Most of the countries negotiating a global overhaul of cross-border taxation of multinationals have backed plans for new rules on where companies are taxed and a tax rate of at least 15%, they said on Thursday after two days of talks.

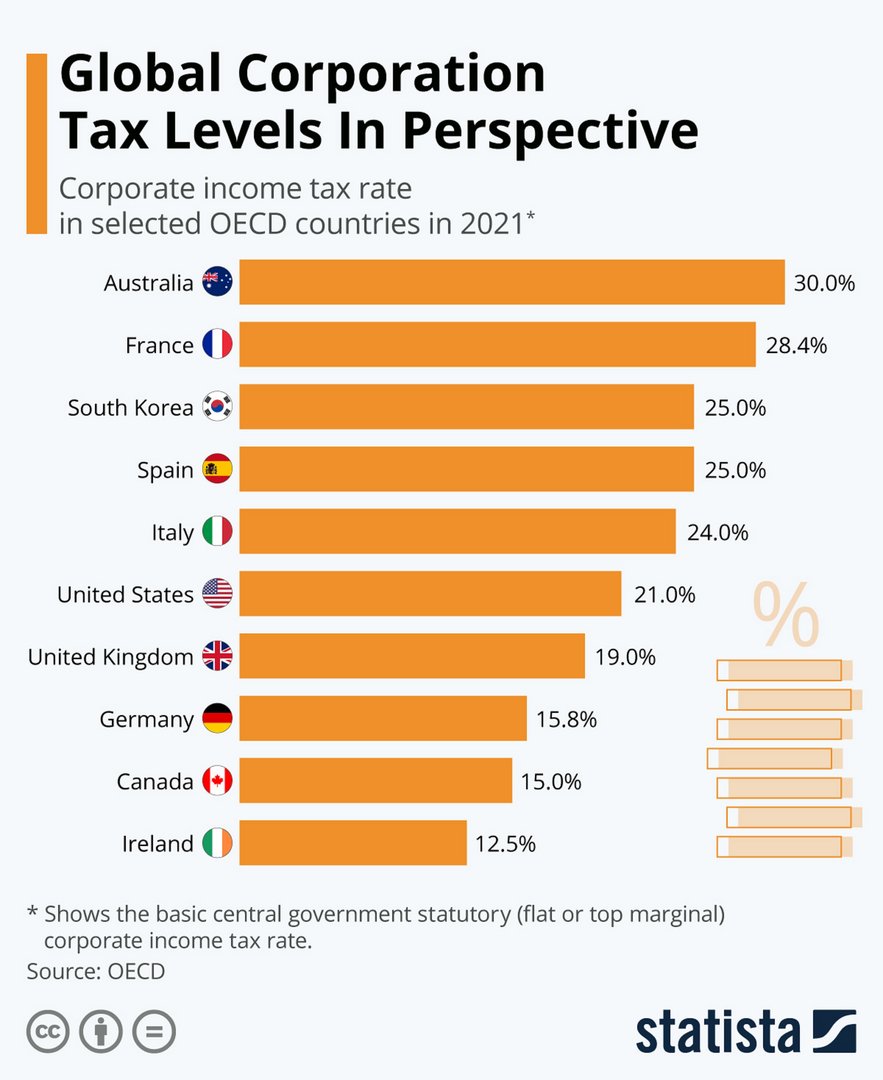

The Paris-based Organisation for Economic Cooperation and Development, which hosted the talks, said a global minimum corporate income tax of at least 15% could yield around $150 billion in additional global tax revenues annually.

It said 130 countries, representing more than 90% of global GDP, had backed the agreement at the talks.

It added that new rules on where the biggest multinationals are taxed would see taxing rights on more than $100 billion of profits shifted to countries where the profits are earned.

“With a global minimum tax in place, multinational corporations will no longer be able to pit countries against one another in a bid to push tax rates down,” U.S. President Joe Biden said in a statement.

“They will no longer be able to avoid paying their fair share by hiding profits generated in the United States, or any other country, in lower-tax jurisdictions,” he said.

The Group of Seven advanced economies agreed in June on a minimum tax rate of at least 15%. The agreement will go to the Group of Twenty major economies for political endorsement at a meeting in Venice next week.

Technical details are to be agreed by October so that the new rules can be implemented by 2023, a statement from countries that backed the agreement said.

The nine countries that did not sign include low-tax EU members Ireland, Estonia and Hungary, and South Korea.

Welcoming the deal as the most important international tax deal reached in a century, French Finance Minister Bruno Le Maire said he would try to win over those holding out.

“I ask them to do everything to join this historical agreement which is largely supported by most countries,” he said, adding that all big digital corporations would be covered by the agreement.

The new minimum tax rate of at least 15% would apply to companies with turnover above a 750-million-euro ($889-million)threshold, with only the shipping industry exempted.

The new rules on where multinationals are taxed aims to divide the right to tax their profits in a fairer way among countries.

Companies considered in scope would be multinationals with global turnover above 20 billion euros and a pre-tax profit margin above 10%, with the turnover threshold possibly coming down to 10 billion euros after seven years following a review.

Extractive industries and regulated financial services are to be excluded from the rules on where multinationals are taxed.

Click here to change your cookie preferences