The shortages of computer chips that forced global automakers to scrap production plans for millions of cars over the past two years are easing – at a new and permanent cost to the car companies.

What had been “war room operations” to manage chip shortages are becoming embedded features of vehicle development, say executives in both industries. That has shifted the risks and some of the costs to automakers.

Newly created teams at the likes of General Motors Co (GM.N), Volkswagen AG (VOWG_p.DE) and Ford Motor Co (F.N) are negotiating directly with chipmakers. Automakers like Nissan Motor Co Ltd (7201.T) and others are accepting longer order commitments and higher inventories. Key suppliers including Robert Bosch (ROBG.UL) and Denso (6902.T) are investing in chip production. GM and Stellantis (STLA.MI) have said they will work with chip designers to design components.

Taken together, the changes represent a fundamental shift for the auto industry: higher costs, more hands-on work in chip development and more capital commitment in exchange for better visibility in their chip supplies, executives and analysts say.

It is a U-turn for automakers who had previously relied on suppliers – or their suppliers – to source semiconductors.

For chip makers, the still-developing partnership with automakers is a welcome – and overdue reset. Many semiconductor executives point the finger at automakers’ lack of understanding of how the chip supply chain works – and an unwillingness to share cost and risk – for a large part of the recent crisis.

The costly changes are coming together just as the auto industry appears to be moving past the worst of an even more costly crisis that by one estimate has cut 13 million vehicles from global production since the start of 2021.

THEY NEVER CALLED

C.C. Wei, chief executive of the world’s biggest chipmaker Taiwan Semiconductor Manufacturing Co (2330.TW), said he had never had an auto industry executive call him – until the shortage was desperate.

“In the past two years they call me and behave like my best friend,” he told a laughing crowd of TSMC partners and customers in Silicon Valley recently. One automaker called to urgently request 25 wafers, said Wei, who is used to fielding orders for 25,000 wafers. “No wonder you cannot get the support.”

Thomas Caulfield, GlobalFoundries Inc (GFS.O) chief executive, said the auto industry understands it can no longer leave the risk of building multibillion-dollar chip factories to chipmakers.

“You can’t have one element of the industry carry the water for the rest of the industry,” he told Reuters. “We will not put capacity on unless that customer is committed to it, and they have a state of ownership in that capacity.”

Ford has announced it will work with GlobalFoundries to secure its supply of chips. Mike Hogan, who heads GlobalFoundries’ automotive business, said more deals like that are in the pipeline with other car makers.

SkyWater Technology Inc (SKYT.O), a chip manufacturer in Minnesota, is talking to automakers about putting “skin in the game” by buying equipment or paying for research and development, Chief Executive Thomas Sonderman told Reuters.

Working closer with carmakers and their suppliers has brought onsemi (ON.O) $4 billion in long-term agreements for power management chips made from silicon carbide, a new material gaining popularity, said Chief Executive Hassane El-Khoury. “We’re making billions of dollars of investment every year in order to scale that operation,” he told Reuters. “We’re not going to build factories on hope.”

Michael Hurlston, the CEO of Synaptics Inc (SYNA.O), whose chips drive touch screens, which had held up some auto production, said the recent, more direct collaboration with automakers could create new business opportunities as well as managing risks.

Hurlston said the automotive industry has warmed up to using OLED screens, which are less durable than the LCD screens, a factor that many perceived would limit their use in cars despite better contrast and lower power consumption.

“But that perception has changed pretty dramatically over the last two years. And that perception has changed as a direct result of us being able to talk to (the auto industry),” he said. “The paradigm has really, really shifted for us.”

Chief executives of Japan’s Renesas Electronics Corp (6723.T) and Dutch NXP Semiconductors N.V. (NXPI.O) have both told Reuters they are co-locating engineers to help automakers design a new architecture where one computer would centrally control all functions.

“They have woken up,” said NXP CEO Kurt Sievers. “They have understood what it takes. They try to find the right talent. It’s a big shift.”

‘WE HAVE UNDERSTOOD’

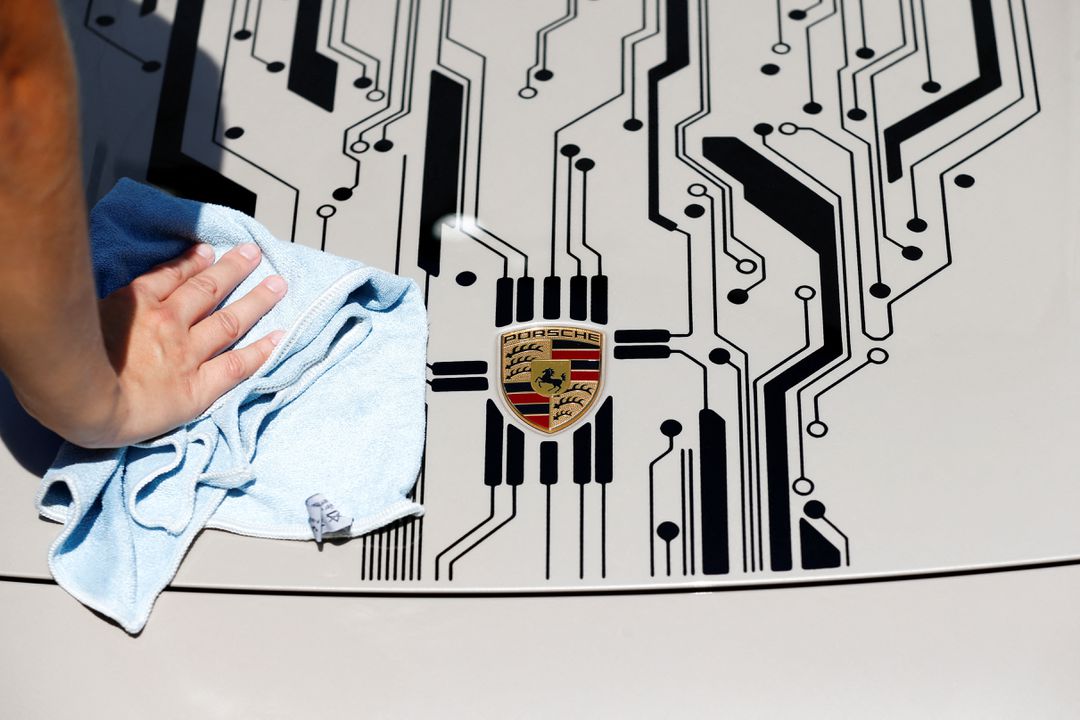

The average semiconductor content per vehicle will exceed $1,000 by 2026, doubling from the first year of the pandemic, according to Gartner. One example: the battery-powered Porsche Taycan has over 8,000 chips. That will double or triple by the end of the decade, according to Volkswagen.

“We have understood that we are a part of the semiconductor industry,” said Volkswagen Group’s Berthold Hellenthal, a senior manager for semiconductor management. “We have now people dedicated just to strategic semiconductor management.”

Securing – and keeping – chip engineers will be a challenge for automakers, which will have to compete against the likes of Alphabet Inc’s (GOOGL.O) Google, Amazon.com Inc (AMZN.O) and Apple Inc (AAPL.O), said Evangelos Simoudis, a Silicon Valley venture capital investor and adviser who works with both established automakers and startups. “I think that that would lead to acquisitions,” he said.

Unlike Tesla Inc (TSLA.O), which designs its own core chips, Simoudis said traditional automakers will have to juggle the production of legacy auto models as they make new investments.

AutoForecast Solutions (AFS) estimates that microchip shortages have forced automakers around the world to cut over 13 million vehicles from production plans since the start of 2021.

“It’s an arrogant industry,” said Sam Fiorani, vice president of global vehicle forecasting at AFS. “Sometimes it just bites them in the rear.”

Click here to change your cookie preferences