Paphos is no longer simply a coastal, tourist destination. In 2024, Ask Wire logged 4,853 property transfers worth €1.19 billion, an all-time high and about 30 per cent above the pre-pandemic peak. Foreign capital now funds well over half of new-build apartment purchases, redefining what “prime” means for local developers. So, where are savvy investors deploying capital today?

Apartments outrun houses

Residential deals reached 3,171 and apartments stole the show: 1,767 flats (56 percent of residential volume) changed hands versus 1,404 houses. New-build stock is the real engine: 786 brand-new units accounted for 44 percent of apartment sales but 64 percent of their value (€210 million). Off-plan towers in Kato Paphos and Chloraka were often reserved with a 10 percent deposit—locking in paper gains well before completion.

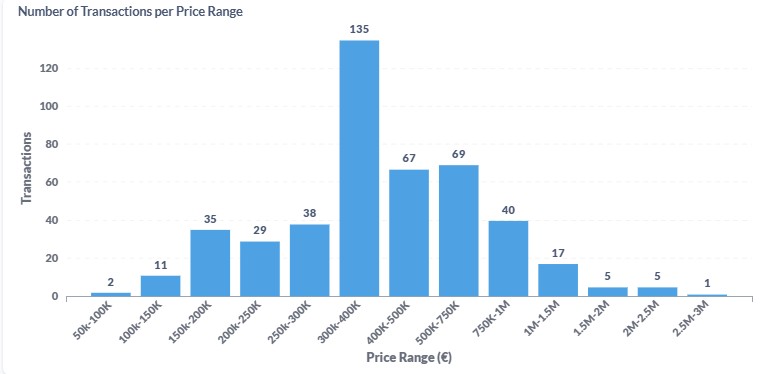

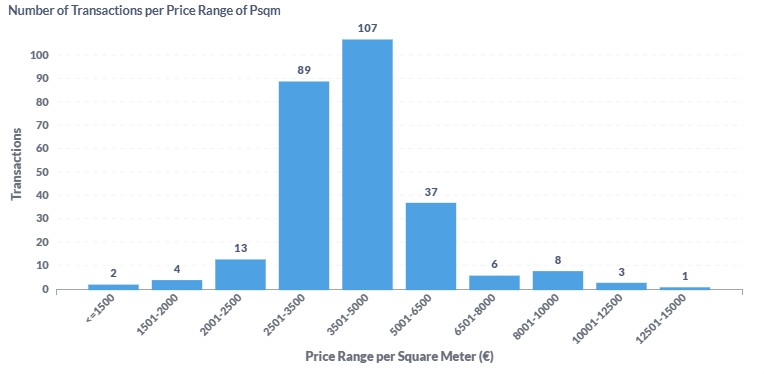

What are buyers actually paying?

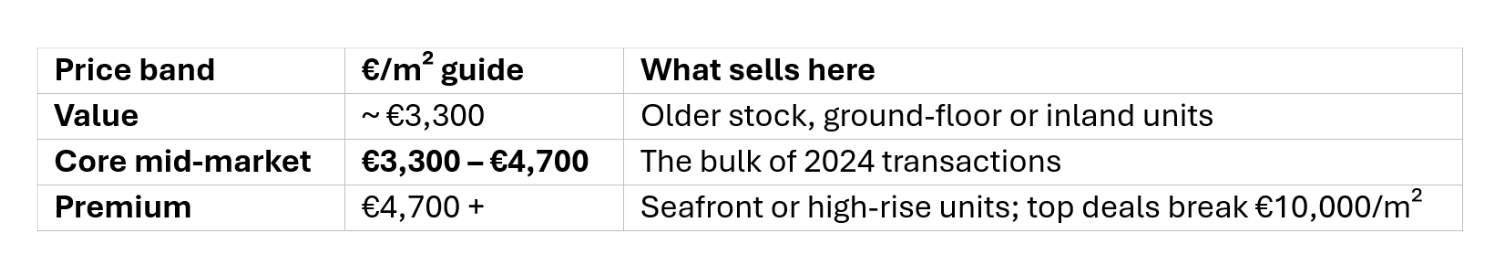

Ask Wire’s Developers View—tracking 125 active projects in Paphos—shows the price ladder in plain sight:

The statistical average is €4,198/m² (median €3,809/m²), but half of all deals cluster tightly around the €3,800 mark—useful “anchor” pricing for new releases. Height commands its own scale: from €3,583/m² on the first floor values escalated to €10,476/m² on the eighth.

In whole numbers, you are looking at €213K for a one-bed, €351K for a two-bed and just under €400K for a three-bed. That “€300K–€400K sweet-spot” aligns neatly with the budget ceiling many residency-seeking buyers apply—drift too far above it and absorption slows.

Hot spots versus cooling corners

The Kato Paphos waterfront leads activity, driven by German, Israeli and Gulf investors chasing short-let yields and permanent-residency perks. The rejuvenated Universal precinct and neighbouring Chloraka are also trading briskly on new tourist infrastructure. Villa demand has migrated north-west to Peyia and Sea Caves, pushing land prices to fresh highs, while Polis–Latchi has plateaued after a two-year sprint. Inland villages such as Tala and Tsada still offer value, but absorption is slower as investors prioritise walkable coastal access.

Why the mix matters for developers

Expat and second-home purchasers took over 60 per cent of new-build apartment completions last year, demanding energy-efficient builds, amenity-rich common areas and concierge-style services. Domestic buyers still anchor the detached-house market. Misjudge unit mix, finish or launch timing and margin disappears; pitch it right and Paphos remains Cyprus’s fastest-moving district.

Turning data into profit

Across those 125 live projects, Ask Wire tracked 281 apartment sales in 2024 worth €101 million. Developers View lets you zoom from the district down to a single floor plate, compare achievable €/m² with build cost and pressure-test multiple exit strategies—long before the first footing is dug. In a market where the “sweet-spot” bands of €300K–€750K and €2,500–€5,000 /m² account for two-thirds of all apartment deals, data-driven pricing is the difference between collecting reservations on day one and sitting on unsold inventory.

Want the full data pack on Paphos—including price-band histograms, sub-market heat maps and project-level comparables? Contact Ask Wire’s team ([email protected]) and stay ahead of the curve.

Click here to change your cookie preferences