Some of the major banks in the world expect global economic growth to slow further in 2024, squeezed by elevated interest rates, higher energy prices and a slowdown in the world’s two largest economies.

The global economy is forecast to grow 2.9 per cent this year, a Reuters poll showed, with next year’s growth seen slowing to 2.6 per cent.

Most economists expect the global economy to avoid a recession, but have flagged possibilities of “mild recessions” in Europe and the UK.

A soft-landing for the United States is still on the cards, although uncertainty around the Federal Reserve’s monetary tightening path clouds the outlook.

China’s growth is seen weakening, exacerbated by companies seeking alternative cost-efficient production destinations.

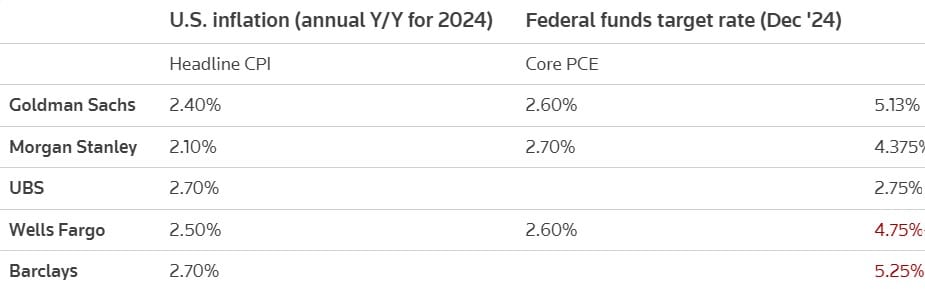

Following are forecasts from major global banks:

The Fed’s main rate currently stands at 5.25 per cent-5.50 per cent:

As of 1040 GMT on Nov. 16, 2023:

S&P 500 (.SPX): 4502.88

US 10-year yield : 4.5019 per cent

EUR/USD : 1.084

USD/CNY : 7.248

USD/JPY : 151.27

Click here to change your cookie preferences