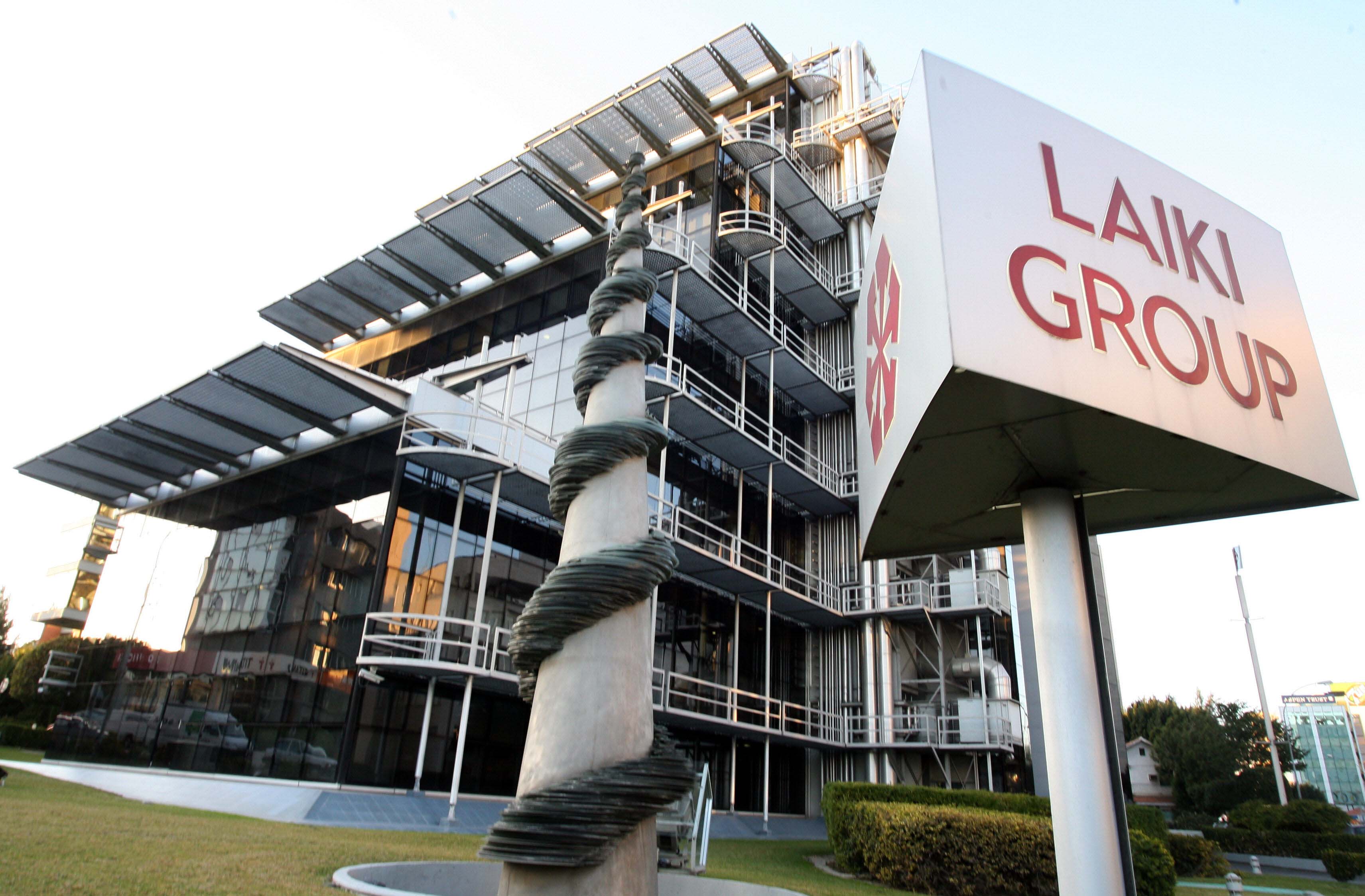

The attorney-general on Tuesday filed an appeal over a Limassol District Court decision that last month awarded compensation to an individual in a 2013 Laiki Bank haircut case.

“In particular, the Republic of Cyprus contests the court’s findings as to the liability of its authorities and the court’s conclusion that the Republic of Cyprus must pay compensation to the depositor,” the attorney-general’s office said.

According to the Limassol court’s decision a Russian was awarded over €780,000 after he lost Laiki Bank savings due to the 2013 ‘haircut’.

The decision marked the first time since Cyprus’ bail-in that a plaintiff won a case over their deposits. All previous court cases have failed.

The court ruled the Central Bank (CBC) – and consequently the Republic of Cyprus – had been negligent in their handling of the financial crisis in 2009 and the lead up to the haircut.

At the time, the attorney-general said it would file an appeal against the ruling of the court, as several other similar cases filed by depositors have been thrown out.

A month ago, the ruling was being hailed by depositors, who lost money during the haircut.

Commenting on the decision then, head of the Laiki Bank depositors’ support group (Sykala), Adonis Papanastasiou told CNA the difference in this case compared to previous ones, was that the judge did not limit himself to the CBC’s claims that the decisions were made to save insured depositors (those with under €100,000 in their accounts) in 2013.

Instead, the judge examined the government’s and CBC’s decisions and omissions, which he said led to the 2013 crisis.

“One cannot start off saying we were in this situation in 2013. For us to be there, things happened before that.”

The CBC, he added, had not exercised the required supervisory control and the Cyprus banks were liable.

“The golden boys of the banks were paid according to the profits the banks had on their balance sheets,” he said, recalling that something similar had happened in the 2000 stock market crisis.

The court found the government negligent because it did not turn to European mechanisms in time for a loan and then “without seriousness and planning” opted for a loan without knowing the bank’s needs, which were greater than those of the state.

Click here to change your cookie preferences