There have been global repercussions from the recent block of the Suez Canal for six days by a stranded container vessel. The Suez Canal Authority is claiming $1 billion in damages, although that claim will no doubt be in discussion for some time. But the effect on the world’s trade, with deliveries delayed to businesses all over the world, is also heavily damaging.

To understand the importance of the Suez Canal block, and its fall out, we are publishing a report from the Bank of Cyprus Shipping Centre, Global Corporate Banking and Markets.

The Suez Canal

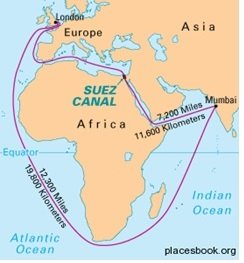

The Suez Canal connects the Mediterranean Sea to the Red Sea. It is the shortest maritime route from Europe to Asia, the alternative requiring an additional c.5,000 nautical mile trip (taking 10-14 days) around the Cape of Good Hope.

The Suez Canal is 120 miles long and at its narrowest it is 200 meters wide.

It is estimated that 10-12 per cent of all global commercial maritime traffic transits the canal.

The Ship

Motor vessel “Ever Given” is one of the largest containerships ever built. She was constructed in 2018 by the Imabari shipbuilding group in Japan and is capable of carrying over 20,000 TEU1 container boxes. The vessel is 400m long, nearly 60m wide and has a draft of 16m. Fully laden, she weighs c.200,000 tonnes. The market value of the vessel is about US$170 million.

According to reports, the vessel is owned by Shoei Kisen, linked to the Japanese Imabari Group. She is chartered to, and commercially managed by Taiwanese container line Evergreen Marine and she is technically managed by German company Bernhard Schulte Shipmanagement.

The Casualty

On Tuesday 23rd of March, m.v. “Ever Given” veered off course whilst navigating the Suez Canal with two maritime pilots2 on board, and ended up diagonally across the canal with bow and stern aground.

The cause of the incident is being investigated but initial reports suggest that strong winds and bank effect3 may have been contributing factors.

The Salvage Effort

Salvage teams worked on land and water, excavating the eastern embankment where the vessel bow was stuck and dredging sand from underneath the hull. Several large tugboats were employed and, with the assistance of high spring tides, the “Ever Given” was finally freed on Monday 29th of March.

Market Impact

It is estimated that the blockage held up nearly US$10bn worth of trade every day. It is reported that over 300 ships were held in waiting to transit the Suez canal, whilst others had already re-routed around Africa. A wide range of cargoes will face delays of many days and weeks.

For delayed vessels employed on ‘time charter’ the additional cost will fall on the charterer which pays a daily rate for the use of the vessel. However, for vessels employed on ‘voyage charter’ or the ones which are unemployed/repositioning, the cost will fall on the shipowner and it is unlikely to be covered by insurance.

Such incidents are generally positive for market freight rates, as the combination of traffic congestion and vessels having to take longer routes, takes vessels out of the market for longer and reduces vessel supply. FFA4 rates for dry bulk vessels initially increased and certain other types such as LR25 tankers also benefitted. The longer term impact will depend on how quickly the congestion can be cleared.

Costs and Claims

The total cost of salvage and claims by a number of affected parties, is unknown at this stage. Vessels like the “Ever Given” are generaly insured for various perils. Damage to the vessel itself from the grounding would be covered by Hull and Machinery (H&M) insurance. Salvage and towing operations may be covered under ‘general average’ provisions by a combination of H&M and cargo insurance. Third party claims such as cargo claims (for perishable goods or delays in delivery), damage caused to Canal infrastructure or claims for obstruction/ loss of income, would be covered by Protection and Indemnity (P&I) insurance. P&I cover is provided by mutual ‘clubs’ of shipping companies. The top thirteen P&I clubs are part of the International Group of P&I Clubs, with a reinsurance tower which covers losses up to an available limit of US$3.1 billion.

Some preliminary thoughts on insurance claims for the specific incident:

- The P&I club of the vessel would be reponsible for third party claims.

- The cause of accident will be investigated and in particular, whether this incident was the result of navigational error or a mechanical breakdown.

- The Suez Canal Authority (SCA) may seek compensastion for loss of income and possibly even reputational damage. The “Ever Given” is thought to be still in the Canal whilst other vessels of the shipowner and charterer will need to pass through Suez Canal in the future, so a satisfactory agreement needs to be reached with SCA.

- Cargo claims: many standard contracts of carriage exempt the shipowner from claims even in case of negligent navigation. There should be financial limitations on claims unless gross negligance is proven.

- Third party ships may only have have limited ability to claim from the shipowner, charterer or manager of the “Ever Given”.

Risk Management

Similar incidents are unusual, and although known to the shipping industry and its financiers, their overall impact is difficult to assess beforehand. For that reason, it is necessary for appropriate marine insurance cover to be in place.

Under the usual terms of ship-financings, vessel insurances are assigned to the bank and are checked & monitored regularly. In addition to this, the bank normally requires that Mortgagees Interest Insurance (MII) and Mortgagees Additional Perils (MAP) policies are also taken out. These provide cover to the bank for the outstanding loan & interest, in case of non-payment under the vessel insurances due to breach of warranties and conditions, and/or when there is insufficient insurance liability cover for a claim.

Future Impact from the incident?

Previous maritime accidents such as the “Exxon Valdez”6 have resulted in changes to ship design and navigation procedures, to improve safety. Incidents that cause blockage of the Suez Canal are indeed rare but there have been concerns that the ever increasing size of ships, particularly containerships, is outpacing the industry’s ability to deal with the growing risk of such large assets. There will be a full enquiry into what caused the incident and what action should be taken to prevent a recurrence. The shipping industry is closely following the developments.

Explanatory Notes

1 Twenty-foot equivalent unit, based on the volume of a 20-foot long intermodal container, also known as a ‘box’, which can be easily transferred between ships, trains and lorries.

² Maritime Pilots are licenced navigatoral experts, guiding vessels for safe navigation when entering ports, during berthing, anchoring or transitioning narrow channels. The pilot plays a crucial role and has good navigational knowledge of the specific waterways.

³ Bank effect occurs when a vessel navigates an enclosed waterway and pressure waves from the hull interact with the bank, causing pressure differentials. This can result in the stern of the vessel swinging towards the bank, causing deviation from the intended course.

⁴ Forward Freight Agreements –financial forward contracts that allow ship owners, charterers and speculators to hedge against the volatility of freight rates.

⁵ Large Range 2 Tanker of 80-160k dwt capacity, carry oil products ranging from jet fuel to heating gas oil but can also carry crude oil.

6 A 1989 oil spill of 11 million gallons of crude oil into Alaska’s Prince William Sound from m.t. “Exxon Valdez”, a VLCC tanker owned by the Exxon Shipping Company.

Click here to change your cookie preferences