The mediterranean island of Cyprus was a one time tax haven which still attracts huge amounts of foreign investment. Its flat, low tax rates, privacy laws and geographical location have made it a go-to destination for Russian Oligarchs and multinationals as well as canny property investors. However, the fly in the ointment that deters some investors is the cost of making an international money transfer in and out of the country; in some cases making a money transfer to Cyprus can cost up to 5%.

This post will look at how to save costs when moving money in and out of Cyprus. We will look at the costs of transferring money to Cyprus from the UK and the USA and shall recommend some of the best international money transfer services.

Why Cyprus attracts investors

Following the demise of the USSR and the fall of the Berlin Wall, the Republic of Cyprus positioned itself as a tax haven and began courting Russian oligarchs and wealthy eastern Europeans looking for somewhere to move their wealth to. In the following decades, the country’s banking sector bloomed to 9 times that of the rest of the economy combined.

In the aftermath of the financial crisis of 2008 though, Cyprus reformed itself and is no longer technically considered to be a tax haven. Still, its flat corporation tax rate of 12.5% and favourable privacy laws mean it continues to be an appealing destination for wealthy individuals and international businesses. Furthermore, the nation is well located for Europe, the Middle East and Russia and boasts a thriving tourism sector – as such the Cypriot real estate sector is thriving.

However, whilst the tax rates in Cyprus may be low, there are other and more substantial costs of doing business in or with Cyrus. In particular, anybody using Cypris as the base for either their business or wealth will need to regularly transfer their money in and out of Cyprus and will feel the painful sting of the bank’s high fees.

The costs of making an international money transfer explained

Whenever somebody initiates an international money transfer using their bank, there are costs to pay. Firstly, all banks levy a charge for handling international payments which can either be a flat fee or a percentage of the transfer. And by all banks, I mean all banks involved in the transaction including the sender’s bank, the recipient’s bank, and any 3rd party intermediary bank used (when the sender and receipt bank don’t have a direct relationship).

But that’s not all. When somebody relies on their bank to handle foreign currency transfer, the bank also gets to choose which exchange rate is used and will always apply a “less than” market rate which allows them to make a few cents on every dollar changed.

It is not uncommon for senders to incur up to 5% of the total value of the transfer in fees. In the case of international investors looking to do business in Cyprus, this can deter them from otherwise sound opportunities.

Transferring money to Cyprus from UK

Cyprus is a very popular destination for British expats, UK based investment groups and British “non-doms” looking to lower their tax liability. Based on money transfer comparison, a guide rating top 10 money transfers, the cost of transferring money to Cyprus from the UK can be up to 3% in markup fees, plus a flat transaction fee of up to £15.

This does not include any intermediary fees either which may mean an additional flat fee, or a further percentage being applied.

Transferring money to Cyprus from USA

The situation is even more drastic when transferring money to Cyprus from the USA. Indeed, some US banks charge a wire fee of up to $40 and then the exchange markup can be as high as 4% when changing from USD to Euros (the Cypriot currency).

Once again, this figure does not include any intermediary or 3rd party banking fees.

Alternatives to bank transfers

The Cypriot economy is nourished on foreign investment and as such, the island needs investors to keep bringing their wealth and foreign currency in. Therefore high international banking transaction fees do pose something of a minor threat to its economy. The good news for Cyprus and its investors however, is that the bank-alternative services are able to offer much more interesting terms and rates.

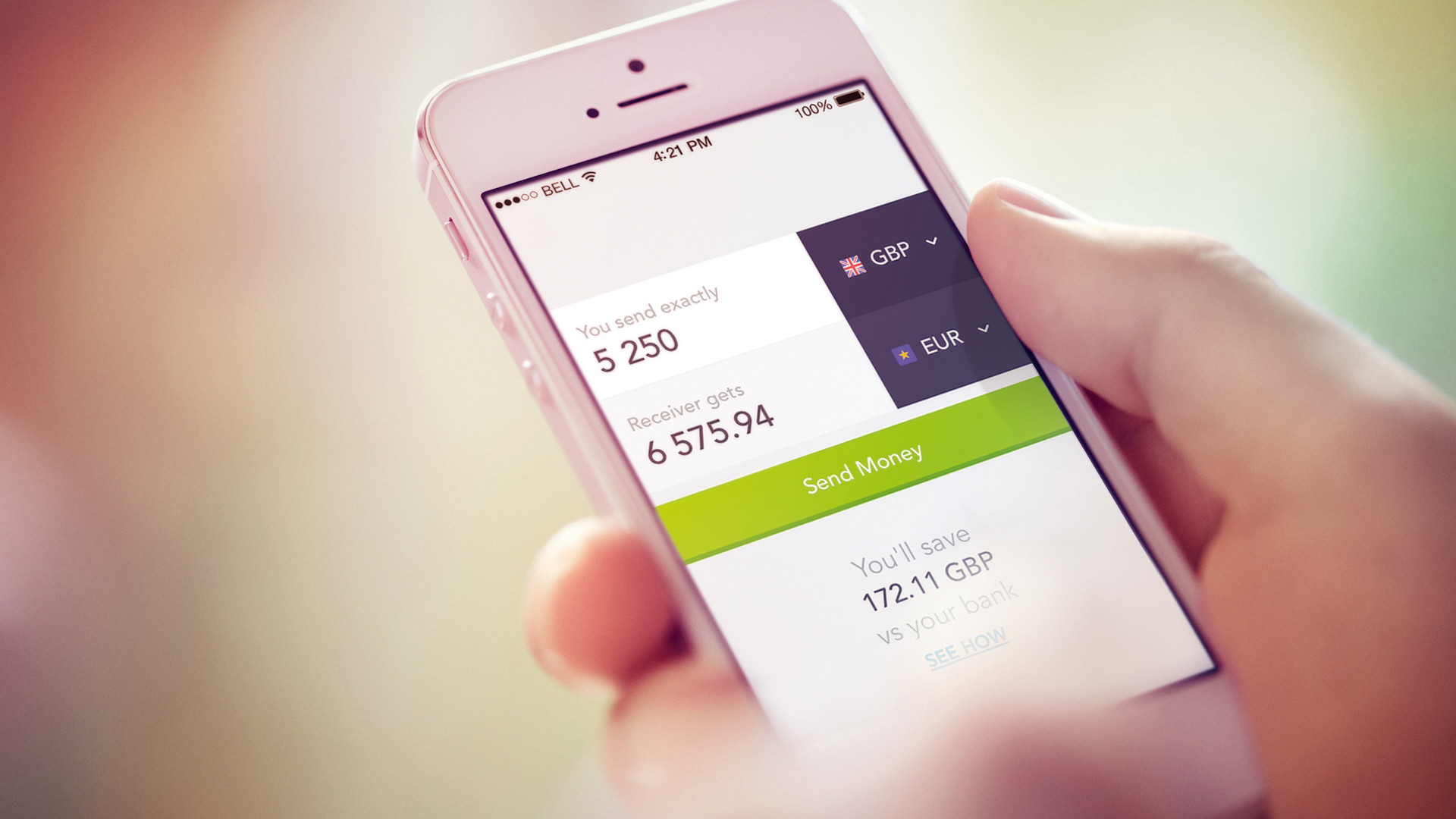

For example Wise, the British fin-tech startup (formerly Transferwise), has managed to woo millions of investor, immigrant and expat clients away from the banks. Wise specialises in low fee international money transfers – think dimes rather than dollars – along with more favourable exchange rates that the banks can offer.

Final thoughts on making a money transfer to Cyprus

Whilst no longer a tax haven as such, Cyprus still prospers as a thriving destination for foreign investors. And now thanks to the best international money transfer services like Wise, making a money transfer to Cyprus is cheaper than ever

Whether transferring money to Cyprus from the UK, or transferring money to Cyprus from the USA, the cost of making an international money transfer need not deter investors any longer.

Click here to change your cookie preferences