s 2026 progresses, market attention has shifted to three tokens: Ripple’s XRP, Binance Coin (BNB), and Mutuum Finance (MUTM). The biggest surprises often come from projects still early in their growth curve. In that context, Mutuum Finance (MUTM) is starting to stand out among the three as the next crypto to explode, driven by its DeFi-focused design, growing ecosystem, and capacity to deliver growth that established tokens may struggle to replicate.

XRP’s steady development

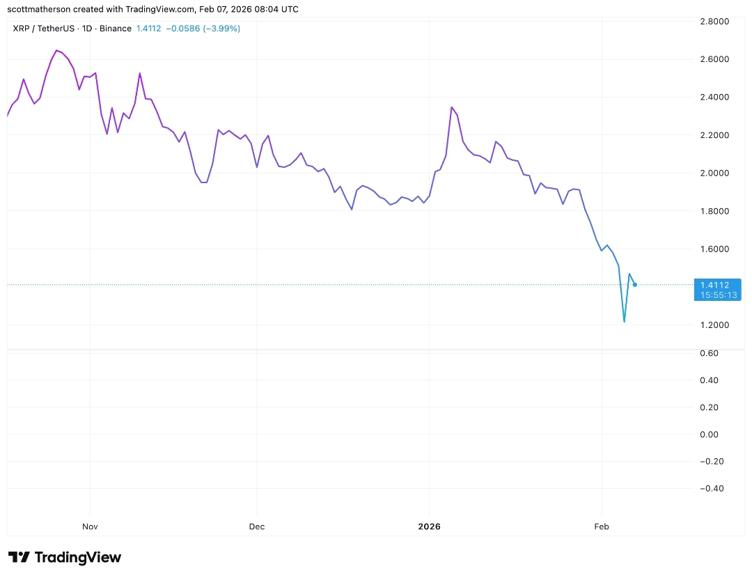

XRP continues to advance quietly, anchored by Ripple’s expanding institutional DeFi roadmap on the XRPL. Upcoming features like enhanced privacy, permissioned markets, and on-chain lending are set to increase the token’s utility, positioning XRP as both a transactional backbone and a practical tool for enterprise use. While these developments signal meaningful progress, XRP remains a more established, steady option rather than a high-growth breakout. For investors exploring high-ROI picks, Mutuum Finance (MUTM) is drawing attention as a top crypto to invest in.

BNB finds support

Binance Coin (BNB) has recently pulled back from its previous range and is now resting on a key higher-timeframe support zone around $620–650, an area that has historically attracted buyers. While the RSI indicates that the token is deeply oversold, hinting at potential seller exhaustion, price action confirmation is still needed before any decisive move can be expected. This indecisiveness has seen investors looking for quicker upside prefer MUTM during its presale.

Early-stage DeFi ppportunity: Mutuum Finance (MUTM)

For investors looking to capitalize on early-stage opportunities in the DeFi market, Mutuum Finance (MUTM) stands out as a high-potential option. Currently in Phase 7 of its presale, the token is priced at $0.04, offering early buyers the chance to secure substantial returns. Forecasts indicate that MUTM could reach $0.50 shortly after its exchange debut, a projection based on robust presale demand, a successful protocol launch on testnet, and multiple passive income streams available to users of the platform.

To illustrate the potential upside, an investor purchasing $800 worth of MUTM at the current $0.04 price would acquire 20,000 tokens. If the token reaches the anticipated $0.50, those holdings would be valued at $10,000, delivering a 1150% return on investment. With nearly 19,000 participants and over $20.4 million raised during the presale, the level of market engagement reflects strong confidence in MUTM as a top crypto primed for success.

Scaling Mutuum Finance and MUTM utility

Mutuum Finance’s roadmap includes plans for multichain expansion. This aims to extend its lending protocol beyond a single blockchain, unlocking lower fees, faster transactions, and access to new liquidity pools across multiple networks. By deploying on alternative chains, the platform can attract users who might avoid higher-fee environments, increasing overall borrowing and lending activity. For investors, this translates to deeper liquidity, higher protocol revenue, and enhanced MUTM utility.

For instance, an early investor acquiring 20,000 MUTM at $0.04 spends $800. If initial adoption on Ethereum pushes the token to $0.08, that position doubles to $1,600. As Mutuum expands to multiple chains, broader adoption and usage could drive the token price higher, potentially reaching $1 and valuing the same 20,000 MUTM at $20,000. This demonstrates how multichain deployment acts as a growth multiplier, scaling both protocol adoption and investor potential across ecosystems, solidifying MUTM as the next crypto to explode.

Mutuum Finance V1 protocol: From concept to live testing

The launch of the Mutuum Finance V1 Protocol represents a key milestone in moving the project from concept to practical application. Now live on the Sepolia testnet, the protocol allows users to interact with its core mechanisms and experience its functionality in a controlled, real environment. This testing phase enables the development team to evaluate performance, identify potential improvements, and fine-tune features before the mainnet release. For investors, early access to the protocol is especially valuable, as it provides a hands-on opportunity to explore the platform and assess its capabilities before committing real funds to the ecosystem.

Central to the ecosystem are mtTokens, which users receive when contributing assets to liquidity pools. These tokens act as digital receipts and appreciate over time as borrowers repay interest. For instance, a user depositing $12,000 in USDC at a 6% APY could earn $720 per year. As the platform scales and adoption grows, annual earnings could exceed $1,200, providing a reliable passive income stream for participants.

While established assets like XRP and BNB offer stability, the biggest market surprises often come from early‑stage projects. Mutuum Finance (MUTM) is emerging as that coin, the top crypto priced at just $0.04 with a live DeFi lending platform, multichain expansion plans, and a presale that has already raised over $20.4 million. Offering real utility and a clear path to high growth, MUTM is positioning itself as the next crypto to explode, capable of delivering the kind of breakout returns that mature tokens may no longer achieve in 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences