It appears that there has been an increase in the rate at which title deeds are being issued. Be it with some years delay (approximately 4-7 years after completion) titles are being issued. This positive development has brought up at an increasing rate some problems that are related to the transfer of properties.

Transfer Fees

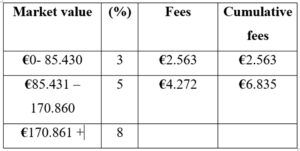

These are calculated on a scale as follows:

However, no transfer fees are payable (at present) if VAT was applicable/paid at the time of purchase of the property and transfer fees are reduced (at present) by 50 per cent on all purchases of immovable property, if VAT was not paid.

Transfer fees paid on the transfer of property to a family company are refunded in five years provided the company still owns the property and there have not been any changes to its shareholders.

On the transfer of immovable property from a family company to its shareholders as well as on transfer by donation between spouses and children or relatives up to third degree of kindred, transfer fees are calculated on the estimated value of property as at 1/1/2013 and at the following rates: between spousese, 0.1 per cent; parent to children, nil; between third degree relatives, 0.1 per cent; and to trustees, €50.

The actual cost refers to very little transfer fees of around €100.

Transfers of immovable property by a company to another company for the purpose of reorganisation of a company are exempt from transfer fees.

The date of the valuation is taken as being the date of sale/acquisition. As such if one bought a property in the year 2002 and transfers the property now, the transfer fees will be based on the market value on the date of the acquisition, ie 2002.

Market value

The law stipulates that the lands office must ascertain the value of a property on the relevant sales date, based on the market value at that time. Usually the lands office accepts the actual sales price, but approximately 20 per cent of the time the amounf is disputed by the lands office if it can ascertain from its own records that the market value at the time was different. This applies to cases where they can charge more and not less.

The main method adopted for ascertaining the market value is the comparable one, though there are others. So if you bought an apartment for say €100.000 and the lands office has sales for €120.000 for similar properties in its records, it will charge you fees based on €120.000.

Regrettably a good percentage of locals and others declare lower prices for the purpose of saving capital gains (by the seller) and transfer fees (by the buyer) and this is widely known – hence the stand of the lands office.

Objection

If one disagrees with the lands office valuation, they can apply to the high court supporting their claim using a private valuer’s report. This must be done within 40 days from the date that the lands office makes its final assessment.

What is infuriating is that even upon final valuation, the lands office does not provide affected parties with a written report supporting its own assessment, whereas the buyer must do so in writing in order for the lands office to reexamine.

Sometimes the cost involved in this procedure – lawyers, valuation and so on – is not worth it for the amount being disputed, so most buyers accept what the land office charges them.

Date of Assessment

If a contract is deposited with the lands office, then the date of sale recorded in the contract is the one adopted. If the contract is not deposited, you must produce your contract as well as the receipt of the down payment, so that the lands office can ascertain the sales date.

Transfer

It has now been ascertained that, after the long, uphill battle to secure them, only 20 per cent of the title deeds issued are actually transferred. This is because, nowadays where every cent counts, people are not willing to come up with, say, €15.000-€30.000 in transfer fees since they feel that the fees are fixed on a certain date and no interest is charged and provided they have no immediate use of the title this may be a solution, be it temporary.

The time span however can cause problems for the owner and transfer may become difficult or even impossible. Our advice is to have a property transferred as soon as possible once the title is issued.

We hope that we have cleared some issues up for you since we know there is a lot of confusion in this area.

Antonis Loizou & Associates EPE – Real Estate Valuers, Estate Agents & Property Consultants, www.aloizou.com.cy, [email protected]

Click here to change your cookie preferences