As part of your offshore financial planning, you want to ensure that you include investments and look into the idea of establishing trusts, savings, and even checking accounts. One question that may be on your mind is what sort of investments to include in your portfolio.

As with domestic investments, diversification is always a good thing when investing offshore. Consider the idea of including gold futures, gold coins, or possibly gold bullion that’s securely stored in international jurisdiction as one of those holdings.

Here are some of the reasons why gold is worth adding to your portfolio.

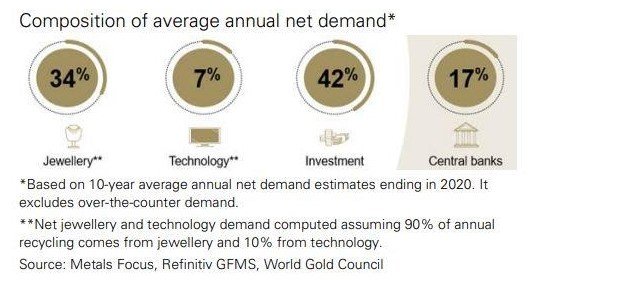

Gold is in demand in more than one way

The versatility of gold has led to it being used in multiple ways. For example, people tend to see gold as a good investment, but many may not be aware of how much is used to create hardware that’s necessary for technology to advance.

This is good news for you as an investor. It means that while the demand may ebb and flow from time to time, it will continue. Thanks to that quality, the odds of generating returns on your holdings are quite good.

The allure of gold is unlikely to fade

If you try to think of a time when gold lacked any real popularity, don’t be surprised if you cannot come up with anything. That’s because people have long valued gold in just about every culture throughout the world. It’s been that way throughout recorded history and isn’t likely to change any time soon.

Look around you; there’s gold everywhere. Jewelry, artwork, medals, coins, awards, and even religious artifacts are often made using this metal. As societies and their values change, gold seems to survive those shifts and remains one of the few things people continue to desire. In terms of returns on investments, that desire makes the gold in any form a worthy asset.

Gold performs well during periods of inflation

One of the advantages of gold holdings is its history of performing better than many other assets during adverse economic periods. For example, gold is more likely to hold value during periods of recession. Even when it tended to fall somewhat, the decrease in value has shown to be less than the losses sustained by other investments.

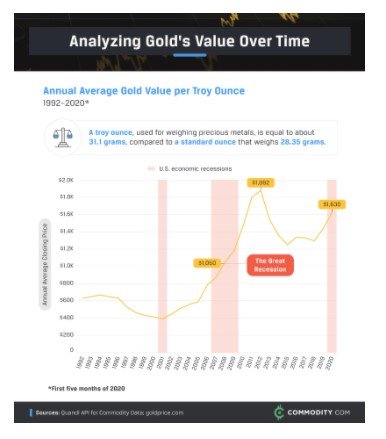

One of the best ways to understand why gold is worth including in an investment portfolio is to look at how it’s performed. A snapshot of that performance between 1992 and the end of 2020 provides some insight:

Without a doubt, the value of gold will fluctuate. This is true of any financial asset. What’s interesting is how gold performs during economic shifts like recessions. It’s also interesting to note how gold held its value and even increased a little during the COVID-19 pandemic peak of 2020. Analysts vary in gold performance in 2021, with some thinking the upward trend will continue while others believe it will level off. In either case, the odds of losing money on gold during 2021 are relatively low.

Why does this snapshot matter? It illustrated a key point. Gold has a history of bouncing back once a rough economic period subsides. That means if you can afford to hold onto the gold and ride it out until things get better, you’re likely to regain any ground that was lost. In fact, you’re likely to see an increase that exceeds the former high point of your investment. The same can’t always be said with other investment options.

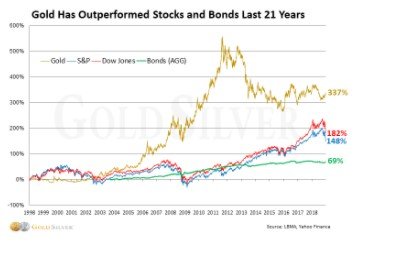

Gold also performs well in comparison to other investments

Gold has indeed gone through periods when it did not perform as well as stocks or real estate holdings. How those three types of assets compare does depend on the length of time under consideration.

For example, gold tends to suffer a bit if you take a snapshot of a 30-year period. Take the period from 1990 to 2020, for example. Gold prices increased by around 360% during this time frame. By contrast, the Dow Jones Industrial Average for the same period increased by 991%.

However, if you drill it down to a shorter term during this same period, specifically 2005 to 2020, things look a little different. You still see gold performance remaining close to the 330% increase that applies to the entire 30-year period. At the same time, the Dow Jones logged an increase of only 153%.

How about bond performance versus gold? If you take the same time period, bonds and gold tended to perform at close to the same level. When narrowed to the 15 years cited, gold easily outperformed bonds.

Dwindling gold supplies increase demand

It’s no secret that finding gold has become increasingly difficult. The result is that what is already in circulation is likely to become in greater demand. Choosing to buy gold now and hold it for several years is expected to result in impressive returns.

So who’s got the gold? Much of it is held by the central banks of different countries. As of April 2021, here’s the list of the 10 nations having the greatest amount of gold assets via their central banks, ranked in order:

1. United States

2. Germany

3. Italy

4. France

5. Russia

6. China

7. Switzerland

8. Japan

9. India

10. The Netherlands

During the calendar year 2020, all of the above made purchases of one tonne or more.

As there’s less gold in circulation and the production yielded from new mines continues to decrease, those who want it will pay more to get it. If you already have gold stored away in a safe place, it’s possible to meet part of that demand and have quite a bit of cash to show for the effort.

Follow the lead of the world’s largest global banks

If you need some hint that the amount of available gold is decreasing, you only need to look as far as the world’s global banks. Quite a number of them purchase gold that can be held as an asset to increase institutional financial stability. In a sense, the gold serves as an insurance policy against economic shifts that would pose some threat to those banks.

Since investing in gold in some form seems to be good enough for the global banks, doesn’t it seem like an investment that merits some consideration on your part? Central Banks are buying physical gold because they know it protects them from the devaluation of their own and other currencies and provides confidence in their currency system.

Making the most of the current gold supply situation

What is the current situation with the supply of available gold? Gold mining is still going strong, albeit not necessarily as strong as in decades past. Countries like China engaged in gold mine production that yielded 383.2 tonnes during 2019.

According to data compiled by the World Gold Council, the Russian Federation, Australia, the United States, and Canada round out the top five countries in terms of gold mine production. Even so, gold mine production was 1% less in 2019 than in 2018.

Check out this interactive gold mining map to see top gold-producing countries around the world.

If gold is being mined, why’s the supply somewhat limited? The reduced production is one factor. Another is that the central banks worldwide are buying more than they sell on an annual basis. That’s not likely to change any time soon.

There’s also a sector of investors choosing to buy gold now and hold it for at least a few years. That’s because they anticipate that the demand will increase as the world moves past the pandemic and various sectors of the economy recover.

What does this mean to you? The fact that gold prices are somewhat dormant now provides the chance for you to buy for less now, when and as you can find assets to purchase. Assuming you can afford to hold them, the potential for a significant return after several years is quite natural.

The value of owning tangible assets

Tangible assets that can be physically passed on to a buyer should always be part of your investment planning. Like real estate, gold bullion is a tangible asset, but it differs significantly from real estate because it can be easily traded. It can be handed over to a buyer with ease. This is true even if the buyer chooses to take control of the gold in the storage facility where it’s housed or arranges to have it physically shipped to a new location.

There may someday be the need to sell assets, and the market for stocks, bonds, and similar instruments may not be all that great. When those types of investments aren’t attracting much interest from potential buyers, tangible assets are likely to fare better.

Depending on what sort of financial need you have, being positioned to sell bullion could mean the difference between living well and barely getting by.

Haven during times of political insecurity

Many kinds of investment instruments lose value during periods of political turmoil. Some may eventually recover, while others will remain worthless. If all your focus is on the latter investments, you can be left with nothing.

Given the nature of gold and the demand that remains, particularly when political insecurity is present, it makes sense to devote a part of your investment planning to own it. The balance that gold brings means that even if events you believe today will never happen eventually come to pass, there will be a good amount left to help you rebuild.

Gold assets provide more privacy

While gold holdings may not be completely anonymous, they tend to come with a greater degree of privacy than many other financial holdings. When fewer people have access to data surrounding the ownership, it’s much easier to ensure that only those who need to know about the gold are privy to that information.

Gold values as related to fiat currency

During the 20th century, many nations went off the gold standard. That is, gold was no longer used as backing for the paper currency issued. Instead, they adopted a fiat system. Fiat means “let it be done” in Latin and is an apt description.

Fiat currency is backed by a government and has a value assigned to it by that government. It’s then traded based on that assigned value and compares it to other currencies’ fiat value.

It’s been said that gold is a tangible commodity that cannot be printed and has a value unrelated to the concept of fiat. Indeed, the gold prices are presented in terms of currency. What’s at question is to what degree the intrinsic value of gold is related to the fiat currency of any nation.

Historically, gold has tended to appreciate even when the worth of fiat currency has plunged. For this reason, holding gold assets in some form is often seen as more practical and ultimately more lucrative than collecting paper currency and keeping it tucked away under a mattress.

Getting started with gold

If you haven’t considered the idea of adding gold to your offshore investment portfolio, now is the time to speak with a precious metals expert. Find out what form of gold would work best with your plans for the future.

Consider your intended purpose for holding the gold carefully. Is it for trading in case of emergency? Then hold easily tradable coins, if for long-term wealth preservation, bars may be a better, cheaper option.

Consider the projected return versus the initial investment.

Look closely at how investing a percentage of your resources in gold could protect you financially in the event of a crisis. You’re likely to find that gold is an asset that should be part of your planning.

Luigi Wewege is the Senior Vice President, and Head of Private Banking of Caye International Bank headquartered in Belize, Central America. Outside of the bank he serves as an Instructor at the FinTech School in California which provides online training courses on the latest technological and innovation developments within the financial services industry. Luigi is also the published author of: The Digital Banking Revolution which is available in audio, kindle and paperback formats throughout all major international online bookstores – now in its third edition.

Click here to change your cookie preferences