Greece’s independent power transmission operator (Admie) will next week formally deliver to the Cypriot government its cost-benefit analysis for the Great Sea Interconnector – the mooted subsea electricity cable linking Cyprus and Greece.

In a statement on Tuesday, Admie said a delegation would visit the island on July 11 to hand over the cost-benefit analysis to Energy Minister George Papanastasiou.

Highlights of the analysis had been presented to Cypriot officials in early June. The Cypriot state is considering becoming an equity investor in the cable project, investing as much as €100 million.

During its upcoming visit to Cyprus, Admie said it would also meet the local energy regulator “so as to reach arrangements for the regulatory framework… and avert risking delays to the project, the cost of which will be borne by consumers.”

While here Admie will additionally meet banks and other financial institutions. They will also give a press conference “for a detailed presentation of the benefits of the electrical connection to Cypriot consumers”.

In the same statement, Admie – the project promoter – referred to a recent decision by Greece’s energy regulator that calculates how much Greek consumers would pay for the cable’s operation.

The decision marks an important step on the path to completing the regulatory framework governing the project.

According to the statement, the Greek energy regulator recognises the need for Admie to have a revenue stream as of the start of construction of the cable. It said that the counterpart regulator in Cyprus took a similar decision in the summer of 2023.

This appears to run counter to earlier public pronouncements by the Cypriot government that consumers here would not be charged a fee on utility bills prior to the operation of the interconnector.

Admie said also the Greek regulator has set the share of operational costs for the cable at 50-50 for Cypriot and Greek consumers, respectively.

As for the capital expenditure, under a formula previously agreed by the countries’ respective regulators, Cyprus undertakes 63 per cent, Greece 37 per cent.

Moreover, the Greek regulator explicitly states that expenses for the project will be fully covered using the regulated asset base model or RAB. Frequently used in large-scale infrastructure projects where private investment is needed, RAB allows investors to receive a guaranteed return on investment for the lifetime of the asset.

This decision is key, said Admie, as it introduces regulatory certainty and therefore averted the company (Nexans) manufacturing the subsea cable from downing tools.

And according to Admie, the next milestones are two more pending decisions by the energy regulators in Cyprus and Greece. These decisions are expected to come by mid-August, and would “eliminate the regulatory risk surrounding the project”.

If all goes according to schedule, Admie would be able to give the cable manufacturer a full ‘notice to proceed’.

Regarding financing for the €1.9 billion interconnector, Admie said it has received a term sheet from a commercial bank, which it did not name. A term sheet is a nonbinding agreement setting out the basic terms and conditions of an investment.

Additionally, Admie said it has filed to both regulators its proposal for the weighted average cost of capital, or Wacc. The Wacc represents the minimum rate of return for a company to produce value for its investors. Higher Wacc ratios generally indicate that a business is a riskier investment.

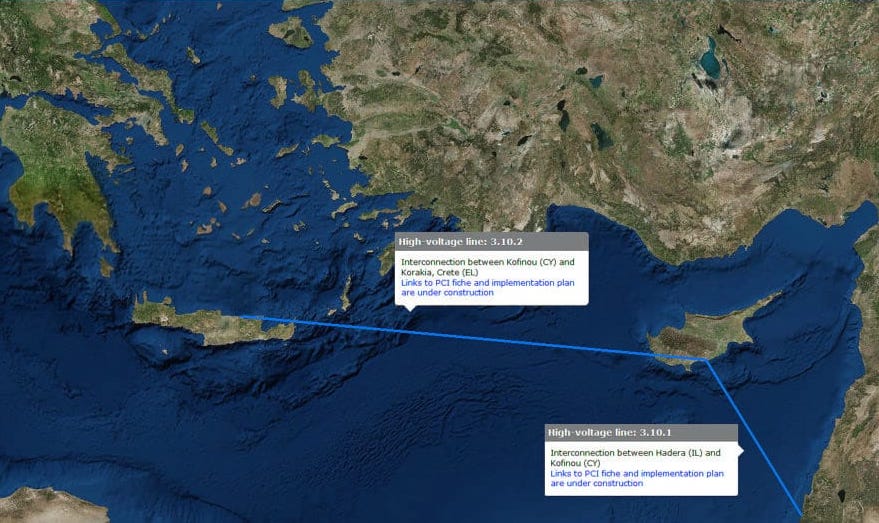

The Great Sea Interconnector was formerly known as the EuroAsia Interconnector – after a Cypriot company of the same name. In October 2023 the Cypriot project promoter dropped out of the project, with the baton handed over to Greece’s Admie.

In January 2022 the European Commission had approved €657 million under the Connecting Europe Facility (CEF) for the cable project. There was also an additional grant of €100 million through the Cyprus Recovery and Resilience Plan, part of the EU Recovery and Resilience Facility.

Some have expressed doubts about the utility of the interconnector or whether it will in fact lower electricity costs for Cypriot consumers. They argue, for example, that Cyprus will end up exclusively importing electricity from Greece, which has a far larger surplus of renewables energy to export.

Click here to change your cookie preferences