The European Central Bank opted to keep interest rates stable on Thursday and hinted at an impending conclusion to its final bond purchase programme.

This move marks the conclusion of a ten-year initiative aimed at absorbing debt across the eurozone.

While the ECB had previously raised interest rates to historic levels earlier this year, recent inflation figures, surprisingly subdued, have largely eliminated the likelihood of further policy tightening.

This shift has redirected discussions toward the speed at which the ECB might now pivot its approach.

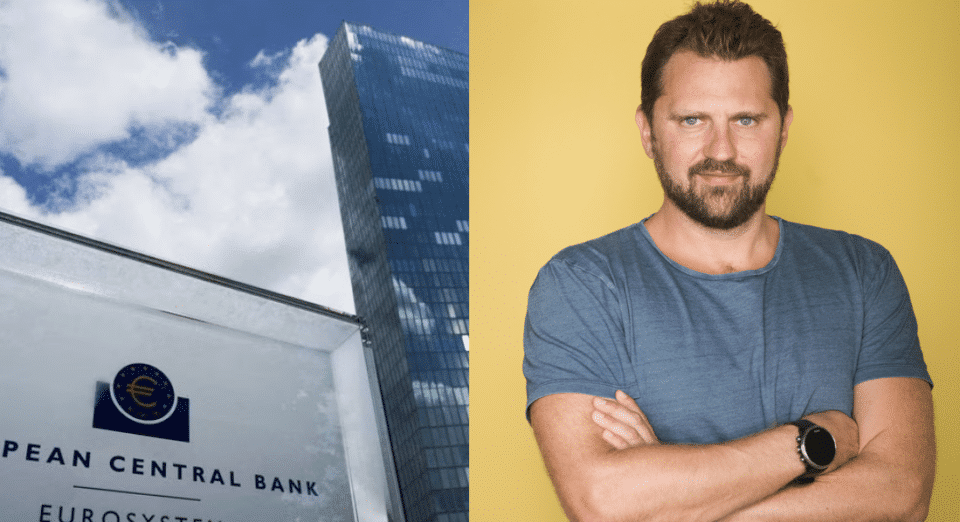

Commenting on the ECB’s decision, Victor Trokoudes, CEO and founder of Plum, said that the announcement did not come as a surprise, since rates were widely expected to be held at their current rates.

“Lagarde’s challenge was to reclaim the narrative of higher rates for longer in the face of softening market conditions, especially as core inflation is still some way above the ECB’s target,” he said.

“Whether she has succeeded in this will become clearer from the reaction in the markets,” he added.

Trokoudes explained that the “recent easing of financial conditions makes it more challenging for the ECB to maintain its success in getting inflation under control, and they’ll be wary of the markets running ahead of them”.

“Nevertheless, there is real cause for optimism in Europe,” Trokoudes said, noting that this upswing in sentiment is being reflected in the stock markets.

He cited the German DAX as an example, which hit a new all-time high last week. In addition, he mentioned that Italian stocks are at 15-year highs and the broader, regional STOXX Europe 600 index was approaching record levels as well.

“That’s because the ECB has made quicker progress than both the US and UK in bringing down inflation to central bank targets,” Trokoudes stated.

He noted that the drop from 2.9 per cent in October to 2.4 per cent in November saw inflation at its slowest pace since July 2021 in the EU.

“And this is leading to expectations that rates will start falling more quickly as well in the EU,” he said.

He explained that “markets are pricing in around 5 cuts by the ECB spanning 130 basis points, with the first cut as early as the spring next year”.

“Whatever the timing of rate cuts”, he continued, “the ECB’s success in getting inflation under control means they critically have more flexibility to increase the pace of rate cuts should the economic headwinds become fiercer”.

In this context, Trokoudes reiterated that “it’s important that Europeans make sure their savings are growing in real terms, by ensuring their cash holdings are earning fair levels of interest”.

“However, the major banks are passing on merely a fraction of the increase in the central bank rate since 2022,” he stressed.

“An increasingly popular alternative to these traditional savings accounts are money market funds, which provide a return that typically follows central bank rates more closely,” the Plum CEO stated.

“Fintechs like Plum are making this option more accessible and it’s critical that people consider all the options available so their money works hard for them,” he concluded.

Click here to change your cookie preferences