The European Central Bank (ECB) decided to keep its deposit rate unchanged at 2 per cent for the third consecutive meeting, a move that many economists see as confirmation of a period of stability for the Eurozone economy.

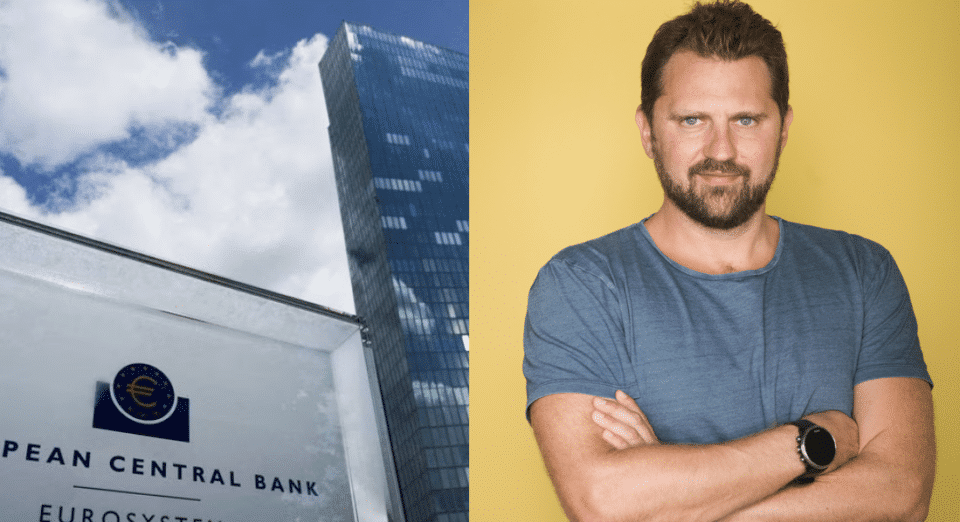

Reacting to the decision, Victor Trokoudes, founder and chief executive of Plum, which operates in the United Kingdom, Greece, and Cyprus, said the central bank’s steady approach offered welcome relief following months of economic uncertainty.

“Many will be relieved to see a relatively calm and steady approach from the central bank after all the recent drama surrounding tariffs and geopolitical tensions,” he said.

Trokoudes explained that the ECB’s stance was justified by current data.

“Inflation at 2.2 per cent is not far from the ECB’s target and in line with expectations, a trade deal has been agreed with the US and the Eurozone economy is stabilising, so there seemed little reason for the ECB to change rates,” he said.

“You can see why ECB President Christine Lagarde said the central bank is in a good place,” he added.

The ECB’s statement described the Eurozone economy as resilient, supported by a robust labour market, solid private sector balance sheets and the effects of previous rate cuts.

The bank also reiterated that it would remain data-driven, refusing to pre-commit to a specific policy path as uncertainty continues around global trade disputes and geopolitical tensions.

According to the bank, Eurozone gross domestic product (GDP) grew by 0.2 per cent in the last quarter, surpassing forecasts of stagnation. Growth in Spain and France outperformed expectations, while early indicators for the fourth quarter suggest further improvement.

However, Trokoudes said that despite some positive signals, challenges remain.

“Financial conditions have become less restrictive, supporting Eurozone growth as short-term interest rates have now been cut eight times since their peak and risk assets have grown in value, although the euro has strengthened,” he said.

He added that while inflation control had been a major success, the ECB might now need to guard against inflation falling below target.

“The ECB may actually need to ward off inflation going well below target with the strong euro making imports cheaper, especially from Chinese goods where prices are even keener, and wage growth is slowing,” he said.

Trokoudes also pointed to the role of Germany’s fiscal expansion, particularly its increased defence spending, in helping to boost Eurozone demand.

“There will be hope that this downside risk can be addressed through Germany’s major increase in fiscal spending finally kicking in, especially on defence, helping to energise the stuttering economy,” he said.

However, he warned that political instability in France and volatile relations with the United States could still unsettle financial markets.

“France’s political turmoil could become a major headache for the ECB, especially if no deal on public spending is agreed and borrowing costs accelerate,” he said.

“And tensions could easily reignite with the US given the capricious nature of leadership there,” he added.

Although business surveys show that private sector activity has reached its highest level since May 2024, consumer confidence remains subdued, and the recovery in private consumption expected by the ECB has yet to take hold.

The ECB’s decision follows a series of eight rate cuts since June 2024, after which it entered a holding pattern as inflation cooled.

While Chief Economist Philip Lane recently suggested that a further “slightly lower” rate might be considered if inflation undershoots, most economists believe the ECB will maintain rates in the near term, assuming uncertainty fades and government spending, especially in Germany, continues to support growth.

With inflation at target, modest GDP growth and improved sentiment in key economies, the ECB appears to be entering a rare period of equilibrium.

But as Trokoudes highlighted, the test of this stability may come later in the year when the bank releases new projections and reassesses its policy path in December.

Click here to change your cookie preferences