By Andreas Charalambous and Omiros Pissarides

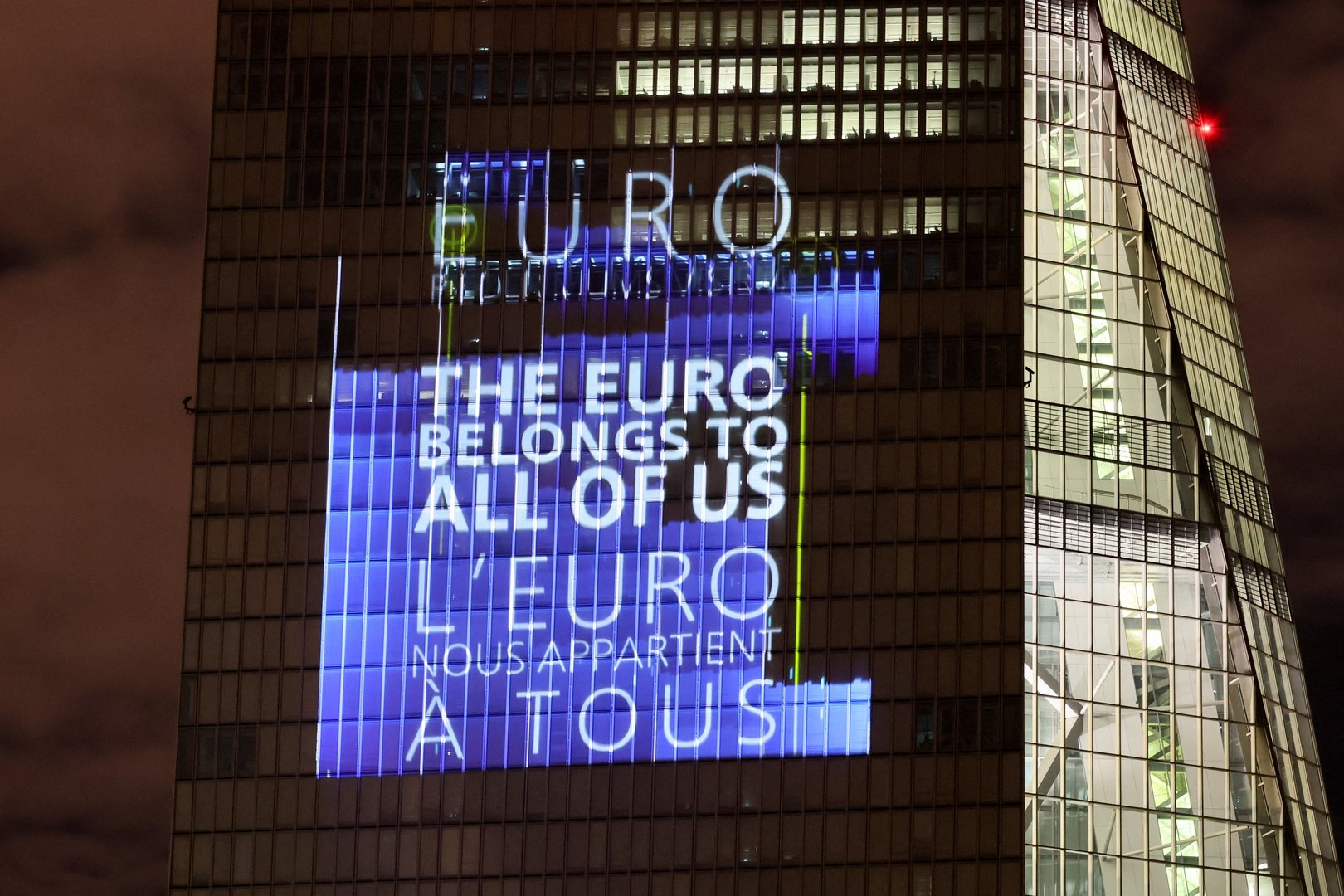

The circulation of the euro began 20 years ago, two years after it was formed virtually. This article aims to critically evaluate the evolution of the Euro until today, which has been characterised by significant successes and ongoing challenges, as well as outline its future prospects.

The euro was originally conceived on the basis of politically motivated considerations. From an economic perspective, doubts about its effectiveness were raised, reflecting the different approaches and interests of various countries and institutions. The economically developed northern countries attached importance to macroeconomic stability, while the southern countries’ priorities included the narrowing of the economic gaps. In reality, and although many economists argued that the Eurozone did not meet the minimum criteria for a viable economic union and questioned its long-term stability, the euro has managed to develop into a global reserve currency, with significant geopolitical and economic weight.

During the initial stage, emphasis was placed on safeguarding macroeconomic stability, and the system wa based on strict fiscal and monetary rules. In retrospect, despite its weaknesses, it led to satisfactory results and stability of prices and exchange rate, which benefited both the developed economies of the north and the economies of eastern and southern Europe, which seized the opportunities. In contrast, the price for member states that did not adapt, such as Greece and, for a period of time, Cyprus, was high.

The financial crisis of 2008 and the current pandemic have added to pre-existing challenges and brought weaknesses of the framework to the surface. On the positive side, difficult compromises were reached, which were instrumental towards ensuring the survival of the Eurozone. The introduction of flexibility provisions in fiscal and monetary policymaking, as well as recent policy initiatives of solidarity to the most vulnerable economies, were crucial. During 2021, a key development was the adoption of an ambitious economic support programme, entitled “EU-New Generation”, financed through the issuance of bonds by the European Commission, and further fuelled by the stepping forward of the European Central Bank, providing essentially a backstop to the whole project.

Consequently, as of today, most analysts agree that the Eurozone is gaining strength. Economic and market participants appear increasingly convinced that the political framework allows, even at the last hour, the necessary adaptive decisions.

The challenges, however, remain. Growing social inequalities, climate change, technological backwardness, the demographic problem, as well as geopolitical challenges, point to the necessity of further evolution of the current structure through permanent reforms, which would necessitate changes in the EU Treaty itself, instead of the ad hoc character reactions that we have observed in the past.

The ability to transcend “national” interests, the deepening of the economic union, the substantial reform and simplification of the fiscal framework, the completion of the banking union, the development of a single capital market and the demonstration of long-term solidarity in practical terms are key elements of such a transformational effort.

Andreas Charalambous is an economist and a former director in the finance ministry. Omiros Pissarides is the managing director of PricewaterhouseCoopers Investment Services

Click here to change your cookie preferences