The European Central Bank (ECB) kept interest rates unchanged at a record high on January 25, meeting the expectations of analysts, and reiterated its commitment to lowering inflation.

In addition, there was no indication from policymakers that they are currently considering a shift towards policy easing.

Although the ECB concluded its fastest-ever rate-hiking cycle in September, it remained firm in its stance that discussing a reversal would be premature.

“The Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal,” the ECB said in a statement.

“The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary,” the ECB added.

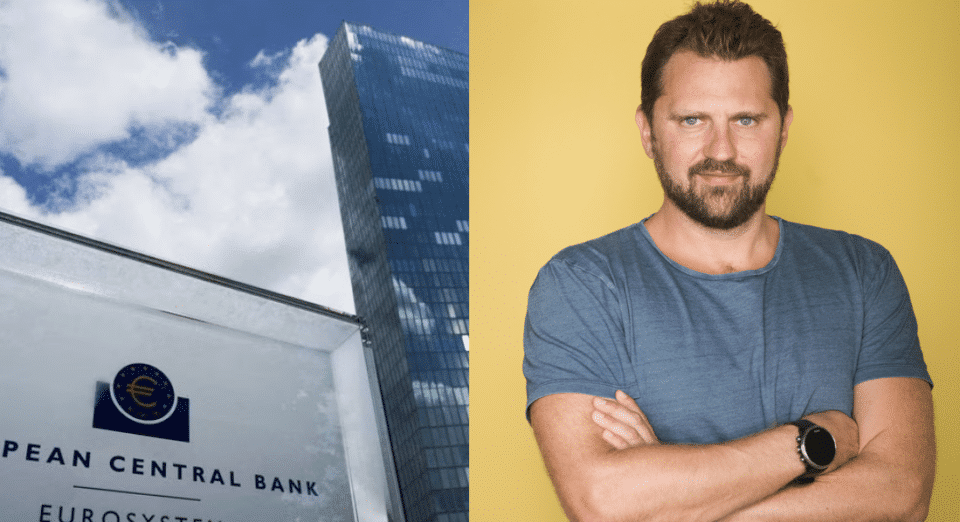

Commenting on the ECB’s decision, Victor Trokoudes, CEO and founder of fintech firm Plum, said that although the European Central Bank decided to keep rates at 4 per cent, market expectations about interest rates for 2024 are focused on cuts, “with the consensus suggesting they’re a matter of when, not if”.

However, he noted that despite these expectations being scaled back in light of recent economic data, markets still appear to be ahead of the ECB’s thinking.

“Several members of the ECB governing council, including President Christine Lagarde, have indicated publicly that a rate cut is likely,” he said.

“But the earliest they’ve said they expect to be in a position to start lowering borrowing costs is this summer,” he added.

Moreover, he explained that “based on Lagarde’s previous comments, it is unlikely that the ECB will change its stance to reaffirm that it is not yet time for rate cuts”, noting that “it’s been reported that she wants to see updated wage data for 2024 first, which will not be available until the Spring”.

Trokoudes continued by saying that “in fact, the ECB may be comfortable with market expectations if it’s doing the work for them in easing financial conditions.”

He also said that they’ll “be wary of the pass-through of higher shipping costs from the attacks in the Red Sea and wage growth remaining resilient”.

What is more, the Plum CEO said that “recent concerning data about economic growth will heighten recessionary fears so the ECB continues to walk a tightrope, wanting to avoid keeping borrowing costs too high for too long”.

“What won’t change is the importance of making your money work as hard as possible, with the potential for people to make real-terms returns from cash for the first time in years,” Trokoudes said.

“In this context, Europeans need to ensure that their savings grow by earning a fair return on their cash holdings,” he added, noting that this “means considering all options to wake up their money and make it work hard for them”.

“For example, money market funds are a popular alternative to traditional savings accounts as they typically follow central bank rates more closely,” he stated, stressing that this is why “Plum has made this option accessible to help people maximise their wealth”.

Click here to change your cookie preferences