The Turkish central bank has held its key interest rate at its current level of 19 per cent, the bank announced on Thursday in a statement.

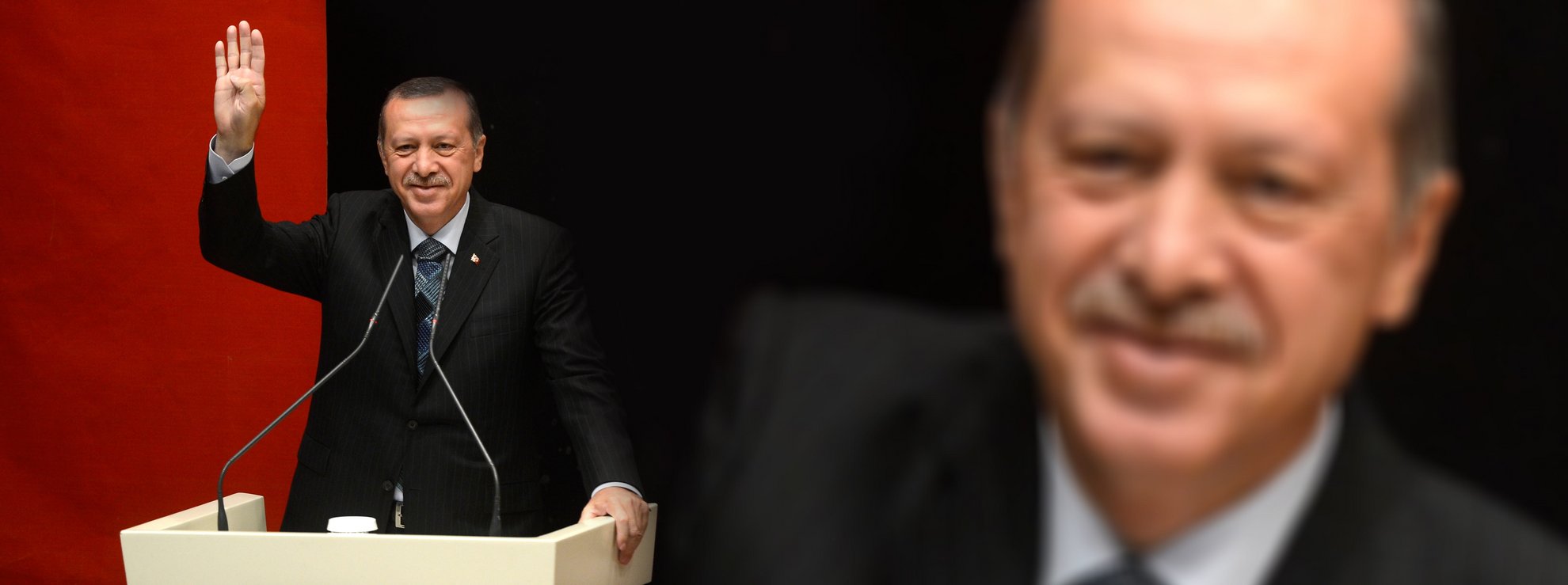

The central bank has been under pressure from the Turkish president Recep Tayyip Erdogan to reduce interest rates. But with inflation at more than 16 per cent, the central bank would have lost all credibility had it done so.

Credibility is clearly an issue. The Turkish lira fell against the euro to 9.72 after the announcement.

Governor Sahap Kavcioglu was appointed after the previous head of the central bank had raised rates, and was removed on March 20. So this has been an important policy test for Kavcioglu – whether he will be able to continue to resist political pressure remains to be seen.

However the policy statement from the central bank has changed. Previously, the bank has promised in its policy statements to tighten rates and fight inflation.

Now the statement reads that the bank will “use of all the tools at its disposition to lower inflation. Raising rates Is no longer in the toolbox, it seems.

“Central Bank of the Republic of Turkey has removed the pledge over further tightening. That’s dovish, it’s obviously clearing the decks to try and cut rates early, and this will be a disaster for lira,” commented Timoth Ash, senior EM sovereign strategist at BlueBay Asset Management said in a tweet after the announcement.

Analysts had not expected a rise in interest rates, but a more hawkish statement would have added to the new governor’s credibility.

“The central bank does not have the policy room to lower rates this year given the elevated inflation outlook,” Ehsan Khoman, Head of Emerging Market Research for Europe, Middle East and Africa at MUFG Bank in Dubai, told Bloomberg. But Kavcioglu’s dovish views suggest the central bank will eventually give in to political pressure, he added.

Click here to change your cookie preferences