The inflation rate in Cyprus is declining, but is still high [at 6.7 per cent in February 2023]. Interest rates are very low, 1.29 per cent for household deposits and 1.27 per cent for business deposits. In addition, there are no other investment opportunities in Cyprus, as the Cyprus Stock Exchange shows low returns of about 2 per cent per annum.

Inflation increases the cost of borrowing and at the same time increases the cost of production, making it more difficult to produce goods and services, including production in the market of real estate, houses, apartments and so on.

Due to the war in Ukraine, the production of new units has been affected due to increased construction costs, although demand remains stable, especially in buildings that are not new.

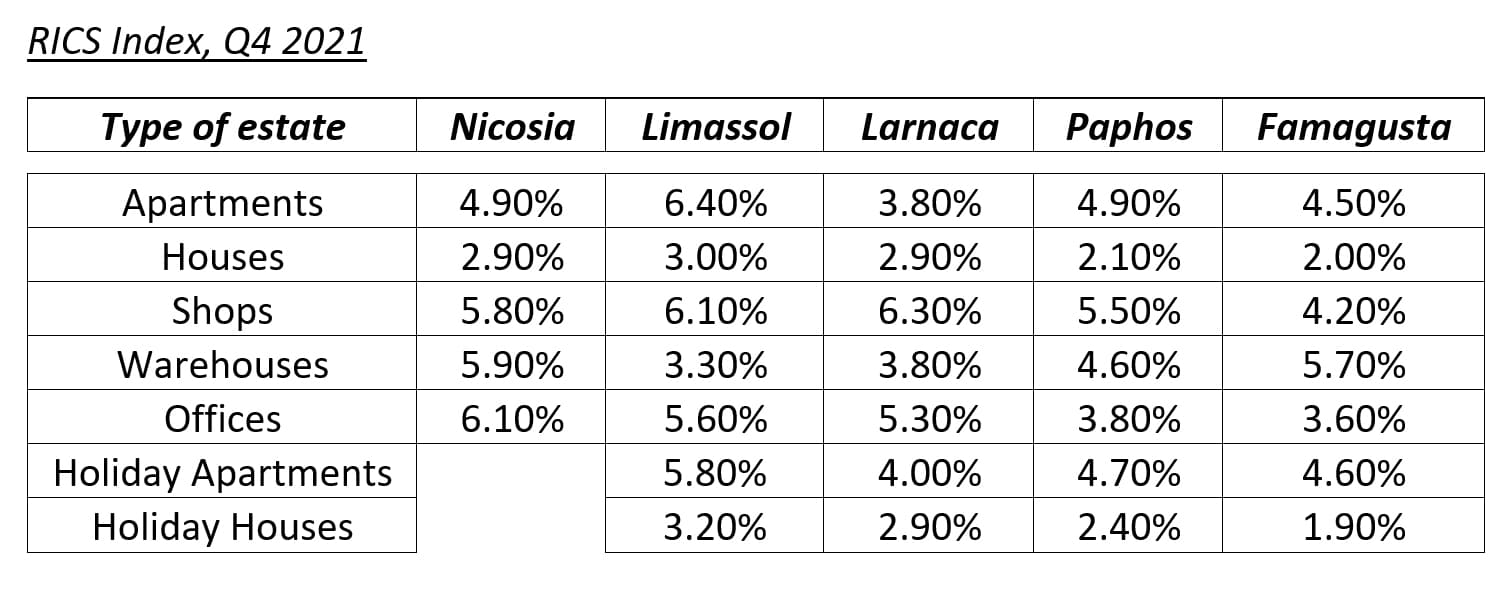

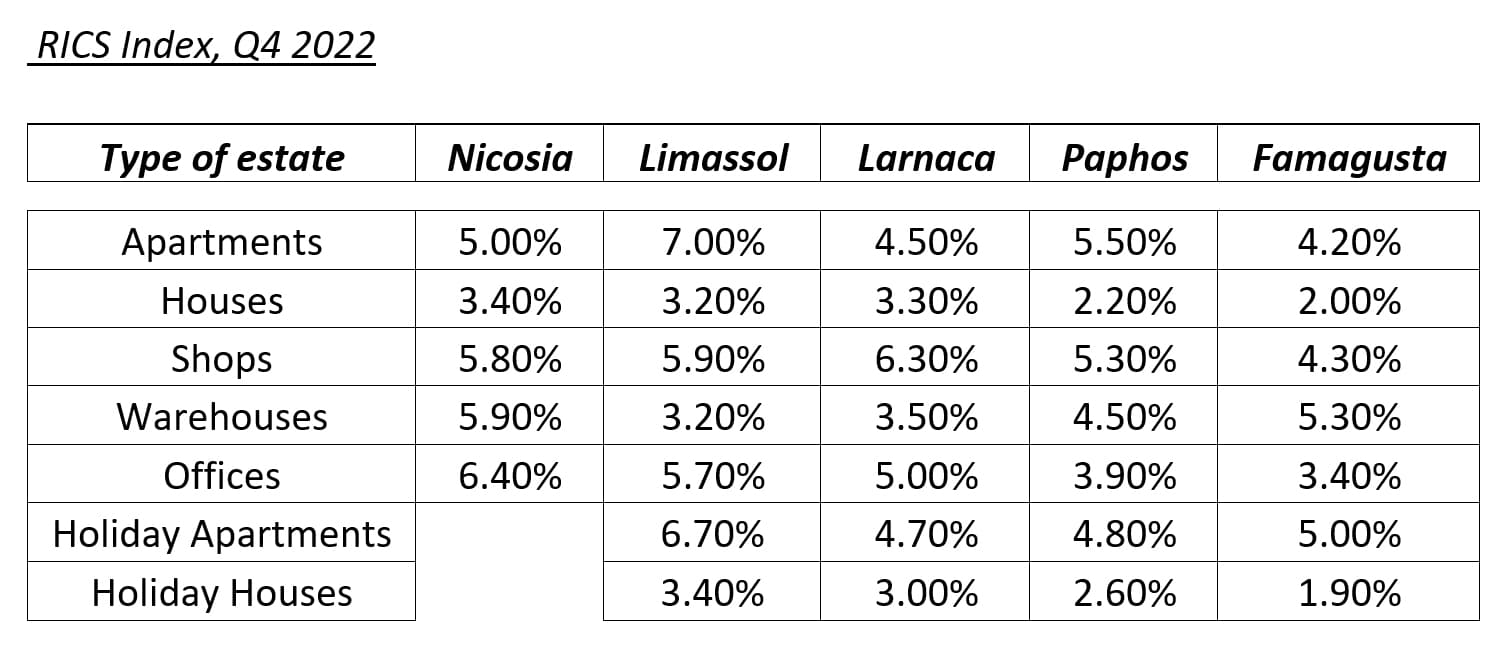

According to the general RICS index, the average return on real estate in Cyprus for the year 2022, is as follows: 5,3 per cent on apartments, 2,8 per cent on houses, 5,7 per cent on shops, 4,3 per cent on warehouses, 5,3 per cent on offices, 5,4 per cent on holiday apartments and 2,7 per cent on holiday houses.

It is obvious from the sales results in 2022 that the real estate market is strong and has reached the amount of almost €6 billion in sales.

According to the land registry the leader in sales is apartments and total sales not only reached 2018 levels, but surpassed them (20,799 sales in 2022 versus 18,336 sales in 2018) with local buyers accounting for over 80 per cent of total sales, EU buyers around 13 per cent and others around 7 per cent.

In a recent report by the land registry, it states that the war in Ukraine had no substantial effect on property values in 2022, while sales deposits contracts increased by around 30 per cent (10,347 in 2021 and 13,409 in 2022).

According to the RICS index, the fact that apartments are the leader in sales in all areas, as they have the highest performance, is confirmed. This is evident especially in Limassol which has the highest yield.

Comparing 2021 with 2022 it is obvious that the yield of apartments and houses increased in 2022.

Therefore, buying real estate in 2023 is a good investment and demand remains high, especially in Limassol with returns of 7 per cent for apartments and 4-6 per cent for the rest of Cyprus, depending on the location and type of property.

It is not expected that property values will be ‘corrected’ downwards, as Cyprus has a strong economy and high demand for real estate, with supply being stable for the time being and building permits decreasing for 2023/2024. Property values will not only be stable but also possibly rise.

So, real estate market is currently the best investment, in particular residential properties with Limassol and Paphos in the lead, however, all cities have good returns depending on personal preference and available budget.

It is also worth noting the apparent increase in demand from foreigners in the Cypriot market between 2020 and 2022, with sales to foreigners rising from 2432 in 2020 to 4123 in 2022.

Cyprus offers more to foreign buyers than just good investments in the real estate market. With a minimum investment of €300,000 they can stay in Cyprus on a residence permit, work, study and enjoy more than 350 days of sunshine, in addition to tax and other incentives, as well as the widespread use of the English language.

Antonis Loizou & Associates EPE – Real Estate Appraisers & Development Project Managers, www.aloizou.com.cy, [email protected]

Click here to change your cookie preferences