By Nicolas Christodoulides, Senior ESG Analyst

BOC is focusing its efforts on fighting climate change, which is the biggest challenge that humanity faces

Stainability is often defined as meeting the needs of the present without compromising the ability of future generations to meet theirs. One of the main threats to future generations is climate change, with extreme weather events happening more frequently, such as this year’s unprecedented snowstorms and wildfires in Europe. The World Meteorological Organisation (WMO) declared that 2023 was the warmest year on record. Therefore, the Bank is aiming to maintain its leading role in the Environmental, Social and Governance pillars and is focusing its efforts on fighting climate change, which is the biggest challenge that humanity faces.

The EU has committed to reaching net zero emissions by 2050 (with intermediate targets by 2030). To keep warming to 1.5°C (Paris Agreement), cuts of 45 per cent are required by 2030, with global greenhouse gas (GHG) emissions reaching Net Zero by 2050. This means GHG emissions need to decline immediately. The transition to a low-carbon economy requires a transformation of assets and behaviours, for which trillions of dollars in finance are required. The transition to a low-carbon economy is associated with both risks and opportunities. Companies that are not aligned with European Union’s net-zero ambition might face increased operating costs, lower revenues, increased capital expenditures to comply with regulatory standards, and closure of business lines or facilities as they may not have a place on a low-carbon economy.

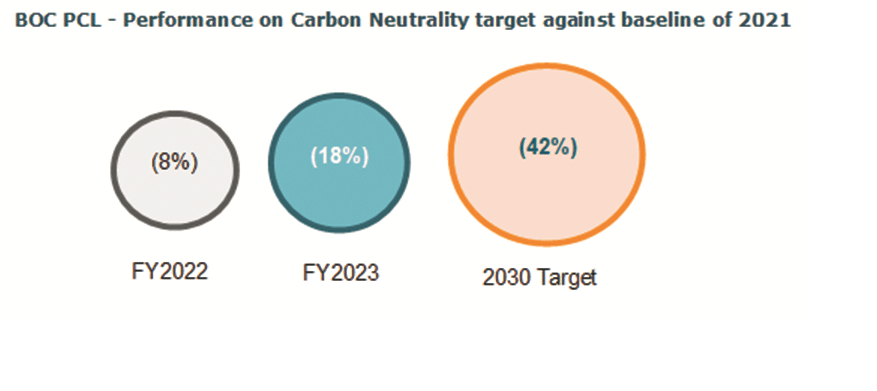

To support climate stability, be exposed to lower levels of risks and align with the fast-pacing climate regulatory environment, the Bank is committed in its ESG Strategy to becoming carbon-neutral by 2030. For the Bank to reach carbon neutrality by 2030, Scope 1 (Fuel combustion) and Scope 2 (Purchased electricity) GHG emissions should be reduced by 42 per cent by 2030 compared to the 2021 baseline. Following the implementation of energy efficiency (boiler replacements, solar panel installations, roof insulation etc.) in 2022 and 2023, the Bank achieved a roughly 18 per cent reduction in Scope 1 and Scope 2 GHG emissions. The Bank plans to invest further in energy-efficient installations and actions and replace fuel-intensive machinery and vehicles from 2024 to 2025, which would lead to roughly a 3-4 per cent reduction in Scope 1 and Scope 2 GHG emissions by 2025 compared to 2021. The Group is also considering several other actions aiming for a further reduction of approximately 30 per cent in Scope 1 and Scope 2 GHG emissions by 2030 compared to 2022.

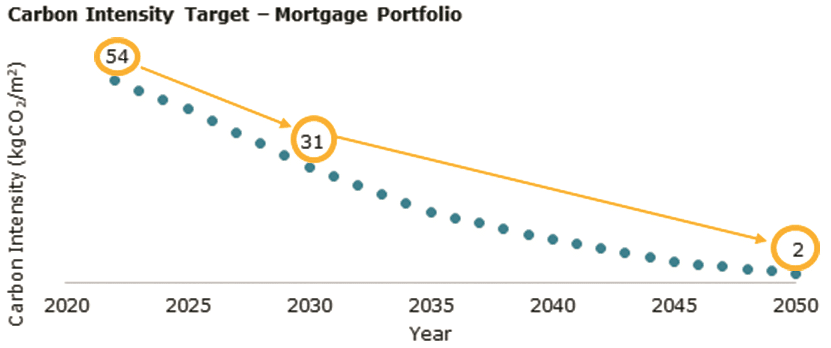

At the end of 2023, the Bank launched the “Green Housing” product, aligned with Green Loans Principles of Loan Market Association. This product drives the decarbonisation strategy of the Mortgage portfolio. The Bank is also examining ways to set additional decarbonisation targets for certain asset classes and sectors of the loan and investment portfolio to monitor progress toward its Net Zero target and support its customers’ transition to a low-carbon economy.

Additionally, considering the results of the Bank’s Business Environment Scan and materiality assessment on climate-related and environmental risks, it has set new Green/Transition lending targets for 2024. This is aimed at supporting our customers and Cyprus in transitioning to a low-carbon economy while limiting exposure to transition risks in specific sectors.

Apart from the risks associated with the transition to a low carbon economy, the Bank is exposed to climate and environmental physical risks which might impact the traditional risks of the Bank. In 2023, the Bank identified specific physical climate-related and environmental hazards, such as wildfires, landslides, floods, earthquakes, and others, using actual geolocation data on our collaterals, REMU portfolio, deposits, and owned buildings. This enabled it to assess material risks and design mitigation strategies.

In 2023, the Bank also established an ESG Due Diligence process to assess both existing and new customers on their ESG and climate risk performance. This involves structured questionnaires applied at the company level, initially deployed to customers within the Corporate Division. The Cyprus Banking industry is working on establishing a common platform to assess customers against ESG factors. This platform will use sector-based ESG questionnaires to score customers’ performance and provide an action plan to improve their ESG performance.

CONTACT

www.bankofcyprus.com

800 00 800

(+357) 2212 8000 (when calling from abroad)

Click here to change your cookie preferences