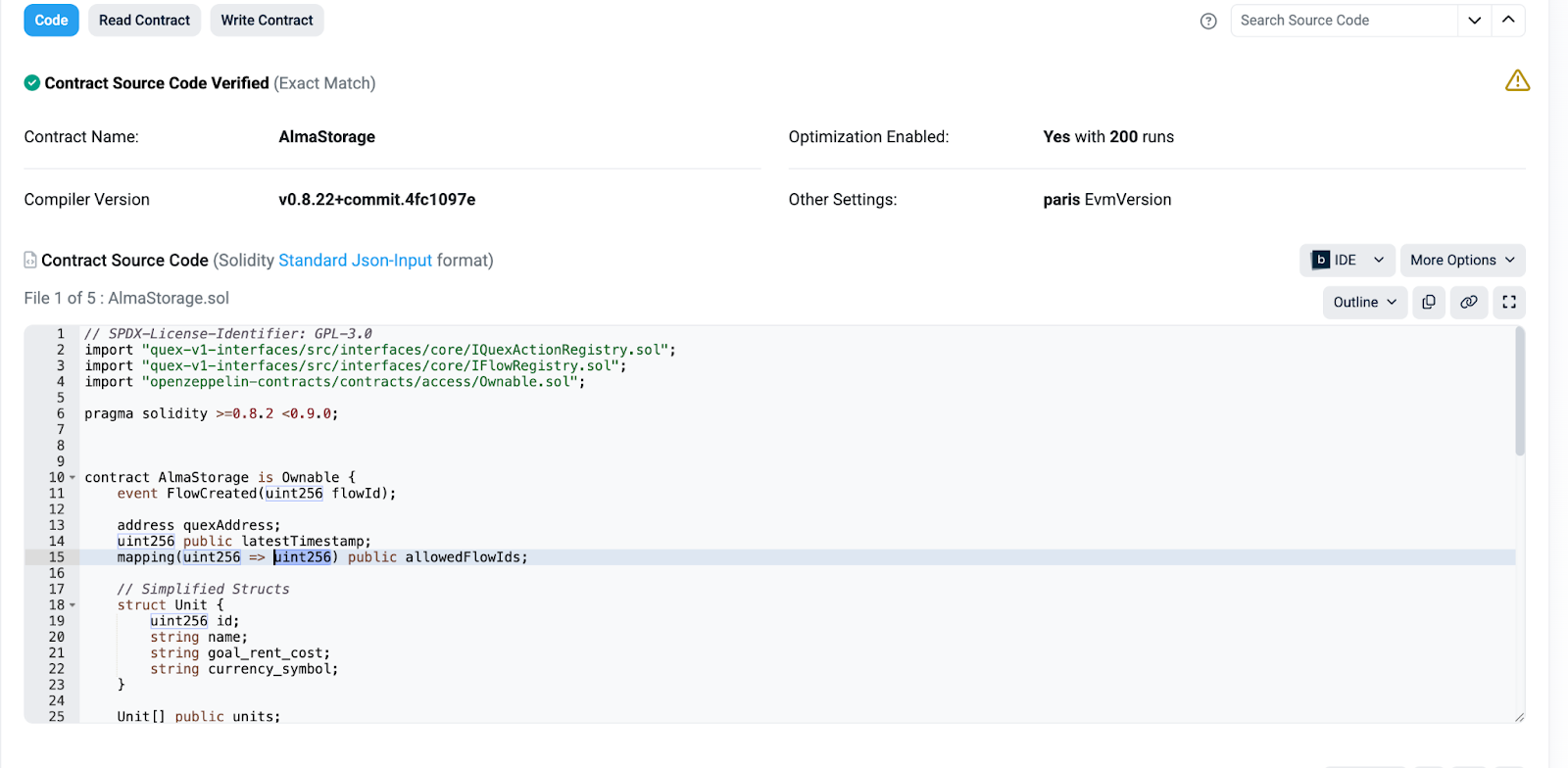

Quex’s implementation, described by founder Dmitry Meshkov, resulted in a Arbitrum contract exposing a method (described as getUnits) that returns a set of “units” with standardized fields such as:

- identifier

- name

- price

- currency

- etc

In other words: a contract-level read interface that anyone on Arbitrum can query – other contracts included – to fetch structured “asset unit” data that originates in alma’s operational system.

This matters because it turns real estate performance data into something closer to a market data primitive: queryable, composable, and available to other protocols without bespoke integrations.

3) Provenance and “how it got there” – not just the value

The real-world assets need verifiable data flows, because oracles are only as reliable as their sources – and because institutional adoption depends on credible provenance.

The Alma-Quex pipeline was designed around that idea: not merely “posting numbers,” but preserving a cryptographic chain of custody for how data was retrieved and processed before publication. In Dmitry Meshkov’s wording, the aim is that users can see “the whole chain” of how and when the data was fetched and committed on-chain.

4) Security: TEE + Intel TDX + remote attestation

The most fragile part of real estate data isn’t the numbers, it’s the access. Operational metrics live behind a closed API, and any leaked credentials or “manual server in the middle” immediately turns an on-chain feed back into trust in an operator.

Quex addresses this with confidential computing: Alma data is retrieved inside a TEE powered by Intel TDX, where API keys remain isolated and inaccessible even to the infrastructure running the workload. Then remote attestation adds a cryptographic proof that the data was fetched and processed inside a trusted execution environment, not altered or spoofed along the way.

That’s how a private operational system becomes a public on-chain data source: without exposing secrets, and with verifiable integrity end-to-end

Why this is “foundation layer” work for real estate RWAs

Most tokenization projects start at the surface: minting a token that represents a share, claim, or unit. But tokenization without data integrity and operational freshness creates a fragile market:

- NAV becomes periodic and disputable

- yield is hard to verify

- collateralization thresholds become risky

- secondary markets lose confidence and liquidity

Sergei Ivanov, founder of alma: “without continuous, trustworthy data feeds, token markets “seize up,” and the benefits of automated payouts, easier trading, and collateralization remain theoretical”.

That’s why alma and Quex’s work matters even if it looks “unsexy” compared to flashy token launches:

- It turns operational reality into on-chain inputs.

- It establishes verifiable provenance for the data supply chain.

- It provides a standard contract interface that other protocols can integrate with.

And that combination – streamlined operational + financial data on-chain – is the prerequisite for the next phase: real estate-backed RWAs that can credibly plug into liquidity and credit markets, be evaluated continuously, and support secondary market growth.

Click here to change your cookie preferences