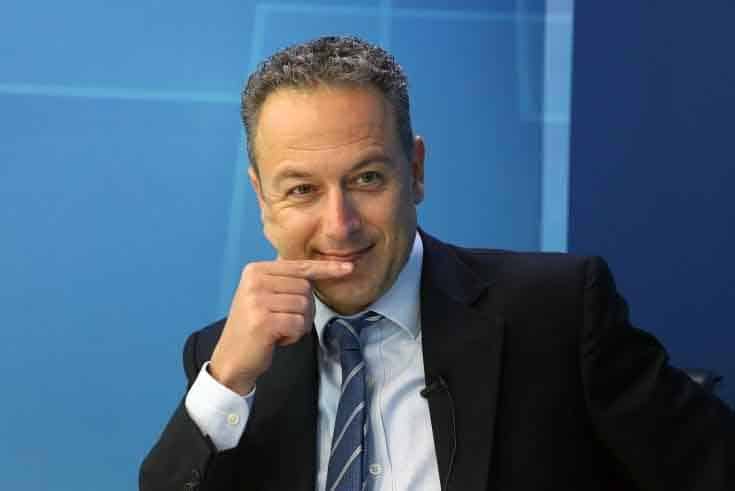

Parliament’s decision to extend foreclose freezes until January 2023 is “ridiculous” and exposes Cyprus for no reason, Bank of Cyprus group chief executive Panicos Nicolaou said on Friday.

“This is tragic for the country, we’re exposing our country without helping borrowers,” he told journalists after a presentation of the bank’s financial statements for the first nine months of 2022.

The bank reported a €9 million net loss for the first nine months of 2022, largely due to the voluntary staff exit plan and the respective one-off cost of €101m recorded in the third quarter.

In his address to shareholders, Nicolaou said: “We have frozen foreclosures in all categories. These are unenforceable laws. We are exposing our country, our credibility and we are exposing it for no reason,” he said commenting on the recent move by parliament. “This is ridiculous.”

The new moratorium on foreclosures until the end of January 2023, applies to a debtor’s primary residence valued at €350,000 or less, business premises where the business’ annual turnover does not exceed €750,000, and parcels of land with a value of €100,000 or less.

“The suspension of the foreclosure law protects strategic defaulters and causes problems for consistent borrowers,” Nicolaou said.

“We as the Bank of Cyprus are willing and have proven it many times that we help vulnerable borrowers. And we do loan restructurings and provide solutions to the extent of our clients’ capabilities and in some cases we even write off part of their borrowing, where and where it is required.”

“In my humble opinion it is a suspension of legislation that cannot be implemented. And the banks are asked to explain to foreign clients and investors as well as to the supervisory authorities what this successive suspension of this disputed law means and what it is for,” he added

Finance Minister Constantinos Petrides has already called on President Nicos Anastasiades to send the law back to parliament, saying in its current form, it protects strategic defaulters and puts Cyprus’ credit rating at risk. He also warned this would have consequences on interests rates and ease in obtaining loans.

Anastasiades said he would seek out the position of the attorney-general on the constitutionality of the law before making a decision. Financial Ombudsman Pavlos Ioannou also commented on the law, saying it has a slew of interpretive issues.

For instance, how a primary property is to be determined is not clearly defined, he said. Though the legislation outlines a primary property is one in which the owners reside in for six months, there is no clarification on how this is to be proved, he noted.

Exploring the long-term consequences in loan defaults in light of increasing inflation and interest rates, Nicolaou said that with an estimated growth rate of three per cent in 2023, no “significant defaults” are expected.

Nonetheless, the bank wants to be conservative and is not reversing forecasts, pointing out that the cost of risk from 44 basis points nine months ago is expected to update to between 50 and 80 basis points in 2023.

Nicolaou added that based on the bank’s data until the end of June 2022, the average balance of private borrowers in the bank amounts to €80,000 with a repayment period of 15 years, while the average interest rate was 2.08 per cent.

If the interest rate increases to 4.08 per cent, the instalment of these loans will increase to €585 from €520 which was the figure at the end of June. With the average salary in Cyprus being around €2,000, every 1.0 per cent interest rate increase corresponds to €35 to €40 instalment increase.

“Therefore, with the instalment increase being two per cent of the average salary, the situation is not so tragic”, he said. The bank will monitor its loan portfolio, it will be careful and “we will proceed with solutions where necessary.”

Regarding the estimates for borrowing in 2023, Nicolaou noted there may be a slight slowdown, but he estimated that there will not be a big difference from the 2022 figures.

Asked if the bank was considering the early repayment of the money the bank has drawn from the European Central Bank through the targeted long-term refinancing operations, Nicolaou said “we are seriously thinking about it, but we have not made a decision.”

“The bank has €7 billion in deposits with the central banks, we have no particular reason to keep them but we have not yet decided what to do,” he said.

Regarding the rent-for-instalment plan, Nicolaou specified that the bank has thoughts on the draft framework, adding that the plan needs clarification and changes. He said he supports the plan, stressing that Cypriot authorities must act.

Click here to change your cookie preferences