As the crypto market positions itself for the next major expansion, investors are looking beyond single narratives and toward assets with diverse growth drivers. Shiba Inu (SHIB) and Solana (SOL) attract attention with their deep roots in the market. On the other hand, Mutuum Finance (MUTM) is emerging as a utility-focused newcomer, combining early-stage momentum, promising infrastructure, and long-term income potential, the qualities many investors look for in the best crypto to buy for 2026. Its utility-driven approach positions it as the top crypto to buy for those seeking more than speculative gains.

Shiba Inu (SHIB): community-driven resilience

Even in a market dominated by selling pressure, Shiba Inu (SHIB) has maintained its weekly support around $0.00000640, showcasing the strength of its community. Predictions suggest upside to $0.00003320, a potential 556% rally for momentum-driven traders. However, SHIB’s gains largely depend on sentiment and speculation, unlike utility-driven Mutuum Finance, which combines growth potential with real DeFi functionality. This contrast emphasizes why some investors may consider MUTM the top crypto to buy compared to Shiba Inu.

Solana (SOL): infrastructure with steady momentum

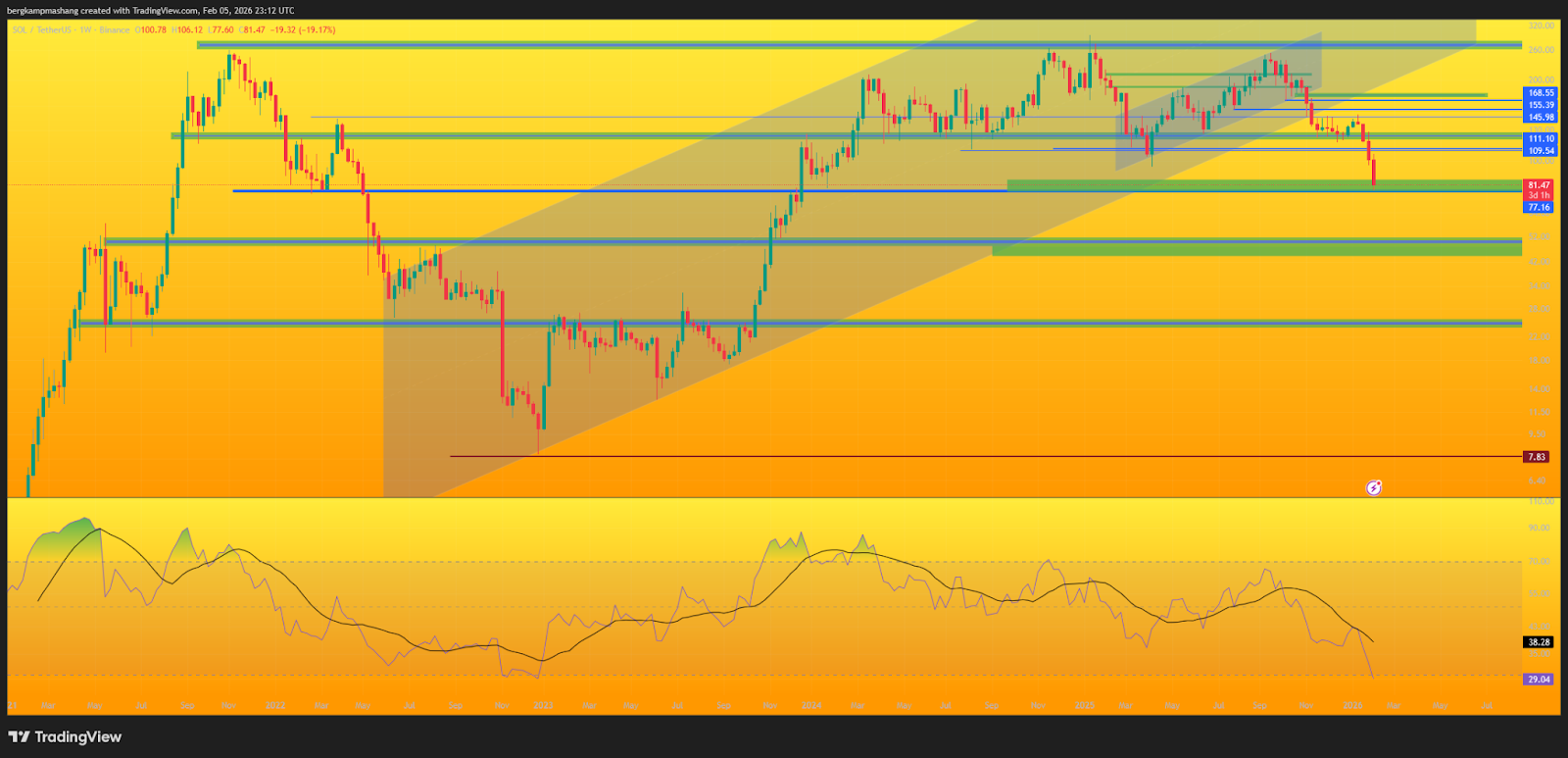

Solana (SOL) has recently tested its first DCA level at $77, with the next key support around $50. While SOL boasts strong blockchain infrastructure and an active developer ecosystem, its growth is influenced mainly by broader market trends rather than innovative DeFi mechanics. In addition, SOL has fallen from an all-time high of $295. Mutuum Finance provides a stronger technical and fundamental setup, blending early adoption potential with platform utility, making it a candidate for the best crypto for long-term holders.

V1 protocol launch highlights utility

A recent V1 Protocol launch allows users to explore Mutuum Finance’s lending and borrowing features in a secure testnet environment using Sepolia test tokens, rather than real assets. This early launch allows the community to experience the system firsthand while showcasing Mutuum’s technical progress ahead of mainnet deployment.

Security is a cornerstone of the MUTM protocol, with loans designed to be over-collateralized, safeguarding both borrowers and investors. An asset with a 75% loan-to-value (LTV) ratio would, for instance, require a borrower to provide $1,333 in collateral to access a loan. This way, lenders’ safety and protocol health are maintained. For the borrower, Chainlink Oracle infrastructure provides real-time price feeds, protecting them from unfair liquidations. For instance, if the price of their collateral were to fall by 10% and swing back up within minutes, the oracles keep the prices up to date.

This robust risk management framework not only protects capital but also reinforces MUTM’s credibility, making it a strong contender for investors seeking security alongside attractive returns in the DeFi market, and aligning it with best crypto considerations for careful portfolios.

Strong presale momentum and growing investor confidence

Mutuum Finance’s presale continues to gain traction, raising over $20.43 million with nearly 19,000 holders to date. Following the V1 protocol launch, the platform saw a notable increase in activity, including a $15,000 whale investment and over $200,000 raised within 72 hours. This surge underscores growing investor confidence as the project demonstrates tangible progress.

The current Phase 7 presale price of $0.04 remains discounted compared to the confirmed $0.06 launch price, offering a limited-time opportunity for early participants. Since Phase 1, when MUTM was priced at $0.01, the token has already climbed 300%, with total growth expected to reach 500% by launch. This illustrates the advantage of early entry and why MUTM is the top crypto to buy for proactive investors.

Security remains a core strength of Mutuum Finance. The platform’s lending and borrowing smart contracts were fully audited by Halborn Security, verifying the integrity of its architecture and risk management logic. Additionally, the MUTM token contract achieved a 90/100 Token Scan Score from CertiK, signaling strong technical reliability and investor safety.

Upcoming enhancements

To maintain community engagement during the presale, Mutuum Finance has introduced several incentives, including a $100,000 giveaway where 10 winners will each receive $10,000 in MUTM tokens, and a 24-hour leaderboard competition awarding a $500 MUTM bonus to the top daily contributor. These initiatives reward active supporters while boosting participation as the project approaches its next phase.

With the V1 protocol live on Sepolia testnet and over $20.43 million raised, Mutuum Finance continues to validate its credibility through consistent technical milestones and community growth. The successful launch demonstrates the project’s commitment to delivering on its roadmap while still in its early growth stage, securing its place as the best crypto option for strategic investors.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences