By Pavlos Loizou, managing director, WiRE

The Cyprus market for office space is expected to decline 10 per cent to 15 per cent as companies adopt the remote working model, Pavlos Loizou, managing director of the real estate asset management and advisory firm WiRE, said in a note.

In a recent Barclays Capital survey, employees said they expected to work 60 per cent more at home (1.6 days a week on average) while employers estimated that working days from home would double (ie two days). per week).

While it is not clear to what extent this pattern will be followed in Cyprus, it is certain that more people will work at home for longer hours after the pandemic than did previously.

Traditional institutions and bureaucracies are gradually increasing their digital footprint and automating various processes, and this will also lead to more remote work, the note said.

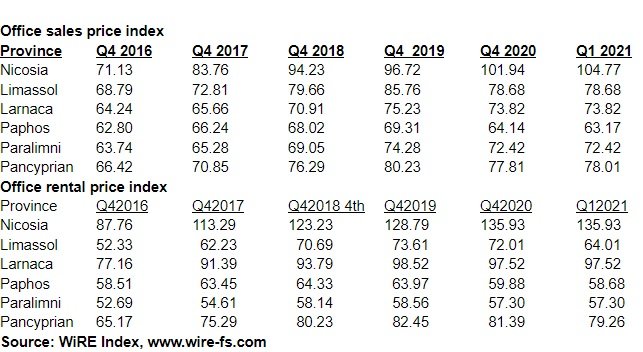

According to the WiRE Index, sale prices of office space have shown an increase over the past five years (starting in 2016), as the Index shows an increase of 11.4 points from the reading 66.4 to 78.1 (base of the Index, i.e. 100 is 2009).

It is also noteworthy that in each year, the Index showed an increase with the exception of 2020, apparently due to the effects of the pandemic.

Analysing the data by province, the data for the province of Nicosia, where sales prices showed a significant increase within a five-year period, are especially impressive. Specifically, from the reading 71.1 at the end of 2016, they rose to 104.8 in the first quarter of 2021.

Apparently, the pandemic was not able to stop this course, since in 2020 the price index for office space in Nicosia recorded an increase,” the note points out.

In Limassol, which is considered the capital of trade but where there is a relatively low volume of construction in this market, within five years the index increased by only about 10 points, from 68.8 to 78.7. In fact, in 2020 the annual decline exceeded 8 per cent. Of course, it is important to mention that the selling prices per square meter in Limassol are much higher than in Nicosia and other cities, so the margins for price increases are limited. Also, the Limassol real estate market, even commercial real estate, has been affected by the termination of the Cyprus Investment Program (CIP).

In Larnaca, Paphos and Paralimni, prices have risen again in the last five years, while in 2020 small losses were recorded.

In relation to office rental prices, the picture is again similar. On a pan-Cypriot basis, the Index at the end of 2020 rose to a reading of 81.4 from 65.1 in 2016. At the end of 2020 there was a decrease on an annual basis of 1.2 per cent which was maintained in the first quarter of 2021.

In Nicosia, however, there was a very significant increase in rents for office space which in a five-year period increased by almost 55 per cent and remained at the same level in the first quarter of 2021. Even in 2020 amid the pandemic, the course of rents was upward.

In Limassol, the increase has been more limited in the last five years (about 22 per cent), however, office rental prices are significantly higher in this province, making it more difficult for them to rise dramatically. However, the decrease observed in the first quarter of 2021 was dramatic, with the index reading at 64.01 in Q1 2021 down from 72.01 in the last quarter of 2020.

Based on this research, in the post-pandemic era, an investment in quality, serviced office buildings with large spaces, ideally in Nicosia and Limassol, could be considered good. There are many companies, both large and small, that are looking for good quality offices that can meet their needs. Needs such as ease of landscaping, full access on a 24-hour basis, etc.

In addition, offering services to tenants, such as cleaning, pick-up / delivery of clothing for cleaning, support services, car washing, etc. is a good way to increase revenue.

Again, based on our research, an investor in Class A offices could enjoy a return of between 6 per cent to 7 per cent per annum. However, for investors who are not themselves active in the field of land development, our view is that the best way to invest in the sector is through specialized Real Estate Investment Trusts (REITs) or Exchange Traded Funds (ETFs) to disperse risk and to have professional management to make their investments.

Click here to change your cookie preferences