Bank of Spain governor Pablo Hernández de Cos on Tuesday said that the European Central Bank (ECB) will proceed with cutting interest rates, without, however, specifying the timeline for such a move, underlining the ECB’s commitment to data-driven decisions in terms of its inflation policies.

The Spanish Central Bank chief spoke to the media after having discussions with key stakeholders of the Cypriot economy, including Central Bank of Cyprus (CBC) governor Constantinos Herodotou and Finance Minister Makis Keravnos.

Herodotou echoed the importance of adhering to the available data and stressed the need for timely adjustments to interest rates, avoiding both delays and premature moves.

Responding to journalists’ questions, de Cos expressed optimism regarding inflation returning to the medium-term target of 2 per cent.

Moreover, he noted that the ECB does not wish to explicitly state the timing of the interest rate reduction, as further data on inflation trends is being expected.

“It is crucial for European citizens to know that we are optimistic that the next move will be an interest rate reduction,” de Cos said.

“Still, I believe it is appropriate not to be exact about when this will happen because that will depend on the data,” he added.

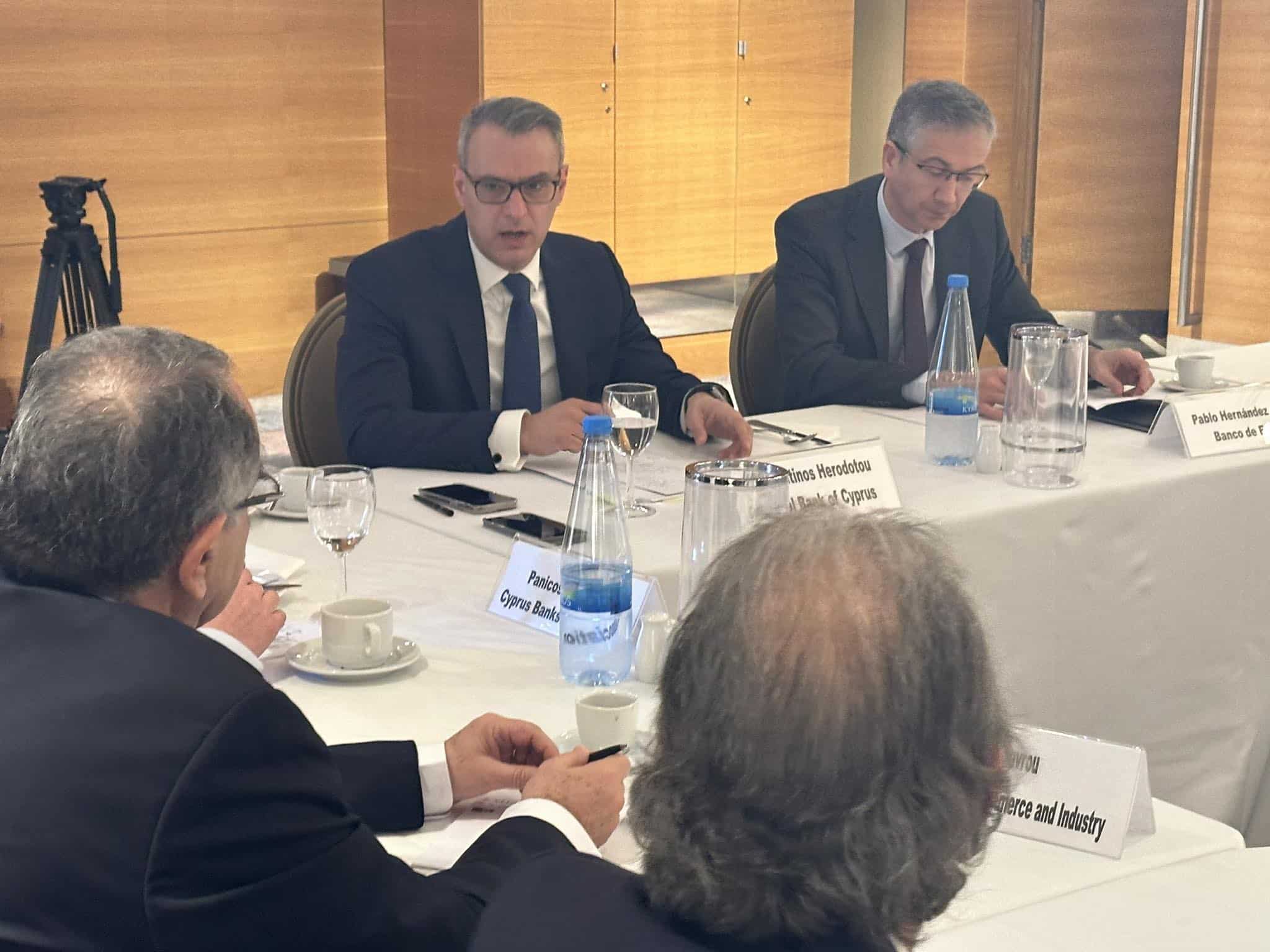

Central Bank of Cyprus (CBC) governor Constantinos Herodotou with Bank of Spain governor Pablo Hernández de Cos (credit Christos Theodorides)

Herodotou was aligned with de Cos on this matter, stating that “if you genuinely depend on the data, you cannot announce or declare now when interest rate cuts will begin”.

“We need to examine the data because we must not delay the downward adjustment of interest rates, but neither should we move prematurely,” he added.

Furthermore, addressing a relevant question, de Cos highlighted that the transmission of monetary policy decisions to the real economy is still pending.

He acknowledged that interest rate hikes have tightened financial conditions, but there is a time lag in terms of the impact of stricter financial conditions on the real economy.

Responding to a question about market expectations of an interest rate cut in April, de Cos stated that the ECB will act based on its own assessments.

He mentioned that the ECB’s next forecasts, scheduled for March, will provide insights into the future trajectory of inflation.

Governor Herodotou added that market expectations may influence yield curves. However, he stressed that “at the end of the day, a thorough examination of data and underlying inflation trends is crucial for making the right timing decisions for monetary policy adjustments”.

Responding to queries about feedback from economic entities, Herodotou said that interest rates were just one aspect occupying the concerns of economic stakeholders.

He explained that they are preoccupied with the repercussions of geopolitical tensions on business operations, the transition to climate neutrality, and the impact on the competitiveness of businesses, along with prevailing financial conditions.

Central Bank of Cyprus (CBC) governor Constantinos Herodotou with Bank of Spain governor Pablo Hernández de Cos (credit Christos Theodorides)

On his part, de Cos said that he was positively surprised that the discussion focused on structural issues affecting businesses, with inflation being the final segment of the conversation between the parties involved.

As he stated, this signifies that appropriate decisions regarding monetary policy have been made, and businesses consider the falling of inflation as the likeliest scenario.

What is more, both de Cos and Herodotou praised the collaboration between the two central banks, both in terms of monetary policy and financial stability matters.

In addition, the Spanish Central Bank governor commended Herodotou’s contribution to the decisions of the ECB Governing Council since taking office in April 2019.

“Since April 2019, when he started his term, his acute understanding of financial markets and the economy of the eurozone has enriched the collective thinking of the Governing Council (of the ECB), helping us navigate through challenging times,” de Cos concluded.

Finance Minister says Cyprus solution “would benefit all Cypriots”

Meanwhile, in a statement released after the discussions and press conference had concluded, the Finance Ministry said that the meeting with de Cos involved an exchanging of views on the global economic environment, as well as the challenges facing world economies, including that of the EU.

The meeting between de Cos and Finance Minister Makis Keravnos also involved a discussion of the green transition and related energy policies.

Finance Minister Makis Keravnos with Central Bank of Cyprus (CBC) governor Constantinos Herodotou and Bank of Spain governor Pablo Hernández de Cos

The ministry’s announcement also said that de Cos praised the performance of the Cypriot economy and highlighted the resilience of the Cypriot financial system.

He also mentioned that inflation in the EU, in general, is on a downward trajectory, but risks still exist.

Moreover, Keravnos provided a general overview of the Cypriot economy and the main reforms planned by the government.

He also stressed that monetary policy in the Eurozone should respond at the right time, taking into account developments in inflation.

Keravnos also referred to the efforts of the president of the Republic of Cyprus to resolve the Cyprus problem and stressed the need for more intense initiatives from the European Union, emphasising that a solution to the national problem will have decisive implications for economic development, benefiting all Cypriots.

Click here to change your cookie preferences