Analysts are increasingly highlighting Mutuum Finance (MUTM) as one of the best cheap cryptocurrencies to buy. Market strategists say the new token has the potential to be the next big crypto since the Shiba Inu (SHIB) explosion in 2021, citing its utility, tokenomics, and strong presale momentum. Unlike Shiba Inu, which is purely hype-driven, MUTM focuses on decentralized lending and borrowing. Its presale has attracted more than 18,000 participants and raised close to $20 million.

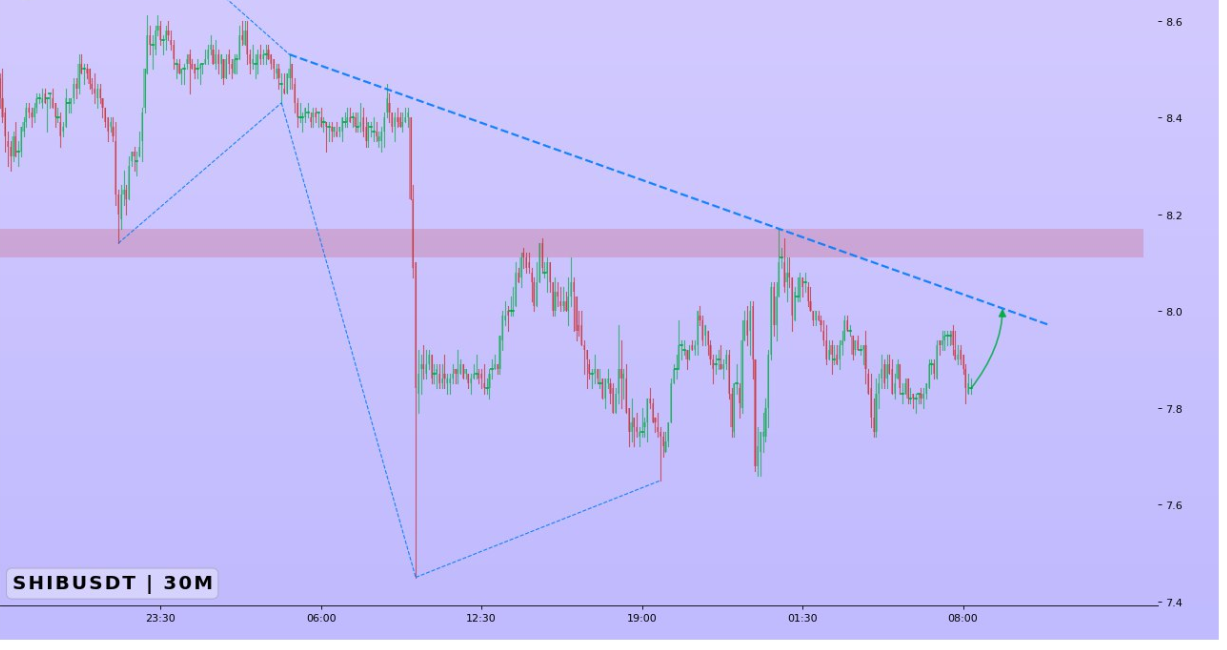

Shiba Inu attempts recovery

Shiba Inu (SHIB) is testing the $0.0000078–$0.000008 resistance zone following a prolonged sequence of lower lows. While a break above this trendline could allow a move toward the next resistance level, the setup remains purely technical and lacks strong confirmation of momentum. Overall, SHIB’s outlook appears tentative, driven more by short-term trading interest, leaving its recovery vulnerable to broader market shifts. Shiba Inu took the market by storm in 2021, briefly skyrocketing into the top 10 and making millionaires. Analysts now see similar potential in Mutuum Finance as its presale gains strong momentum.

Presale gains give early investors a head start

The Mutuum Finance (MUTM) presale has already delivered strong returns for early adopters. Initially priced at $0.01 in Phase 1, the token has advanced to $0.04 in Phase 7, with Phase 8 set to begin at $0.045. An investor allocating $1,500 at the current Phase 7 price could see their position grow to $1,800 in Phase 8, locking in a $300 gain before public trading even begins.

At launch, when MUTM lists at $0.06, that same investment will rise to $2,250. That’s a $750 profit long before the crowd joins in. Looking further ahead, analysts suggest that widespread adoption could drive a 20x increase, potentially turning the $1,500 position into $30,000. This upside has placed MUTM on the radar as a high-growth DeFi project for 2026 and a strong candidate for the best cheap cryptocurrency to buy now.

Built-In protections through liquidation and reserves

Mutuum Finance integrates key safety mechanisms to safeguard liquidity and ensure long-term platform stability. Liquidation fees play a central role in maintaining balance. For example, if $2,000 worth of ETH is liquidated, a 10% fee ($200) applies, 30% ($60) is directed to MUTM’s reserve fund, while 70% ($140) rewards the liquidator for restoring system health.

The reserve factor further reinforces resilience by allocating part of interest payments to reserves. On a 10,000 USDC loan at 8% APY with a 10% reserve factor, 0.8% APY (10% of 8%) flows into reserves, while 7.2% APY is distributed to liquidity providers. These measures help stabilize returns, protect participants, and maintain consistent liquidity across the ecosystem.

Buy-and-distribute rewards for long-term holders

Mutuum Finance also enhances holder value through a buy-and-distribute program. A portion of protocol revenue, generated from borrowing fees, interest spreads, liquidations, and reserves, is used to repurchase MUTM tokens from the market. These tokens are then distributed to users who stake mtTokens within the platform’s safety module.

This model aligns incentives across the ecosystem, rewarding long-term participation. Analysts see Mutuum Finance (MUTM) as the next big crypto since Shiba Inu, but with real utility. Priced at just $0.04, its presale is already up 300% and offers secure DeFi lending with strong safeguards. With 20x growth potential, MUTM is the best cheap cryptocurrency to buy now and one of the most promising tokens considered the next big crypto in 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:https://mutuum.com/

Linktree:https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences