The crypto stage is illuminating with varied trends. Bitcoin is trading at around $111,600, slightly above a major resistance area, with Solana trading around $208, recording small gains, but with head winds. With markets experiencing this uncertainty, a new participant in the market, Mutuum Finance (MUTM), is making a name outside of its word of mouth appeal. Is MUTM a good buy in this case of instability?

Bitcoin (BTC)

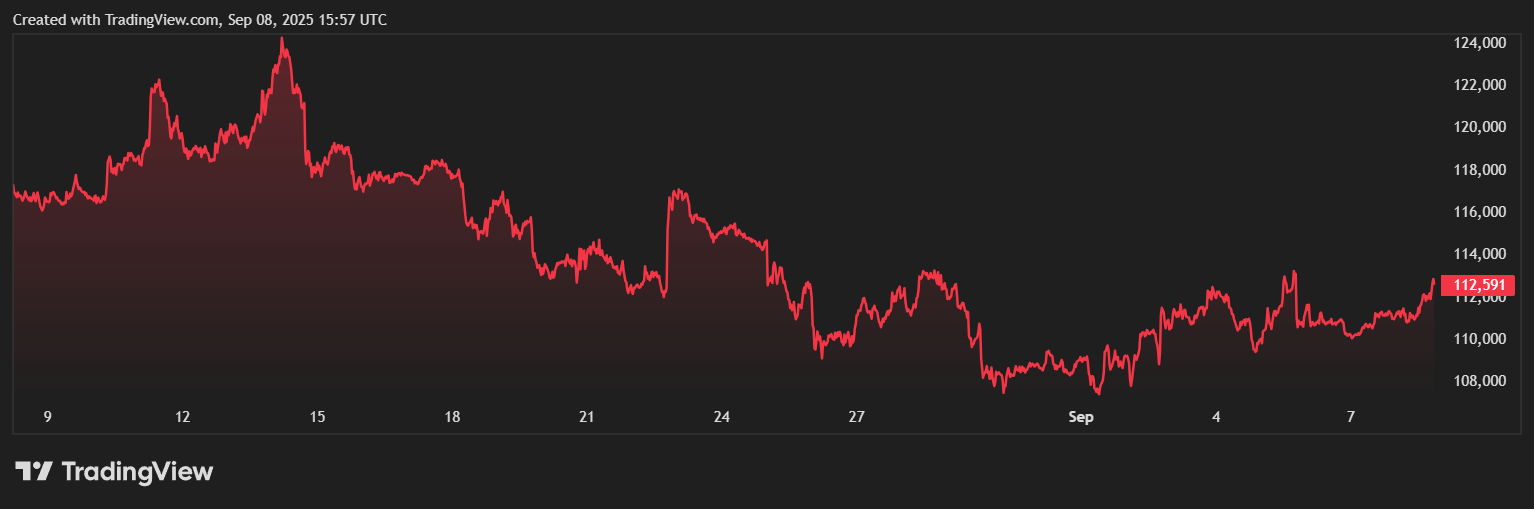

Bitcoin has been dragged slightly further, around $110K-111K on some occasional ETF inflows which have been backed by high network hash rates. Analysts caution of a possible correction down to 100K, but some view the formation as a catapult to new upwards actions. ETF flows are a key swing factor–some are bloating portfolios, and long-term holders still are reaping profits.

Meanwhile, markets are waiting for the next decision of the Fed. Telegraphed rate cuts may free up additional risk appetite – however, sentiment is not overly indulgent yet, and many view Bitcoin as a treasury reserve and not a high-growth asset.

Solana (SOL)

Solana is trading at $208-$209 and is remaining unchanged among its technical pattern being followed by analysts. It is trading on a narrowing wedge that, with any breakout, would expose it to $216 resistance. Some floor is given to traders on the levels of support about $190 and lower.

Solana has solid fundamentals on-chain even though there is a wider discussion of altcoins. DeFi is not finished yet and the ecosystem is adjusting to keep the momentum going despite volatility increasing.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) has become what is called in a market between macro uncertainty and technical gridlocks a project that is constructed by structural mechanics and not external hype. Its buy-and-redistribute model puts protocol fees to buy MUTM in the open market. Those tokens are subsequently recycled to users who deposit in the safety module and create a continuous purchasing force and strengthen token value, over time.

In order to deposit, users get mtTokens, which confirm their contribution to the liquidity and are stakeable. Then the stakers receive redistributed MUTM, creating a positive-feedback loop where demand is directly caused by utility of the platform.

Mutuum Finance is more than theory and is supported by actual momentum. The presale, which began at just $0.01 in Phase 1, has already advanced to Phase 6 at $0.035, marking a 350% surge from its starting point. The confirmed launch price of $0.06 means today’s buyers still have nearly 100% upside locked in before trading even begins. So far, the presale has collected more than $15.5 million and an increasing population of over 16,100 holders. For early participants, this structure has created tangible growth, with the progression of each phase rewarding those who acted quickly. New whale activity in the six-figure range is an indicator of investor confidence that is synonymous with initial development stages of established crypto.

In addition to capital, Mutuum Finance has undergone a CertiK audit with a very impressive score of 95/100 on security. Such a score places the project at the highest level of audited protocol and indicates that there were high confidence levels in the code. In an additional move to bolster its security, the team has also implemented a $50,000 bug bounty program whose rewards are offered in tiers based on the level of vulnerability found. Minor bugs can be eligible for the smaller payouts and critical bugs can unlock the largest rewards.

Also in the roadmap is the beta launch of the platform as well as the debut of the tokens, a strategic decision that stands a high chance of making early listings on the leading exchanges. Exchange exposure will spearhead increased visibility that will facilitate attracting more users and developing organic demand.

Mechanism-supported growth potential.

Mutuum Finance is scaling to the long term. The protocol intends to become Layer-2 (L2) compatible according to its roadmap, meaning that it will be able to offload transactions on overloaded Layer-1 blockchains. It would reduce transaction fee and shorten the confirmations hence borrowing and lending becomes a lot easier to ordinary customers. Tapping into L2s, Mutuum Finance will target not only retail users but also should target institutions that demand to move capital economically.

Scalability advantage will be of utmost importance at volatile times. Ethereum or mainnets gas fees tend to skyrocket in the event of spikes in the trading volume, yet L2 integration is intended to protect users against those bottlenecks. That would facilitate easier running of loans, repayments and redistributions, making the protocol appealing even when wider markets are strained.

The planned implementation of powerful oracle infrastructure is also noted in the roadmap. Oracles are intermediates between blockchain applications and market prices, and Mutuum Finance expects to use Chainlink price feeds to provide high-quality, tamper-resistant market information in supported market assets. Accurate inputs will ensure the system is in a better position to handle overcollateralized loans, and the users will be cushioned against cascading liquidations caused by defective data.

The design also considers fallback oracles and possibly aggregated feeds in order to strengthen reliability. Such redundancy would provide a guarantee that the protocol does not depend on just one stream of data, so there would be fewer chances of outage or manipulations. Mutuum Finance plans to fashion a safer environment between borrowers and lenders through trusted oracle networks and with high collateral requirements–a sharp contrast with tokens that depend only on community attention, lacking any structural protections.

Is MUTM your best crypto buy?

Bitcoin is range-bounding, Solana is technical but in consolidation. The market is volatile and macro and liquidity factors are keeping most investors on their toes.

Mutuum Finance (MUTM) provides a better alternative. It is riding on structural demand through redistribution model, robust presale momentum, audited foundations and roadmap that is aligned with launch-ready utility. MUTM is the crypto coin on a rock in a sea of volatile ones, whose growth potential isn’t simply a community energy, but built-in.

To the person who would have the question of what crypto coin to invest in during this uncertain time, MUTM is becoming one of the leading candidates.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer: The information provided in this content is for general informational purposes only and does not constitute financial, investment, legal, tax or health advice. Any opinions expressed are those of the author and do not necessarily reflect official position of any other author, agency, organization, employer or company, including NEO CYMED PUBLISHING LIMITED, which is the publishing company performing under the name Cyprus-Mail…more

You should not rely on the information as a substitute for professional advice tailored to your specific situation.

Click here to change your cookie preferences