Only district courts have the jurisdiction to adjudge cases relating to the 2013 ‘haircut’ on bank deposits, the attorney-general’s office said on Monday.

The AG’s office was citing a recent ruling (February 20) by the supreme constitutional court. The top court upheld prior jurisprudence, reiterating that cases relating to the 2013 bail-in fall under private law – and thus under the jurisdiction of the district courts.

The decision came after more than 200 people had appealed a ruling by the administrative court. The appeals had been filed by depositors, bank shareholders and bondholders affected by the 2013 financial meltdown.

The plaintiffs had wanted the administrative court to accept jurisdiction in cases filed against the Central Bank of Cyprus, the governor of the Central Bank and the finance minister of the Republic. They claimed that the bank resolution measures imposed in 2013 were null and void.

However the administrative court found against them, saying such cases fall within the sphere of private law, not public law. Therefore the court said it had no jurisdiction over such matters.

Next the plaintiffs appealed this decision – concerning jurisdiction – with the supreme constitutional court. The latter sided with the administrative court and rejected the appeals.

In March 2013, big savers with the Bank of Cyprus had 47.5 per cent of their uninsured deposits (any amount over €100,000) converted into shares, under the terms of an international bailout.

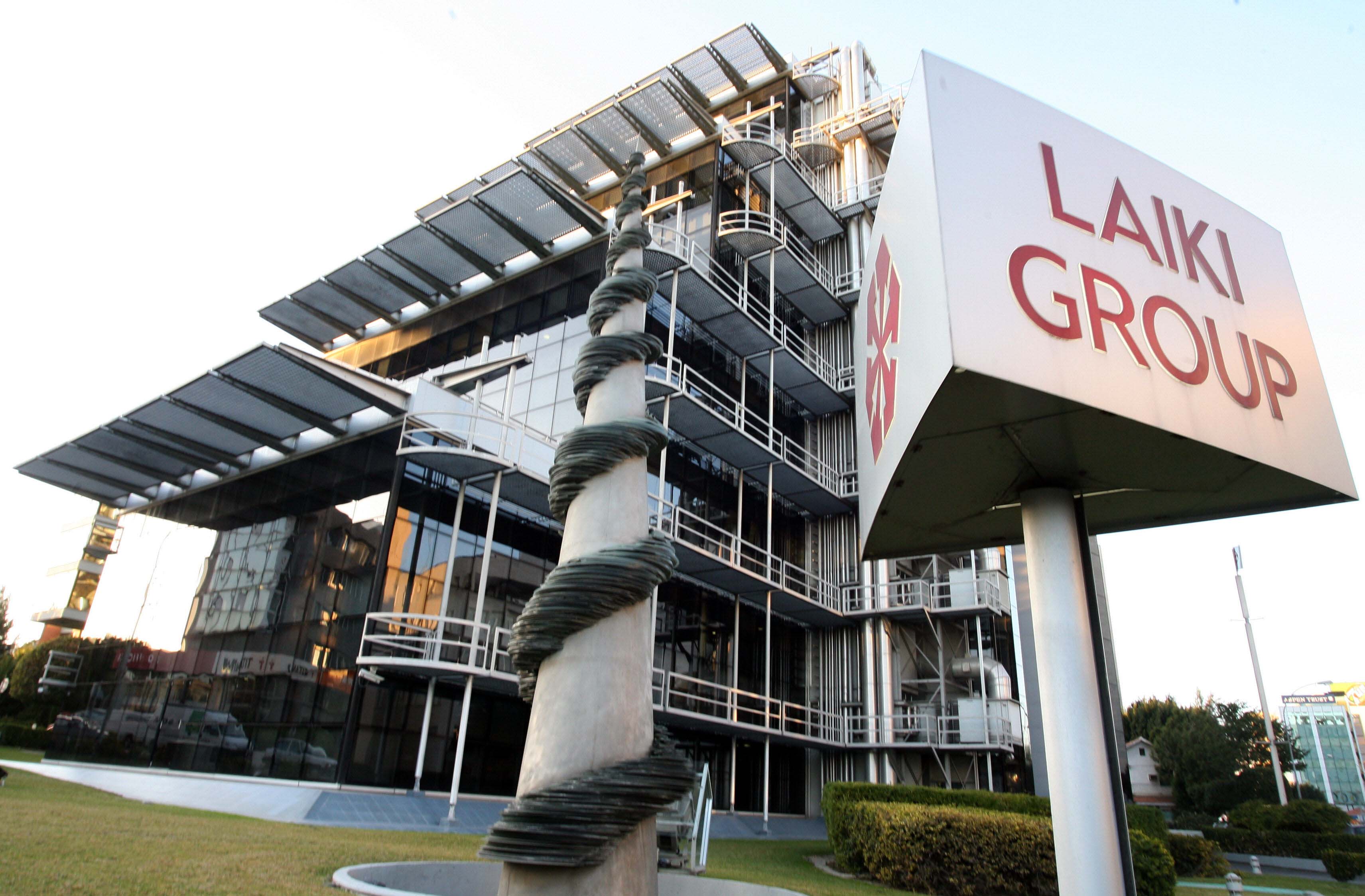

As for Laiki (Popular) Bank, all uninsured deposits there were wiped out, and the lender was wound down and its operations folded into the Bank of Cyprus.

Click here to change your cookie preferences