On-chain data is a skill every crypto investor should learn and be aware of. Due to crypto’s decentralized nature, every single transaction can be seen and tracked, and data shows huge buy orders for Collateral Network (COLT) from Polkadot (DOT) and Tezos (XTZ) holders. These early investors in Polkadot (DOT) and Tezos (XTZ ) know a good project when they see one, and this article delves deeper into Collateral Network (COLT).

Polkadot (DOT)

Polkadot (DOT) is the layer zero protocol that looks to solve the interoperability issue that blockchains face. Polkadot (DOT) recently partnered with Encode Club to launch a hackathon on April 11th. Given Polkadot’s (DOT) lead developer is Gavin Wood, many gifted coders will likely attend. Polkadot’s (DOT) development team certainly is one of its key strengths, and Polkadot (DOT) has 173 active developers, second only to Ethereum (ETH), which has 189.

Analysts remain relatively bullish on Polkadot (DOT) long term, giving price predictions ranging between $11.27 and $13.06 in 2024- a decent upside from Polkadot’s (DOT) current price of $6.24.

Tezos (XTZ)

Tezos (XTZ), sometimes called the evolving blockchain, can upgrade and change without hard forking the network. Tezos (XTZ) recently pushed its Mumbai Upgrade, introducing smart rollups to the Tezos (XTZ) ecosystem. This layer two scaling solution brings Tezos (XTZ) directly into the optimistic rollup race to compete against popular chains like Arbitrum (ARB) and Optimism (OP).

However, analysts are still determining whether Tezos (XTZ) can truly compete in this space, given the runaway success of layer two scaling solutions built on Ethereum (ETH). Tezos (XTZ) trades at $1.10, with price predictions ranging between $2.04 and $2.38 for Tezos (XTZ) in 2024.

Collateral Network (COLT)

Collateral Network (COLT) is a young disruptive protocol that has already raised over $400,000 in its presale and seeks to challenge the idea of lending in the crypto space. Over-collateralized crypto-backed loans have dominated DeFi until Collateral Network (COLT).

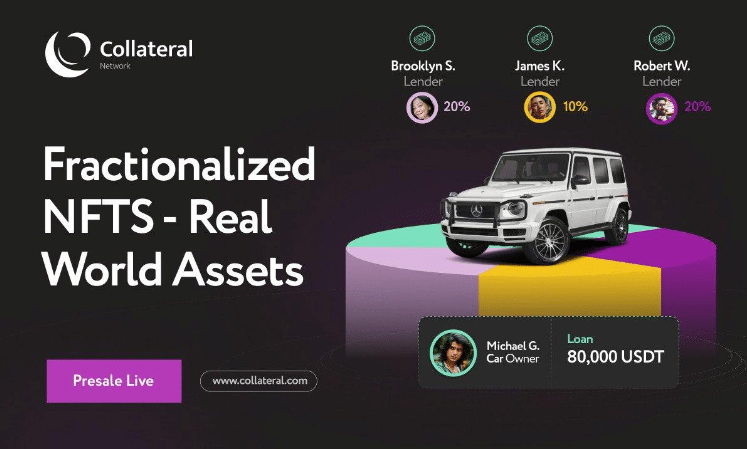

Collateral Network (COLT) will allow off-chain assets to be brought on-chain through the use of 100% asset-backed NFTs. Users can collateralize real estate, jewelry, vintage cars, fine art, and more. They send the item to Collateral Network (COLT) for valuation. Then the protocol mints an NFT which remains fully liquid and tradeable on the secondary market, or the user can access crowdfunded liquidity through a fractionalized NFT system.

Collateral Network (COLT) has plans to go cross-chain, and this hybrid infrastructure model brings together lenders, borrowers, and institutional-level liquidity. Lenders earn passive income from interest payments, borrowers unlock liquidity of their assets in private without the need for sale, and Collateral Network (COLT) massively upgrades DeFi’s value proposition by bringing real-world assets on-chain.

The COLT token has several powerful utility cases, such as discounted fees, passive income through staking, and access to the auction where holders can buy distressed assets. Analysts have already predicted that COLT will rally by 3,500% before the presale ends, with further gains expected when COLT launches on centralized exchanges. Therefore, unsurprisingly, DOT and XTZ holders have begun aggressively targeting the presale.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk

DISCLAIMER – “Views Expressed Disclaimer: Views and opinions expressed are those of the authors and do not reflect the official position of any other author, agency, organization, employer or company, including NEO CYMED PUBLISHING LIMITED, which is the publishing company performing under the name Cyprus-Mail…more

Click here to change your cookie preferences