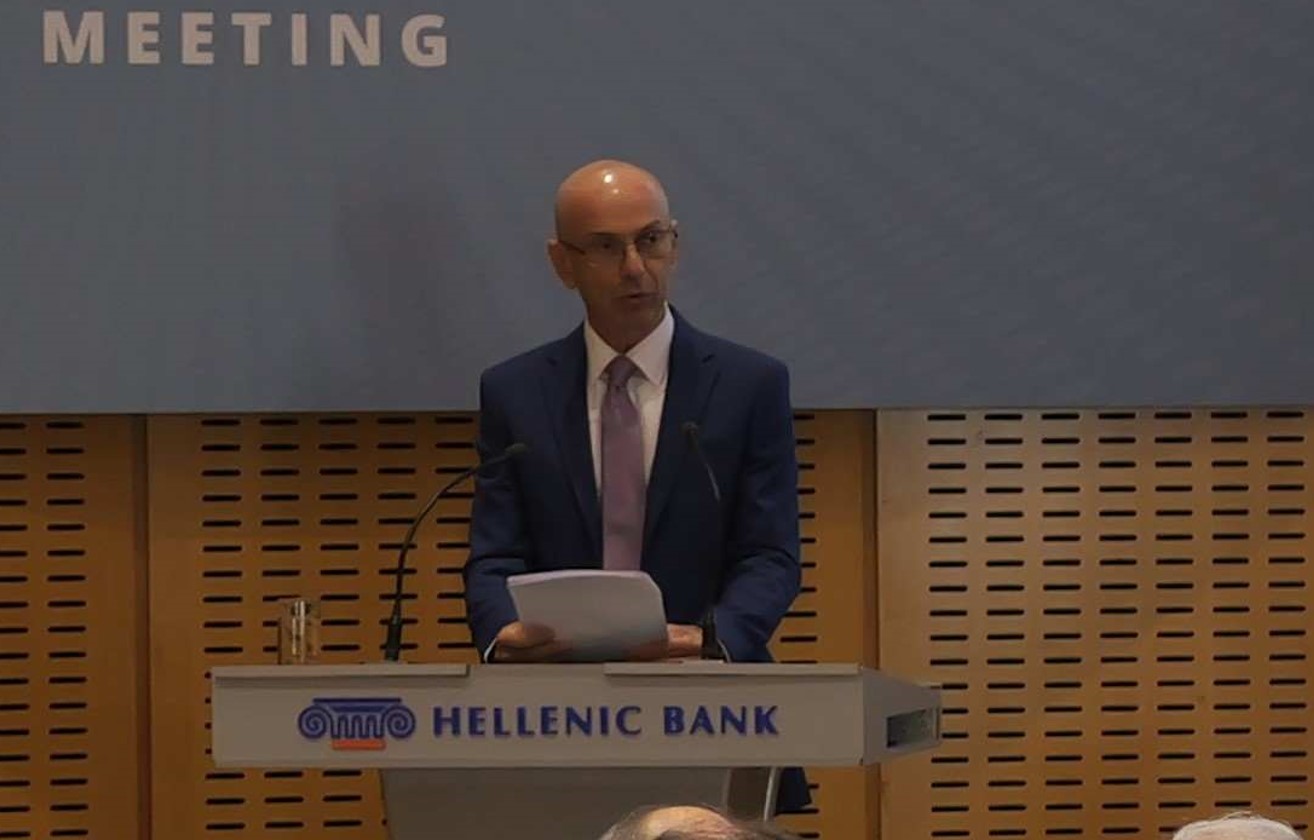

Hellenic Bank provided an update on the bank’s achievements and developments since early 2024 during its annual general meeting on Wednesday.

In a statement, the bank said that the meeting “marked a significant milestone as it transitions into a new era”, saying that “the meeting was held in an optimistic atmosphere”.

In his address, group chairman Petros Christodoulou highlighted the ongoing transformation of the bank, referencing recent landmark events.

“With the acquisition of the majority shareholding by Eurobank, Hellenic Bank has received a substantial vote of confidence and secured a promising future with new prospects and opportunities,” he said.

“Eurobank, now our primary shareholder with an increased stake, marks our transition as part of a financial giant in Southeast Europe, with assets exceeding €80 billion,” he added.

Christodoulou also touched upon the bank’s acquisition of CNP Cyprus Insurance Holdings Limited, creating the largest insurance group in Cyprus.

“This agreement complements our business model and represents a milestone for the further development and strengthening of our insurance activities,” he stated.

Furthermore, Christodoulou highlighted the successful conclusion of negotiations for renewing the staff collective agreement, to be formalised by the newly constituted board of directors.

In addition, he emphasised that the bank places great importance on environmental, social, and governance (ESG) matters and investments, noting that these contribute to “building a sustainable and inclusive society”.

Meanwhile, interim group chief executive officer Antonis Rouvas reported on the improved financial results of the bank.

“Total net revenues increased to €664 million, primarily due to higher interest income, while profits reached €365 million,” he said.

Moreover, Rouvas highlighted the significant enhancement in the bank’s balance sheet quality, including the sale of approximately €0.7 billion in non-performing loans and the APS Debt Servicer.

“We are proud to have substantially reduced non-performing loans, considering that over 99 per cent of new loans since 2018 are performing,” he explained.

Additionally, Rouvas noted the bank’s successful issuance of a €200 million subordinated bond in March 2023, which attracted significant investment interest, with international investors accounting for 90 per cent of the demand.

This success, Rouvas said, was mirrored by a recent €100 million bond issuance with a 4 per cent coupon, compared to 9 per cent for a similar issuance in 2022.

What is more, Rouvas also stressed that the group’s achievements have been recognised by major rating agencies, with upgrades reflecting the bank’s progress.

Finally, Rouvas also outlined the ongoing transformation plan aimed at improving customer experience, increasing efficiency, streamlining processes, bringing about better cost management, and leveraging the latest technology.

Click here to change your cookie preferences