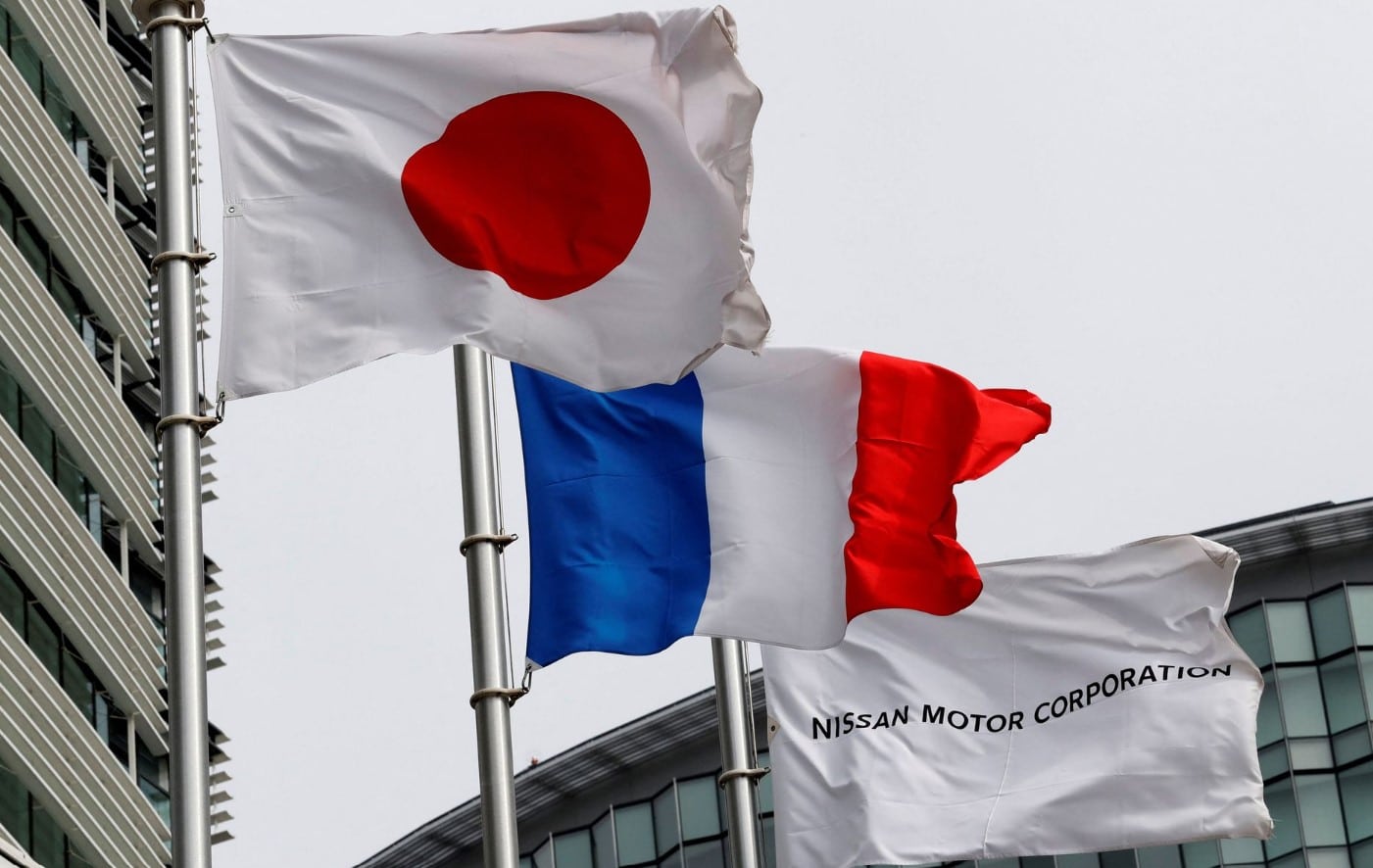

Nissan Motor Co (7201.T) and Renault SA (RENA.PA) agreed on Monday to a sweeping remake of their two-decade-old automaking alliance that will put them on equal footing and see the Japanese company invest in Renault’s new electric vehicle business.

The joint announcement capped nearly four months of intense talks that sources told Reuters were complicated by concerns about the sharing of intellectual property as Renault sought tie-ups with companies outside their alliance.

The deal, still subject to board approvals, will see Renault reduce its stake in Nissan to 15 per cent from around 43 per cent, it said. That will see Renault put around 28 per cent of the Japanese automaker in a French trust, crucially making the two more equal partners.

Their unequal relationship had long been a source of friction among Nissan executives. While Renault bailed out Nissan two decades ago, it is the smaller automaker by sales.

The alliance, which was also includes junior partner, Mitsubishi Motors Corp (7211.T), was deeply strained by the ouster of its architect and former chairman, Carlos Ghosn, amid financial scandal.

Nissan and Renault will now have a 15 per cent cross-shareholding that will allow Nissan to exercise its voting rights, which it was unable to do previously.

“The ability to exercise voting rights is welcome from a corporate governance perspective and acts as a guardrail to keep interests aligned between the two parties,” said Jon Withaar, head of Asia special situations at Pictet Asset Management.

The deal includes a lock-up that prevents share sales for a certain period, as well as a standstill obligation, which puts other limits on a stock sale.

Shares of Renault were 3.8 per cent lower in Paris trade at 0850 GMT. The market may have been waiting for more details, said Gregoire Laverne, a fund manager at Apicil Asset Management, which holds Renault shares.

FREE REIN

For Nissan, any negative impact from a potential share sale by Renault was likely to be short-lived, said Masayuki Kubota, chief strategist at Rakuten Securities in Tokyo.

The Japanese automaker would get freer rein in the longer term to adopt a strategy focused on the United States, China and emerging markets, he said.

Renault plans to instruct the French trustee to sell the Nissan shares, worth around $4.1 billion at current market values, if commercially reasonable for Renault, in a coordinated and orderly process, it said.

Since the two automakers announced they were in negotiations to restructure their partnership in early October, shares in Renault gained almost 25 per cent, while Nissan shares, facing a potential stock overhang, were up just 3 per cent.

As part of the deal, Nissan and Renault have pledged to pool more resources into key projects in Latin America, India and Europe, involving markets, vehicles and technologies. Nissan also said it would invest in Renault’s new battery-electric vehicle unit.

The future shape of the Franco-Japanese alliance has implications for both companies as well as the global auto industry. It also highlights how the immense technological upheaval in the auto industry is forcing companies to both partner and compete with a dizzying number of newcomers and tech firms.

Renault, for instance, has said it will partner with companies from China’s Geely Automobile Holdings (0175.HK) to semiconductor giant Qualcomm Inc (QCOM.O).

The French company is separately working to finalise a deal with Geely and to bring Saudi Arabian state oil producer Aramco (2222.SE) in as an investor and partner to develop gasoline engines and hybrid technologies, Reuters has reported.

Click here to change your cookie preferences