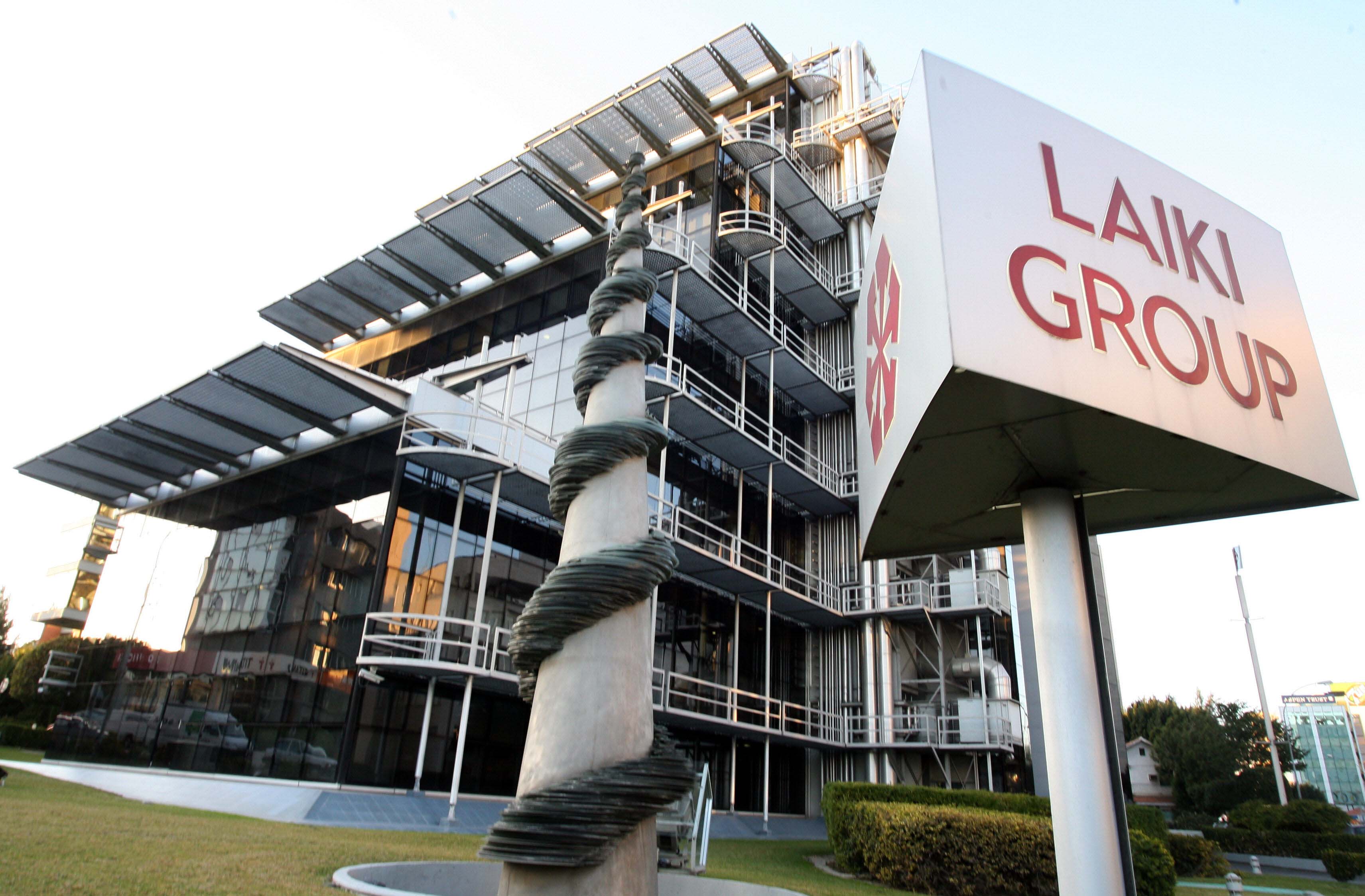

An ‘unprecedented mass claim’ of Laiki and Bank of Cyprus depositors and bondholders amounting to US$600 million was dismissed at the International Arbitral Tribunal of the World Bank, the Legal Service announced on Thursday.

The arbitration named Theodoros Adamakopoulos and others v. Republic of Cyprus (ICSID Case No. ARB/15/49), consisting of 968 natural persons as claimants and six companies.

They are all Greek nationals with the exception of one company incorporated in Luxembourg.

On May 21, the Arbitral Tribunal issued a Decision on Liability where it unanimously dismissed all of the claimants’ claims (with the exception of one) that related to the measures taken in March 2013 during Cyprus’ banking crisis.

The claimants argued that the Republic should be held responsible for the losses they incurred in connection with the resolution measures because the Republic allegedly caused the banks’ financial problems, failed to adopt available alternative measures that would have avoided or largely limited their losses, and applied the resolution measures in an expropriatory and discriminatory manner.

The total claim against Cyprus amounted to around US$570m (including interest), plus costs to the amount of approximately US$30m, the Legal Service said.

In its own arguments, the Republic rejected the allegations as baseless.

The tribunal ordered the claimants to pay the Republic approximately US$6m in costs.

Welcoming the decision, the Legal Service said it “welcomes the tribunal’s decision finding that the resolution measures did not breach its obligations under the investment treaties and were not arbitrary, disproportionate, expropriatory or discriminatory.”

In particular, the tribunal concluded that the measures of March 2013 were a legitimate exercise of the regulatory power of the state acting in the public interest, according to the Legal Service.

It upheld the position of the Republic that if the resolution measures were not adopted, “there would have been a disorderly collapse of the banks and of the economy as a whole.”

The tribunal further confirmed that the decision to invoke the resolution measures was a decision reached in light of an appreciation that there were no other options available.

It also upheld the action taken by the officials of the Central Bank of Cyprus in preparing for all contingencies, as well as that the Central Bank had satisfied itself that the shareholders, bondholders and depositors would not have been better off if the banks had been allowed to collapse and gone into liquidation.

The claimants initiated the arbitration under the Republic’s bilateral investment treaties with Greece and Luxembourg.

One unique claim of a single claimant was not dismissed however, which the Legal Service is currently examining.

The tribunal found a violation after it concluded that the state did not treat him in a similar manner to other exceptional cases at a later stage.

A detailed review of the decision is currently underway, the Legal Service said.

Click here to change your cookie preferences