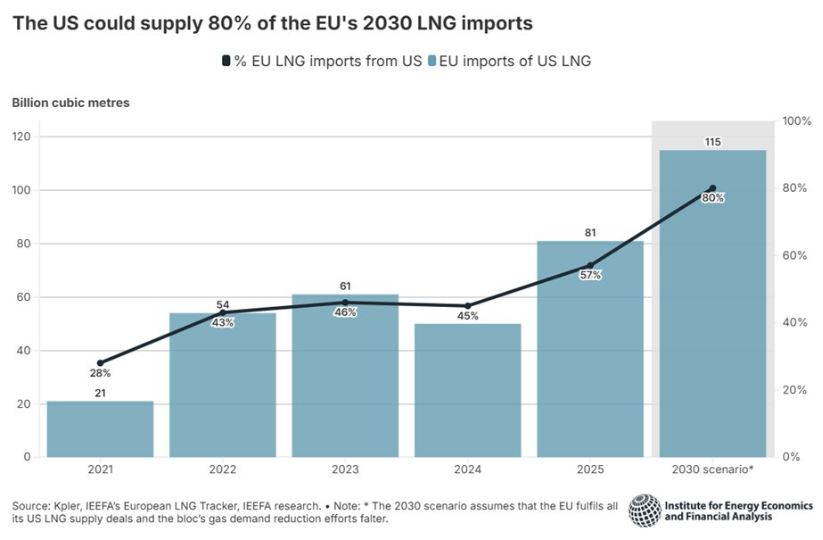

Forecasts published last week show that by 2030 the EU could be reliant on the US for 80 per cent of its LNG imports (Figure 1). That could mean about 40 per cent of all EU gas and LNG imports coming from the US by then, which would be at a level similar to the dependence on Russian gas prior to the invasion of Ukraine, that was considered by many to be a risky ‘dominant and monopolistic position’. We all know the consequences of that.

The EU has now agreed a full ban on Russian LNG by the end of 2026 and pipeline gas by late 2027, something that will reinforce the dependence on US LNG.

The EU is already the largest buyer of US LNG, having taken over 50 per cent of US LNG exports in 2025.This is an over-reliance that, given the unravelling EU-US political relationship under President Trump, poses risks to future supply security. It also contradicts EU plans to enhance energy security through diversification. In effect, the EU is finding itself under an increasing danger of replacing one dominant gas import dependency, Russia, with another, the US.

Figure 1: EU imports of US LNG

These concerns came to a head last week when President Trump threatened to take Greenland over by force, followed by threats to apply additional tariffs to the eight European countries that sent military contingents to Greenland.

The threat receded late last week in Davos when Trump backed off the Greenland threat and said he will follow the negotiation route. However, the risk remains.

But what it did achieve, was to shutter any illusions the EU had about relying on the US for its defense, but also as a close, reliable, ally. The threats also put into question EU’s heavy reliance on the US for its energy supplies. US LNG was meant to be a safe alternative to Russian gas. That is no longer a given. If President Trump were prepared to use tariffs in a retaliatory manner, what is there to stop him doing the same with energy supplies – turning US’ strong oil and gas position into a weapon to try to coerce European countries.

Such an outcome would be far more serious, with immediate consequences. A substantial and abrupt stop in LNG supplies could plunge the continent into darkness and cause industrial disruption. Europe’s vulnerability to a political dispute with the US has increased.

EU’s energy dependence on the US

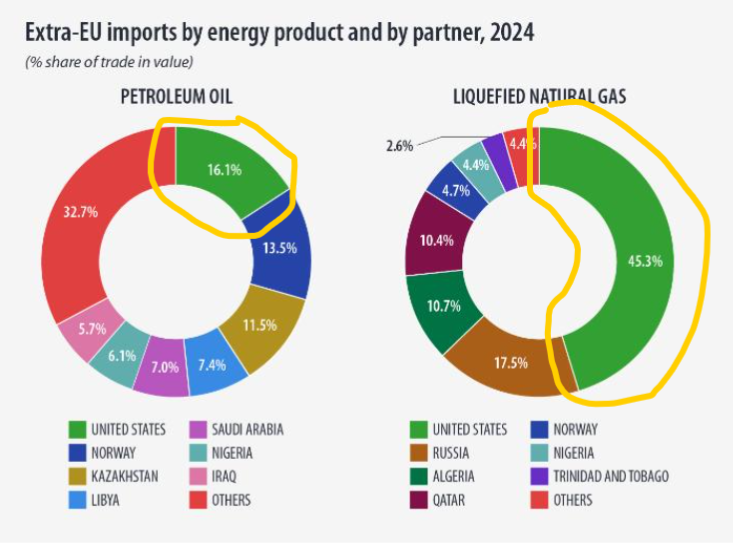

EU’s dependence on the US for its energy is growing. And it is not just LNG, but also oil, with over 16 per cent of its imports in 2024 (Figure 2) having come from the US.

Figure 2: EU energy imports by country, 2024

Source: Eurostat, News Articles, 21 March 2025

Under the now frozen trade deal with the US -agreed last July- the EU is committed to increase these imports even more. The deal states: “The US and the EU commit to cooperate on ensuring secure, reliable, and diversified energy supplies, including by addressing non-tariff barriers that might restrict bilateral energy trade. As part of this effort, the EU intends to procure US LNG, oil, and nuclear energy products with an expected offtake value at $750 billion through 2028.”

The deal is designed to lead to a “substantial increase” in energy cooperation, especially as in 2025 EU imports of US energy products were limited to $74 billion.

But escalating transatlantic tensions following Trump’s attempts to annex Greenland, and his threat to apply additional punitive tariffs, have led the EU to freeze the approval process of this deal indefinitely. If anything, the political situation is worsening, with many European leaders advocating for “strategic autonomy” and de-risking from US financial dependence. Even if nothing happens in the immediate future, the ‘cat is out of the bag’.

It is very likely that European energy security concerns as a result of this dispute could limit further growth of US energy product exports to the EU. What is clear is that the EU needs to return to the original ‘diversification’ of energy supplies strategy envisioned by REPowerEU, whichever way its relationship with the US develops.

Alternatives

This is coming at a time when global LNG capacity additions are on the increase, with 88 million tonnes per annum (mtpa) of new LNG entering the markets in 2025 and 2026, rising to 170-200 mtpa by 2030. Not only will this lead to a glut of LNG supplies, but it is expected to bring prices down, to as low as $6/MMBtu in accordance to OIES.

It also gives the EU flexibility to secure alternative LNG supplies to the US. The developments so far in 2026 support this. Even though most of the new LNG will come from the US, Qatar is increasing its export capacity by 65 mtpa by 2030. Canada and Africa are also adding to this.

What is also coming to EU’s rescue is the projection that its gas demand is likely to fall by 7-10 per cent by 2030 -from 2023 levels- driven by renewable energy expansion, electrification, and energy efficiency measures under its flagship REPowerEU policy, especially in the power sector.

The unravelling geopolitical situation may accelerate EU’s transition to renewables, provided bottlenecks such as grid modernization and capacity, interconnection and electricity storage are overcome.

Already, nine European countries, including the UK, have agreed to build a vast, joint, offshore wind grid in the North Sea. They are they aiming to support a steady build-out of 15 GW of offshore wind each year between 2031 and 2040. They said they are not against energy trading with the US, but they, also, are not aiming at replacing one dependency with a new dependency. They want to grow their own energy.

Impact on Cyprus

At present Cyprus is not affected. But it will have to consider its options as and when it progresses the switch of power generation from diesel/HFO to natural gas. Cyprus is trapped into high electricity prices and high emissions that add to the cost of energy, making this switch an urgent priority, despite current delays and indecision. If such delays continue, Cyprus risks remaining dependent on expensive diesel/HFO for electricity generation, missing out on cheaper international LNG markets. All options to complete the Vassilikos LNG import project must be considered exhaustively, including applying for EU derogations where current legal requirements limit such options.

Charles Ellinas is Councilor of the Atlantic Council. The article is republished from the Blog of the Cyprus Economic Society (https://cypruseconomicsociety.org/blog/blog-posts/)

Click here to change your cookie preferences