Greece’s Independent Power Transmission Operator (Admie) said Monday it has signed a memorandum of understanding with a major asset manager interested in acquiring a direct stake in the company executing the Great Sea Interconnector – a mooted subsea electricity cable linking Cyprus to Greece.

Admie is the project promoter for the interconnector.

In a statement, Admie said Meridiam is a global investor and asset manager based in Paris specialising in developing, financing and managing long-term public infrastructure projects. Operating in 56 countries, Meridiam manages more than $22 billion (€20.5 billion) in assets.

In addition, Admie said it’s continuing talks with other potential investors. It has already agreed with the US International Development Finance Corporation (DFC) for the dispatch of the term sheet. A term sheet is a nonbinding agreement setting out the basic terms and conditions of an investment. Recently the DFC had addressed a Letter of Intent to Admie.

At the same time, the company said, it’s in negotiations with Greek commercial banks, as well as with Bank of Cyprus, concerning possible financing for the project.

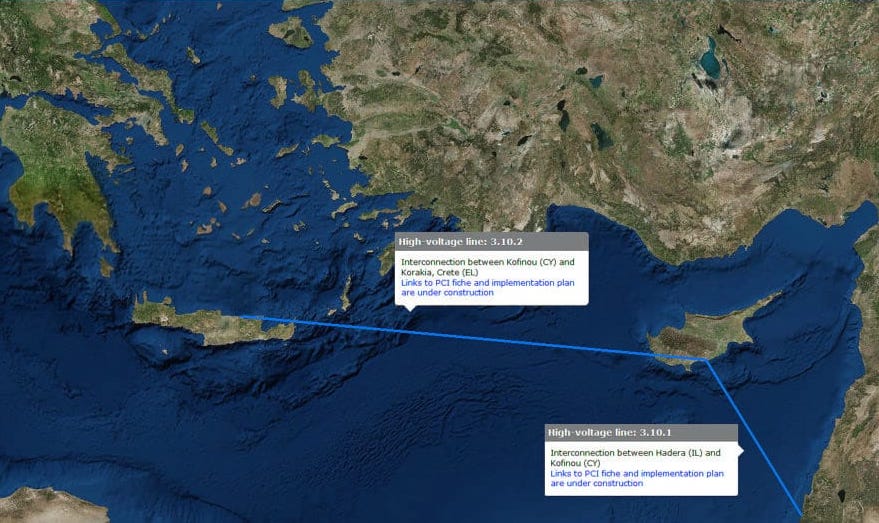

The Great Sea Interconnector – formerly the EuroAsia Interconnector – is costed at around €1.9 billion.

The Cypriot state is mulling whether to become a direct stakeholder in the project, investing up to €100 million.

Recently Admie presented to the government here a cost-benefit analysis for the project. The government will commission a consultant to assess the analysis, and then take the decision on whether to invest.

Click here to change your cookie preferences