Consulco, is a specialist investment manager focusing on real estate, credit and private equity investment opportunities in London tailored for High-Net-Worth Individuals (HNWIs) and institutional investors

Headquartered in Cyprus with operations in London and Dubai, Consulco’s strategic approach in real estate and credit investments provides an appealing opportunity for HNWIs and institutional investors seeking resilient and high-yield opportunities.

With decades of experience in managing investment portfolios, Consulco revolves around capitalizing on lucrative opportunities in London, one of the world’s most resilient and attractive property markets and structuring these opportunities into high-yield investments for its clients.

Combining Lending and Real Estate

In today’s fast-paced and often unpredictable financial environment, investing requires both resilience and foresight. Through its London-based lending arm, London Credit, the company offers three different investment solutions through short- and medium-term secured loans, also known as bridge financing. This form of lending is primarily targeted at London-based business owners seeking fast, flexible financing solutions.

London Credit has successfully funded 585 such loans, maintaining a 100 per cent principal collection rate, a testament to its rigorous risk management and due diligence processes.

LC London Credit AIF V.C.I.C. Public Ltd

LC London Credit AIF V.C.I.C. Public Ltd (“the Fund”), an alternative investment fund managed externally by Consulco Capital Ltd, an authorised and regulated alternative investment fund manager, provides investors with indirect access to London’s property-backed lending market. Launched in 2021 and regulated by the Cyprus Securities and Exchange Commission (CySEC), the Fund has quickly gained momentum, increasing its assets under management, all of which derive from the Cyprus market.

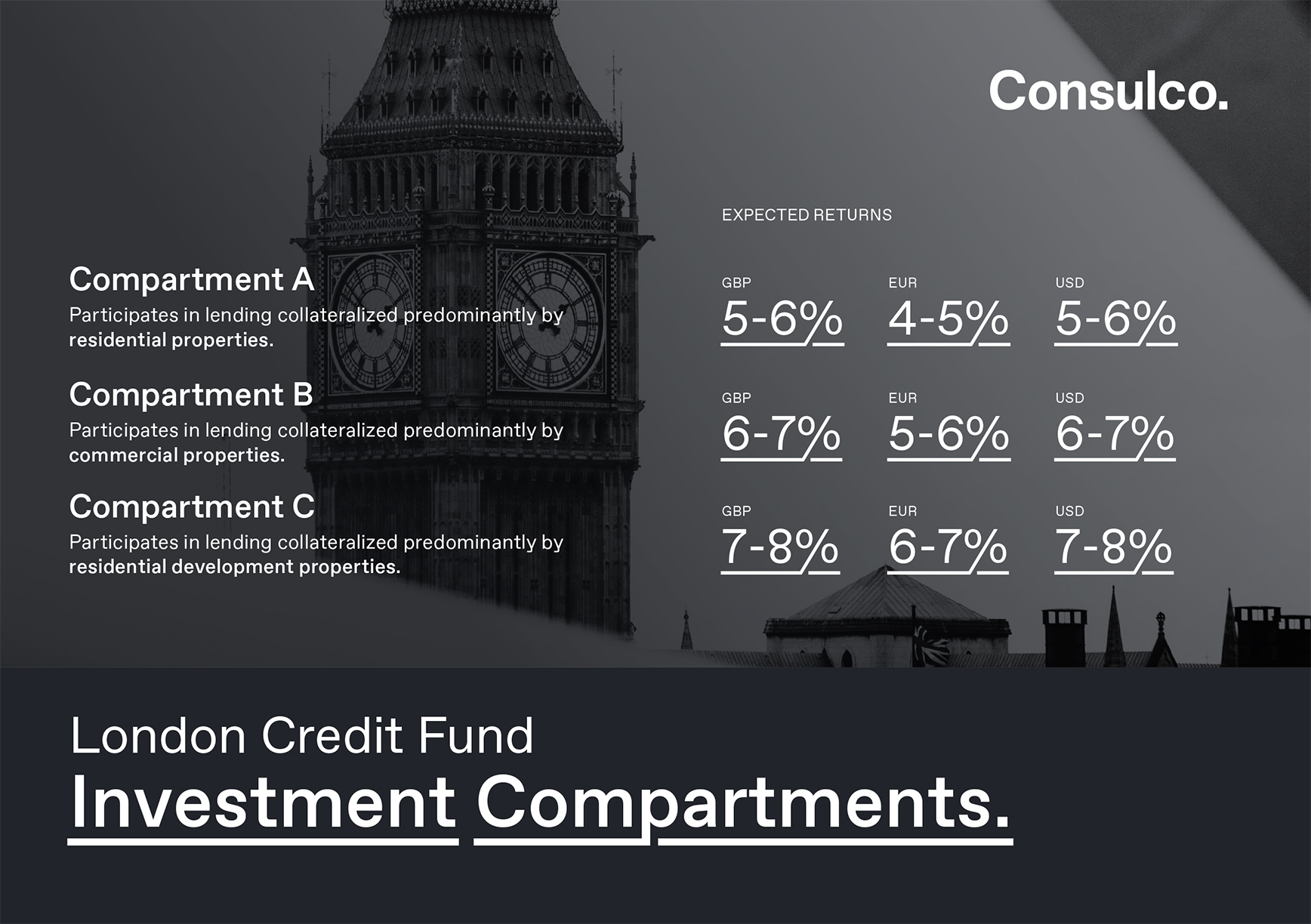

The Fund is structured as an open-ended umbrella fund with three compartments, each offering a different risk-return profile to cater to diverse investor preferences:

Compartment A: This compartment participates through a subsidiary on short-term lending secured predominantly against residential investment properties in the UK. Residential properties typically offer more stability, making this an attractive option for investors who prioritise safety while still seeking solid returns. The target returns for this compartment are 5+ per cent for investments in Sterling and Dollar, and 4+ per cent for investments in Euro.

Compartment B: This compartment participates through a subsidiary on short-term lending secured predominantly against commercial investment properties in the UK. Compartment B offers potentially higher returns, making it more suitable for investors willing to accept a moderate level of additional risk. The target returns for this compartment are 6+ per cent for investments in Sterling and Dollar, and 5+ per cent for investments in Euro.

Compartment C: Building on the success of Compartments A and B, this Compartment broadens the Fund’s investment scope to include high-potential opportunities in the residential development sector. Through a subsidiary, it will participate in short-term lending focused primarily on residential refurbishments, conversions, and developments. These investments are strategically located in regions with strong growth prospects, such as Greater London.

Aiming to deliver competitive returns, Compartment C targets annual returns of 6+ per cent for Euro investments and 7+ per cent for Sterling and Dollar investments.

Fund Performance

Since its inception in 2021, the Fund has met or exceeded its annualised performance targets. With prudent management and strict adherence to risk controls, the investor returns remain on or above targets and competitive.

Key Terms

The Fund operates under the following terms:

Expected Distributions: Quarterly for Compartments A & B and Annually for Compartment C.

Minimum investment: €125,000, catering to professional and well-informed investors.

Redemption Notice: The investor can exit with a 6-months’ notice.

Fund Administrator: KPMG, ensuring professional, compliant management.

Custodian Bank: Eurobank, adding an additional layer of security for investor funds.

It is worth noting that the London Credit Fund is only addressed to professionals and well-informed investors. Consulco’s clientele comprises of institutional investors, High-Net-Worth individuals, Provident Funds, Banks and Insurance Companies.

In such a resilient property market, it’s time for our investors to enjoy higher returns. “Compartment C marks a significant advancement of our London Credit Fund, expanding our investment focus to residential refurbished and development projects while at the same time upholding our commitment to provide security, liquidity and diversification” said Director of Investment Services at Consulco, Michael Tannousis.

Learn more about securing a high-yield future through Consulco’s investment strategies.

Click here to change your cookie preferences