Bank of Cyprus (BoC) is adding value to its customers’ deposits by offering two 18-month “Step-Up” deposit products, with an increased interest rate of up to 3 per cent.

Specifically, the two products are aimed at customers with deposits of between €20.000 to €500.000, who can now benefit from even more preferential interest rates compared to BoC’s other deposit offerings.

The Bank’s first “Step-Up” 18-month proposal, is for deposits of €20.000 to €100.000, with an interest rate of up to 2.60 per cent, while the second 18-month proposal is for deposits of €100.000 to €500.000, with an interest rate of up to 3 per cent.

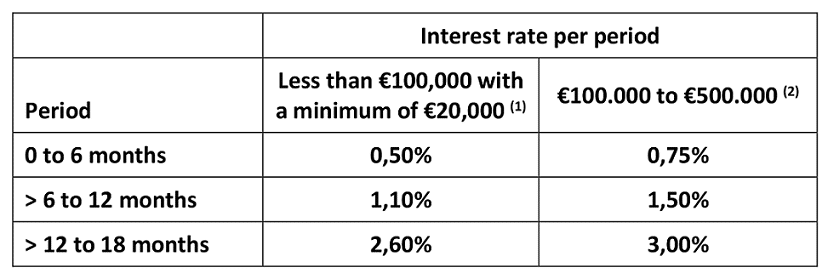

The interest rate on the 18-month “Step-Up” fixed deposit, increases in increments every six months, and interest is automatically paid every six months to an account indicated by the customer.

The average annual interest rate is 1.40 per cent for 18-month “Step-Up” accounts of under €100.000, and 1.75 per cent for 18-month fixed deposit accounts of over €100.000. The products are offered to individuals and legal entities.

The interest rate increases every six months, depending on the amount of the deposit, as follows:

- (1) Average annual interest rate: 1,40%

- (2) Average annual interest rate: 1,75%

There are charges in case of withdrawal of a part, or all of the deposit amount, before maturity.

Deposits in Bank of Cyprus Public Company Limited are protected by the Deposit Guarantee and Resolution of Credit and Other Institutions Scheme (DGS).

For more information, please contact the Branch Network or visit the Bank of Cyprus website.

Click here to change your cookie preferences