While the concept of decentralisation has been around for more than a decade, an explosion of interest in decentralised finance has been observed over the past few months.

By Alexandros Vacanas, Senior Associate, Blockchain, PwC Cyprus

Following the original Bitcoin whitepaper, which was published in 2008, amid a global financial crisis, and the launch of Ethereum in 2013, a milestone in the history of cryptocurrencies, the smart contract concept has emerged, providing a trusted framework for DeFi to be explored and developed.

Decentralised Finance, otherwise known as DeFi, uses blockchain infrastructure and is essentially an attempt to decentralise core traditional financial services through the use of public distributed ledgers, establishing an ecosystem that enables the facilitation of permissionless financial services governed by smart contracts. Smart contracts are transactions posted in the blockchain network and are automatically executable given that they satisfy certain conditions defined by the user.

This key automation aspect is what makes DeFi so unique, as it enables financial services to automate their transactions and services through the use of blockchain networks, having a guaranteed executable smart contract based on a set of predefined conditions. Consequently, Ethereum has been on the forefront of DeFi due to its capability to support smart contracts. Even though, as of today, no project other than MakerDAO has gained considerable attention in the DeFi spectrum, it is apparent that there is space for innovative exploration for new projects that bridge the gap between the traditional centralised finance (CeFi) and advance the current financial services ecosystem.

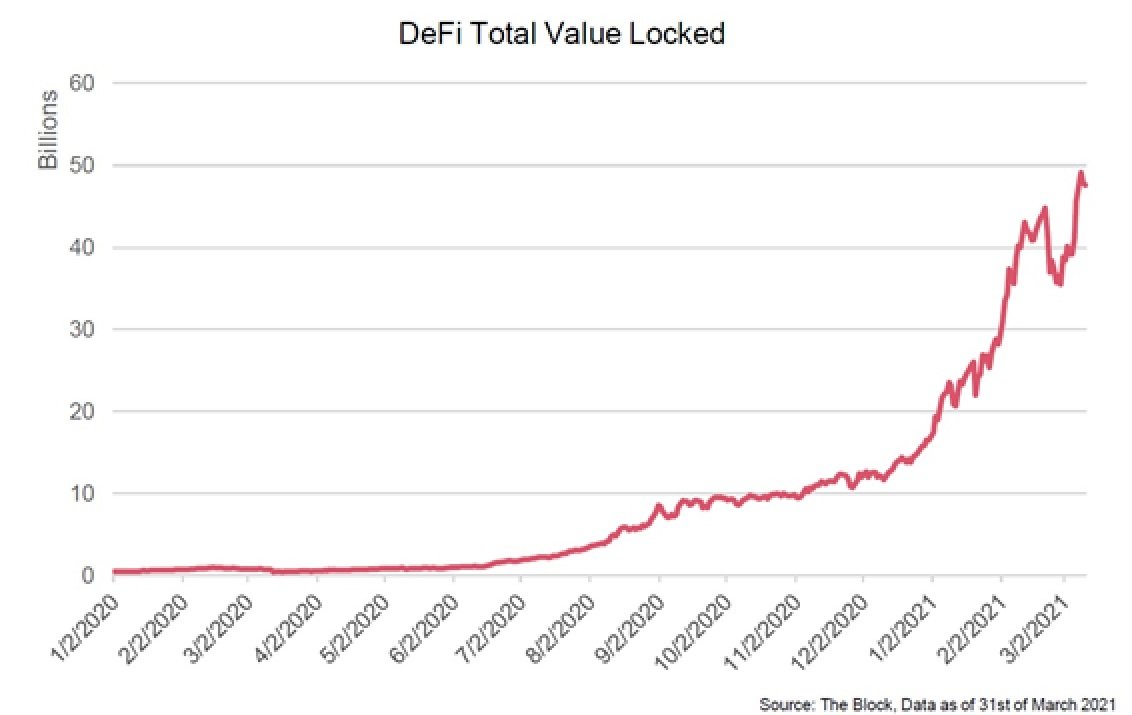

Following the launch of Ethereum and the realisation of its potential, many firms and developers have been researching and exploring the DeFi concept in the financial services, with new projects starting to surface and others starting to mature. This has been evident in the considerable rise of the Total Value Locked, which went from $1 billion in 2020 to $50 billion as at the end of March 2021, according to The Block.

The rapid development and widespread adoption of blockchain technology, has made the involvement of regulators inevitable, with many jurisdictions strenuously trying to establish regulatory frameworks for the crypto industry, either through new legislations or by amending existing regulations to include crypto activities.

In September 2020, the European Commission published a proposal for the Markets in Crypto-Assets Regulation (MiCA), aiming to establish a harmonised regulatory framework for crypto-assets and related services, while strengthening confidence in the EU crypto-asset market. MiCA will apply to EU firms involved in the issuance of crypto-assets, and services related to them (e.g. exchanges, custody services, advice, etc.), which are not regulated under MiFID (or other EU legislation). While the draft MiCA regulation does not specifically address any DeFi regulatory considerations, it is expected that this could have a significant impact on the ecosystem due to a centralised approach towards crypto-asset issuers, treating each as an individual entity.

In March 2021, the Financial Action Task Force (FATF) which is the global money laundering and terrorist financing watchdog, overseeing and supervising more than 200 countries, published updated guidelines to address and clarify any unclear issues in relation to Virtual Asset Service Providers (VASPs) based on the services they provide in the financial and crypto industry. The guidelines clarify the need to comply with certain AML/CFT principles and help reduce any possibilities of regulatory arbitration between countries.

Considering the decentralised principles of blockchain technology, the interaction and relevance with any territory-wide legislation may contrast its application – traditional legislation has historically focused on a centralised party and the legal owners behind, whereas in a decentralised concept, there is no centralised party since the decisions are executed by computer code instead. Nonetheless, some aspects of DeFi such as smart contracts may provide some groundwork on how to reconcile this ideological gap between the two and offer a clearer direction on regulatory issues.

Given the speed at which developments and changes are happening in the crypto-space, the DeFi industry is racing way ahead of regulators, who are faced with the challenge of keeping up as well as amending the relevant legal framework.

Click here to change your cookie preferences