“You have to keep in step with the times,” said an official. “That depends, said the French diplomat Talleyrand, ”on what you have to step in.”

This epigram may seem misplaced in a publication dedicated to the Fourth Industrial Revolution, but it is actually quite apt. The 4.0 enterprise integrates the union of strategy and technology, and there are times when that union involves a kind of ‘special’ relationship: Strategy first, and then using technology when it’s useful.

For nearly all the wealth managers interviewed in this third edition of Cyprus 4.0, building trust and a solid personal relationship with clients is simply essential to strategy. That character is central to wealth management has been true for centuries; The 18th century private banker Francis Baring was described as ““unquestionably the first merchant in Europe; first in knowledge and talents, and first in character.”

The avatars of ‘modernisation,’ placing technology ahead of personal relationships, have even invented a neologism called “hyper personalisation”. “Hyper-personalisation leverages artificial intelligence and real-time data to deliver more relevant content, product, and service information to each user,” a consultant tells us.

This is useful in selling shoes, or, for that matter, in delivering the right kind of actionable content for many types of organisations.

But not in wealth management.

Even in the 20th century, the Swiss private banker epitomised the ‘trusted family advisor,” able to solve problems of all types while remaining discretely in the background.

But can character still come first in this time of digital transformation, remote working, and increased client attention to return on investments and yield? What about adapting to new trends?

“We don’t need to go to data analytics to learn about current trends affecting our clientele. Our clients tell us all about them,” one wealth manager told the Cyprus Mail.

For the wealth managers here, the Fourth Industrial Revolution does not change the subordination of technology to strategy; it simply offers a vast richness of tools that weren’t available previously.

Wealth management in the 22nd century means using digital transformation to accelerate office processes, communication, gathering information, getting rapid access to data on companies and assets.

The fundamentals remain important, but the ability to harness data analysis can complement that activity. Wealth managers certainly make use of data analytics, using natural language processing to gain insights from hundreds of news releases or online articles, or the ability to analyse hundreds of funds with the click of a mouse to find new opportunities.

Or, for example, in working with new clients, collecting all the compliance-related information can be easily automated, as can AML/KYC verifications, etc.

Another example: Data storage security can be assured with new technology, and keeping client and transactional information safe now calls for technology solutions.

These examples will seem painfully obvious to most educated observers, as they might be applied in any back office in almost any industry. And they have no affect on the critical decisions in wealth management which will still, and perhaps always, be made with two or more people sitting together – with social distancing, of course.

Evolution of HNWIs

Our specific topic is the evolution of the high-net-worth-individual (HNWI) market in 2020 in Cyprus and abroad. Surprisingly the pandemic has had relatively little impact on that market, according to the Crédit Suisse Global Wealth Report. The number of UNHW individuals increased by more than 16,000 last year.

There are, unfortunately no available statistics for Cyprus, but all the wealth managers interviewed attest to considerable growth in that number, particularly in terms of entrepreneurs who have succeeded in business.

The worldwide impact on wealth distribution within countries has been remarkably small given the substantial pandemic-related GDP losses. Indeed, there is no firm evidence that the pandemic has systematically favoured broad higher wealth groups over lower-wealth groups or vice versa.

Switzerland has more than 1 million HNWIs with wealth at greater than $1 million – more than any other country with respect to population, and this was little-changed in 2020.

At the apex of the wealth pyramid, at the start of last year, there were 175,690 ultra-high net worth (UHNW) adults in the world with net worth exceeding $50 million. Of these, 55,820 were worth at least $100 million and 4,410 had wealth over $500 million. North America dominates the regional breakdown, with 92,740 members (53 per cent), while Europe accounts for 32,280 (18 per cent), and 20,240 (12 per cent) live in Asia-Pacific countries, 21,090 UHNW individuals live in China, followed by Germany (6,524), India (4,590), the United Kingdom (3,900) and France (3,710), Japan (3,140), Russia (3,030) and Hong Kong SAR (2,910).

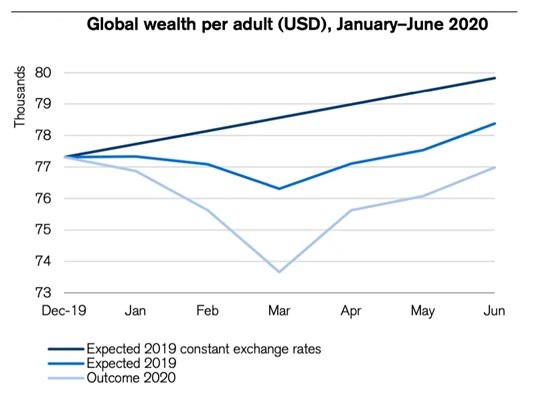

Global household wealth has held up extremely well in the face of the economic turmoil confronting the world, the report shows.

One would be wrong, of course, to assume that the pandemic has had no effect on the sector, for it has had a powerful affect on clients. Made nervous by the volatile global economy, clients are asking more questions than ever before.

Fortunately, they still trust their wealth management advisors to have the answers.

Click here to change your cookie preferences