The importance of the East Med to Chevron’s gas plans was made clear at the company’s ‘2022 4Q Earnings Conference Call’ on January 27 and subsequently at its ‘Investor Presentation’ on February 28. Mike Wirth, Chevron’s CEO, confirmed that he considers the region to be of “high priority”.

He specifically referred to the $673 million ‘Final Investment Decision’ (FID) taken in December 2022 to expand Tamar gasfield production capacity in Israel from 11billion cubic metres per year (bcm/yr) to 16bcm/yr, expected to come online in early 2025. This will enable Tamar to meet Israel’s growing domestic demand and increase gas deliveries to Egypt.

Following the Tamar FID, Chevron and its partners approved close to $100m budget for the development of Phase 1B of the Leviathan gasfield. This includes pre-FEED engineering for field expansion, including construction of a 4.6million tonnes/yr floating LNG (FLNG) facility, three years after FID. The expansion will increase production capacity to 21bcm/yr from 12bcm/yr now.

The choice of FLNG has also been reinforced by concerns that Egypt’s persisting economic problems could make it an unreliable transport hub for East Med gas and by Europe’s reluctance to make longer-term commitments to natural gas. FLNG opens the way for exports to Asia and its growing LNG markets. Chevron expects to finalise development plans by July. This also puts an end to any lingering hopes that the East Med gas pipeline could make a come-back.

In Egypt, the discovery in December of the 100bcm Nargis gasfield about 60km offshore Sinai was described as “very attractive”. Chevron and Eni have agreed to fast-track its development, using existing facilities operated by Eni, including the Damietta LNG liquefaction plant. This would limit development costs, making the project quite attractive.

Chevron is also developing exploration plans for its two blocks in Egypt’s unexplored West Mediterranean region. Confirming Chevron’s interest in the region, Mike Wirth highlighted regional gas needs but also “options to try to get that gas into Europe”.

But Mike Wirth did not make any references to Aphrodite or Cyprus. Evidently this is not considered “high priority” in Chevron’s immediate plans, despite frequently repeated assertions by Cypriot energy ministers that “development of Aphrodite is imminent”.

Despite making a record $36.5billion profit in 2022, Chevron is still focused on capital, cost and operational discipline, limiting capital expenditure to high return projects, prioritising returns to shareholders and debt repayment. Mike Wirth said “Our 2023 capex budgets are consistent with our long-term plans to safely deliver higher-returns and lower carbon,” while maintaining spending discipline.

This also applies to Chevron’s operations in the East Med, where priority is given to high-returns Tamar, Leviathan and Nargis gasfields. Uncertainties about Aphrodite place it into a more cautious development bracket.

Aphrodite gasfield

Chevron and its partners, Shell and NewMed Energy, agreed in September 2022 to drill a second appraisal well at Aphrodite – as required under their Production Sharing Agreement – that would also function as a production well. In November the government granted Chevron an extension on nine months, until August 2023, so a date to drill this well should be announced soon.

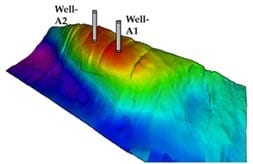

Given what happened after the first appraisal well was drilled, this well is considered to be critical. Aphrodite was discovered in December 2011 (well A1) and was then estimated to hold about 7trillion cubic feet (tcf) gas. Following drilling of the first appraisal well (A2) in 2013, this was reduced to 4.2tcf.

The main reason for this reduction is that the Aphrodite reservoir has a complex geology. It is divided into a number of non-communicating compartments (shown below) and until all main compartments are drilled, it is difficult to be certain about how much gas the reservoir holds. Inferring quantities based on data obtained so far is not sufficiently accurate for investment decisions. Chevron plans to drill the second appraisal well (A3) at the largest compartment by the middle of the year. Much depends on this. Hence the criticality.

Without this information it is difficult for Chevron and its partners to proceed and finalise development plans. This depends on gas quantities. The options considered so far are based on the current estimate of 4.2tcf. Should the second appraisal well lead to a further reduction to this estimate, then it could put these development options into question. Conversely, a significant upside may open up other possibilities.

Visualisation of the Aphrodite gasfield:

Aphrodite development options

The preferred development option appears to be to transport Aphrodite gas to Egypt for liquefaction and export.

Chevon has been in discussions with Shell, considering the use of Shell’s under-utilised West Delta Deep Marine (WDDM) facilities offshore Egypt. The option is to develop Aphrodite using subsea production facilities, transport the gas by subsea pipeline and treat it at WDDM, from where it would be exported to the Idku LNG plant, operated by Shell, for liquefaction and export. With Shell a partner in Aphrodite, this would appear to be an obvious option, but it would preclude sending untreated gas by pipeline to Cyprus.

But there are complications. First, Egypt has always been reluctant to grant access to third parties to its LNG plants, reserving these for its own gas, especially given the high LNG prices in global markets. Last year Egypt’s revenues from LNG sales reached a massive $8.4billion, making a major contribution to its beleaguered finances.

Another is that without new discoveries, Egypt runs the risk of not having enough gas for its own internal energy market. With EGAS being the sole buyer of gas in the country, the concern is that imported gas may be diverted to fill the gap. There is of course the option to divide Aphrodite gas between LNG exports and Egypt’s internal market. However, merely selling the gas directly to Egypt may not be a sufficiently attractive option for Chevron.

There is also the unresolved matter of the unitisation agreement with Israel. Hopefully this will be addressed by the new energy ministers of Israel and Cyprus. Complicating matters further is Turkey’s aggressive position towards any gas developments in Cyprus’ EEZ.

With EU’s determination to reduce gas demand further and accelerate energy transition, uncertainties about the Aphrodite reservoir – that only appraisal drilling can answer – and Chevron’s focus on its high return projects in Israel and Egypt, mean that Aphrodite may have to wait longer before its future becomes clearer.

Dr Charles Ellinas is a senior fellow at the Global Energy Centre of the Atlantic Council and a visitor research fellow, IENE @CharlesEllinas

Click here to change your cookie preferences